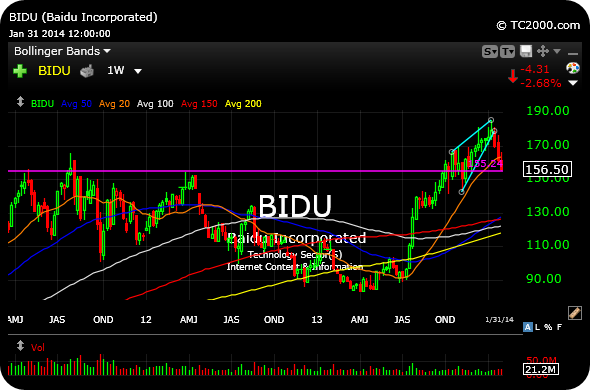

We have suddenly, quite weak financials in the likes of COF JPM, bear-flagging after sell-offs on their daily charts.

But we also have the homebuilders catching a nice bid on Friday, like TOL.

This is definitely a spread worth watching to see in which direction it resolves.

________________________________________________

________________________________________________

________________________________________________

Comments »