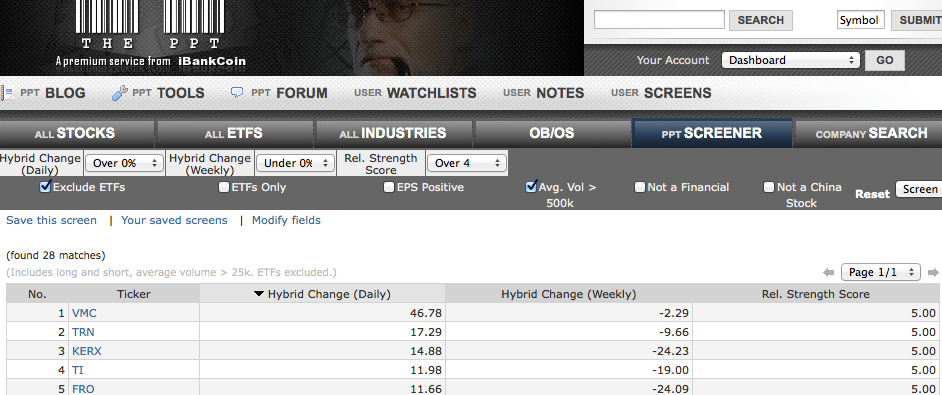

The chart of the S&P 500 futures which I present below, dating back to mid/late-December, should emphasize why I have mainly been focusing on the more energetic opportunities in other asset classes like natural gas and precious metals miners of late–Note the sloppy, sideways action with no net progress.

This evening, futures are still soft as the S&P probes multi-week lows. Whether or not this action marks the beginning of a true correction or even major top is irrelevant to me in the short-term, as I am focused on the most viable opportunities in front of me at any given moment.

Headed into Friday, keep an eye on UA as a short on weakness, while little FRED is a long idea.

I am still stalking re-entries/adds in natural gas, precious metals & miners if the constructive action continues.

Drop me your top tickers overnight.

____________________________________________________________

Comments »