I locked in part of my win in UGAZ just now, a quick jump from yesterday’s entry.

In electing to take some off the table, I think it is worth pointing out a broader concept than any individual trade.

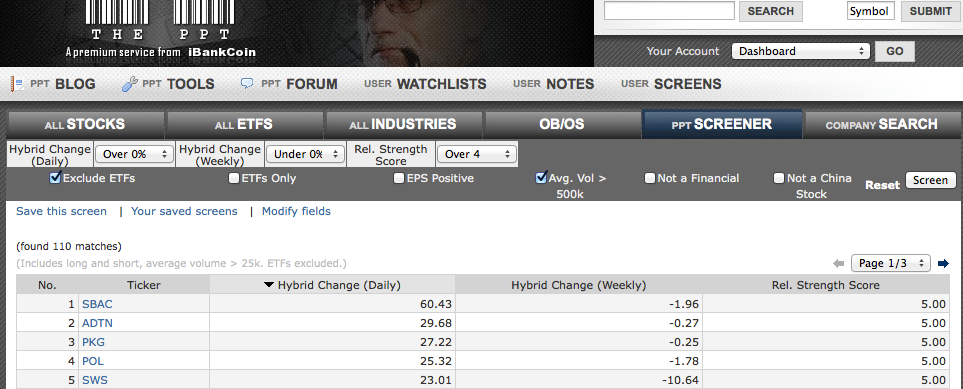

Specifically, the straight-up ETF for natty gas, UNG (first below) hit its upper daily chart Bollinger Band today.

Bollinger Bands are useful secondary technical indicators for measuring, among other things, relative tops and relative bottoms.

Here, the straight-up ETF hit its upper Bollinger Band (signaling relative overbought conditions), while my triple-levered long UGAZ has not yet hit its upper Band.

Despite the fact my money is in UGAZ, I suggest technically keying off the straight-up ETF for clues. In this case, UNG is punching its upper Band, and I am going to respect that by taking partial profits.

The highly levered ETF’s are merely vehicles to express your thesis based upon the technicals of the straight-up ETF (and futures contracts, to be even more to the point). But they are just that–Trading vehicles, and nothing more.

_________________________________________________________

_________________________________________________________

Comments »