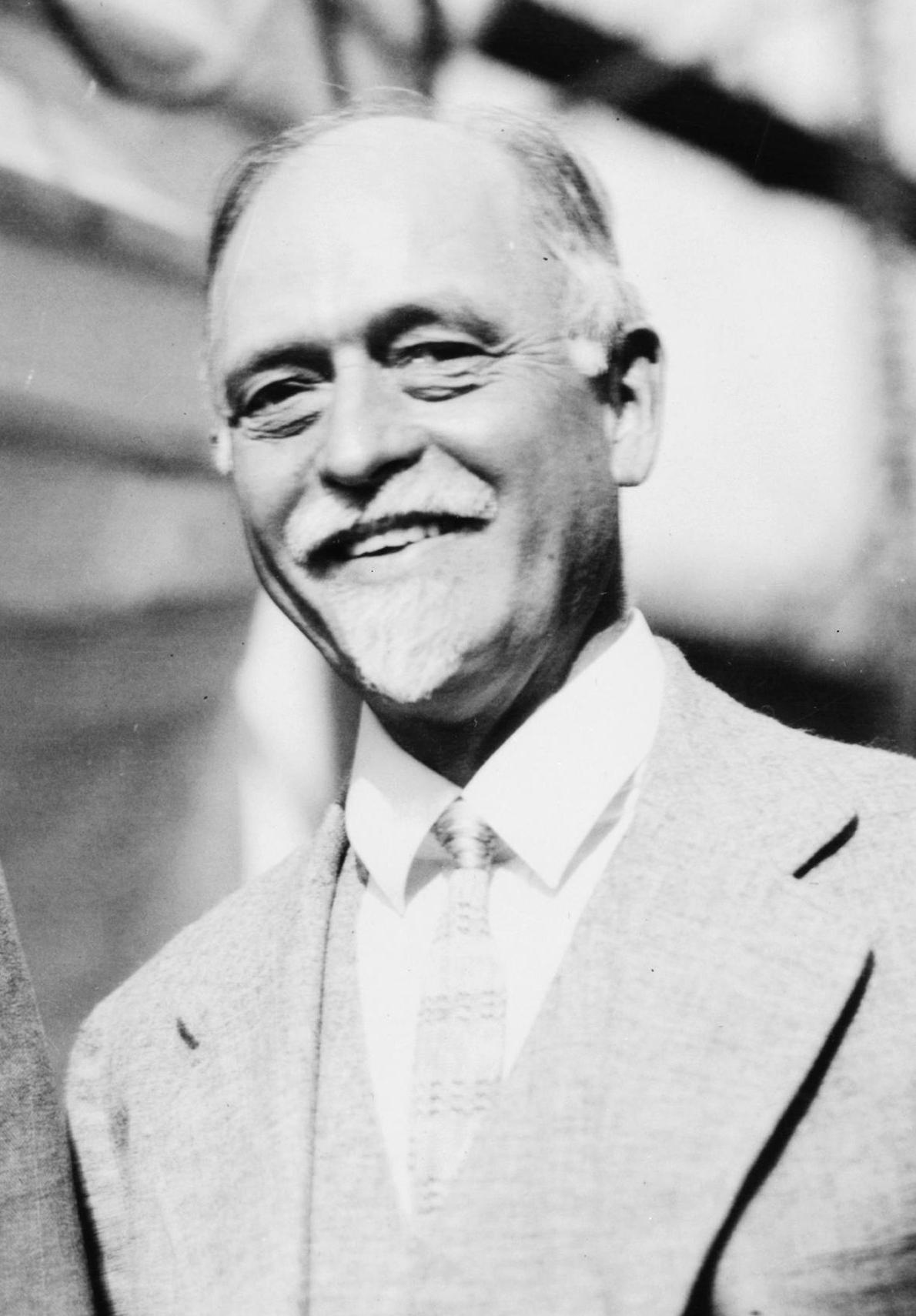

On Monday we were greeted with a Tweet by Ben Bernanke introducing his new blog. His first two blog entries were to discuss why interest rates are so low and why Larry Summers Secular Stagnation thesis is wrong. Well well well! Where do I begin. I feel an epic rant coming coming on. I will try to contain myself.

Apparently the reason why interest rates are so low is not primarily due to the Fed but primarily due to the state of the economy. Ahh I see…of course. This guy sounds like my 11 year old son trying to spin his way out of why his 9 year old sister is crying and there is a red mark on her face. “Did you hit her?” “Yes but she….” As you can imagine whatever comes out of his mouth next is just utter nonsense. He is not supposed to hit his sister. Interest rates are low but not because of the Fed but because of the economy. Just absolutely absurd. If we did not have a Fed the interest rates would be set by the market. Ben needs to understand that the Fed does not exist in a vacuum but that their actions have an effect on the economy in complicated feed back loops. Had we let capitalism do its job many companies would have gone bankrupt in the financial crisis and the recession would have been worse but guess what we would be recovering by now with a true secular recovery and a real bull market. We would have restructured the debt and recapitalized companies and households with debt loads that could be serviced by the existing income. Instead we have kicked the can down the road and put impaired private debt on the Global Governments balance sheets which will make the the last down turn look like a cake walk compared to the coming horror show.

Instead we have an abortion of a recovery that was forged in a forced credit expansion. Ben in his wisdom decided to solve a debt problem with more debt. That is the definition of insanity. To keep doing the same thing over and over again hoping for a different result. It stopped the bleeding temporarily but solving a debt problem with more debt needs continual expansion of credit in order to prevent defaults on the outstanding debt. The problem is that eventually the market reaches a point were it say no mas! We may be close to that point. How do I know that? Currencies, commodities and credit spreads are suggesting that we are quickly approaching the end game.

In his next blog he decided to challenge Larry Summers about secular stagnation. He does not believe we are experiencing that. I contend there is secular stagnation and that his Debt creation is the direct cause of it.

Ben since you decided to enter the blogosphere I challenge you to debate the fact that I believe your policies have caused secular stagnation and your QE is directly responsible for the deflation that is currently raging across the globe.

In May of last year Einhorn commented on how his meeting with Bernanke scared the crap out of him:

“I got to ask [Bernanke] all these questions that had been on my mind for a very long period of time, right? And then on the other side, it was like sort of frightening because the answers weren’t any better than I thought that they might be. I asked several things. He started out by explaining that he was 100 percent sure that there’s not going to be hyperinflation. And not that I think that there’s going to be hyperinflation, but it’s like how do you get to 100 percent certainty of anything?”

Read Ben’s blogs for yourself and you will come to realize that these folks that you think are Gods have no idea what the hell their policies do in the real world. They are academics who are clearly book smart but do not operate in the world in which you and I live in. They have never managed P&L risk. His blogging does not come at a good time for the omnipotence of the CB meme. The more he talks the more people will realize that Fed Chairs are little men and women behind the curtain and not the all powerful OZ! God help us all!

http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/30-inaugurating-new-blog

http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/30-why-interest-rates-so-low

http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/31-why-interest-rates-low-secular-stagnation

Comments »