The bulls have won. All is well in the world. All those crazy deflationary fears from a few weeks ago have disappeared. The charts look fantastic. There are no more bears left according to Investor Intelligence Survey clocking in at 80.84% bulls. In fact we are at a bullish percentage higher than 2007 (76.26% bulls) and 2000 (67.84%bulls) tops. What could go wrong? After all, the bullish percentage was 80.31% at the 1973 top so obviously we are going higher. The super duper smart hedge fund community agrees as their net exposure is at highs again. Why would anyone not be long in front of the ECB QE which begins this week? Additionally, stock buy backs reached a crescendo in February at $98 billion and Greece is but a distant memory. Then there is the March bullish seasonality that has been sited. Since the market trouble in January, a stunning 21 Central Banks have eased including China yesterday. Its a good thing they all eased because clearly its working as the SPX is a whopping 14 handles above its December high. Only a complete jack-ass or mad man would short this market.

On Friday I initiated shorts……..I am that jack-ass and mad man.

Markets never top on bad news. I only see good news. Additionally, a very special (double secret probation) indicator is flashing warning signs just like it did in September.

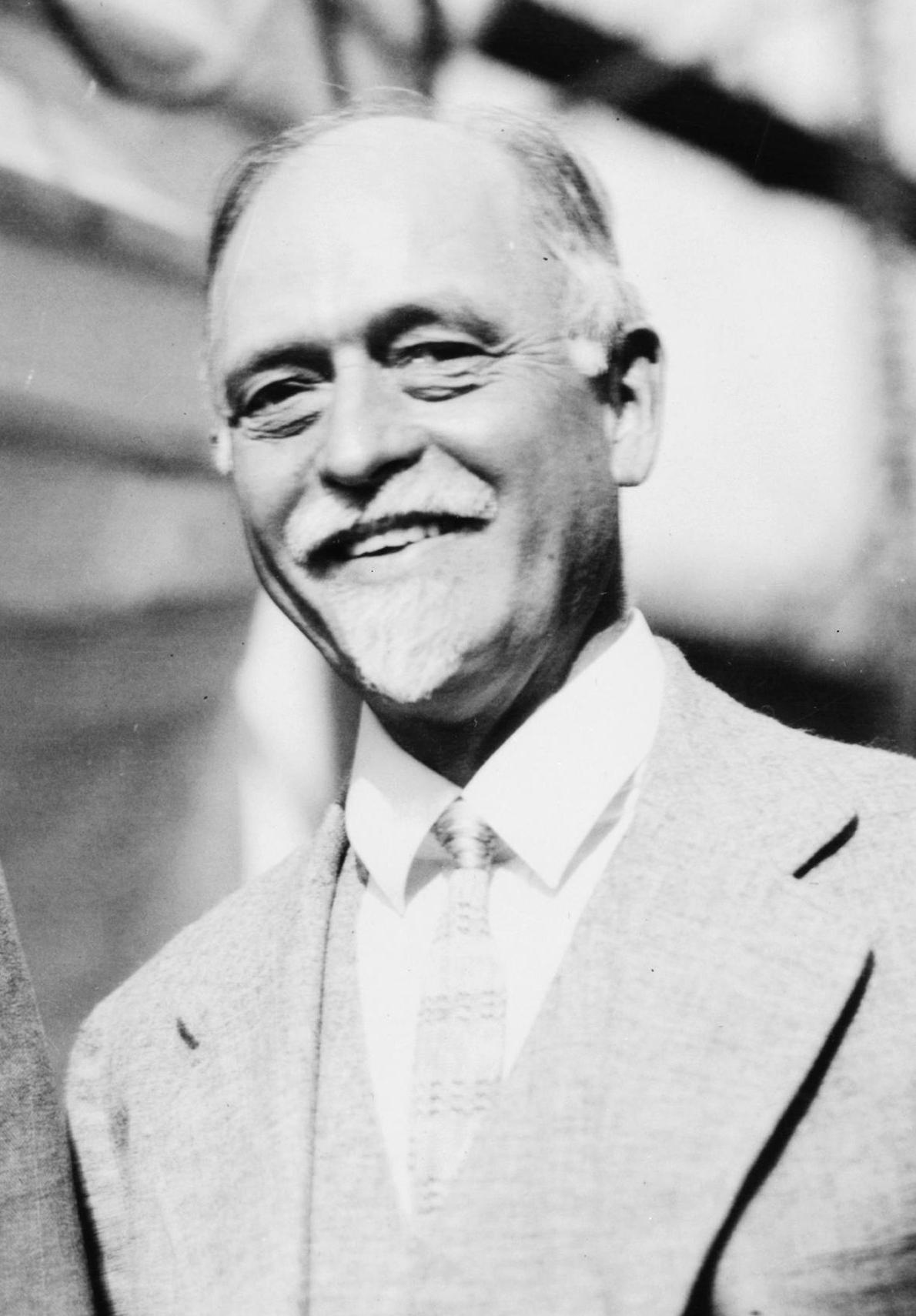

The above picture and quote is Irving Fisher who was a famous economist from the 20’s and 30’s. His quote was curiously timed.

If you enjoy the content at iBankCoin, please follow us on Twitter

Pray tell

Mind saying what equity or part of the market you shorted?

Although this market always seems stretched and it is approaching downside levels on the very short term, why wouldn’t you wait for a pop that isn’t an all time high to start shorting.

PLEASE let us know what the double-secret probation indicator is. PLEASE! 😉

golflover123,

more will be revealed as the week progresses.

helicpter ben,

“why wouldn’t you wait for a pop that isn’t an all time high to start shorting.”

Because I am a jackass and a mad man.

Patrick,

LOL. Excellent!

Utter nonsense

Blue. The whole world is printing like never before ever ever. Would not a blow off top seem inevitable? Prices are just numbers on a screen. They only count when more than a few humans try to sell. What is the catalyst to sell?

Dr. Fly,

http://youtu.be/aNH8zLaZHAk

ironbird,

Correct me if I am wrong, but have you been one of the bears posting over the last year? If you are and you have flipped then I rest my case. Also imagine what happens if the markets do turn down here with CB’s basically all in. Can you imagine the fear and panic that will ensue. There never is a catalyst at a top. Having said that I could be completely wrong. But I have a good feeling about this.

Best

Blue. Indeed, i was a doubter. The oil collapse being soaked up like a gentle wave turned the screws. Not exactly full Hugh but turned bull no doubt.

ironbird,

I am not saying you will be wrong but I have had many conversations with former bears who have thrown in the towel. Be careful.

Msg from the Central Banks:

9 second version https://www.youtube.com/watch?v=zOXtWxhlsUg

2 min version https://www.youtube.com/watch?v=LARx7M9s15w

a manager once said, you know its going to sell off once the media starts poking fun at all the naysayers.

still long but finger on the trigger.

I too have a double secret probation indicator/model!

Haha, good to know that you know yourself well, blue.

Blue I’m totally with you…however I’m waiting till equinox March 21, based on nothing more than spurious anecdotal feelings – this is all I’m left with since logic left this psychotic market quite a while ago.

Again -wait for the jobs report.

Also read ZH -more haters than you can shake a stick at. Until some of those fuckers turn bull then I’m a bull.

Gorby, I doubt the ZHrs will ever turn bull. People commenting on the site are waiting for the rapture.

jimmy-two-times, Your probably right ,but nothing turns big until we all believe in tulips.

The fed though will have lots to say . Even a small increase in rates will strengthen the U.S. buck which will

affect manufacturing(jobs) and dollar

denominated debt.

Worthwhile interview, but man speaks with forked tongue. He talks gold down, but owns gold miners?

http://www.futuremoneytrends.com/trend-videos/interviews/swiss-billionaire-fed-no-way-out?utm_source=Future+Money+Trends&utm_campaign=51b5f21a27-FMT_Callinex_Mines_Email_Pitch3_1_2015&utm_medium=email&utm_term=0_9a1f3a75ec-51b5f21a27-174430217

gorby,

I believe there are currently over 80% of investors on the bullish side of the boat. What are you waiting for 85%, 90%, 95%, 99%?

Ask the guys who were short the Swiss Franc how long they had to get to the other side of the boat – before the 41% move?

Not saying things will go that way or move that fast, but it’s not impossible.

80%—That is definitely fucked up

On the other hand isn’t that normally the

case.

Gorby,

the people that respond to zero hedge don’t have any money and live in their parents basement. positioning is all that matters. and as I have said 80% of you are bulls. higher than 2007 and 2000 tops.

I agree with you bluestar. Being long here is madness and simply against the odds of making money. Some third grade math and Newtons first law of motion is more than enough to know that a short position here is pure logic. I admit though that it’s not for the emotional weak but trading never is.

Well no one can fault you for being emphatically, blinded by your bearishness. You’re gonna be right one day, but you just won’t make any money until then.

forgetalpha,

Thank You! I have been waiting for your arrival ever since I wrote this piece. I am now going to double my shorts on the open tomorrow due to the fact when both you and the FLY post at the same time ridiculing me it acts as a super duper timing sign to go short. 100% success rate so far. Again. Thank you for this opportunity.

ha ha…timing sign. Best of luck Blue.

Food for thought:

On day (when, is not clear but sooner than anyone expects) most banks and banking services will become redundant / buggy-whip’d / Kodak’d.

Kodak knew for 20 years that digital photography would obsolete their film processing business model. You might ask, what did they do about it? Essentially, not enough. They made a token effort in the digital realm, while continuing to milk the film cow. Then one day, the film cow was sold for hamburger.

In the not to distant future, Bitcoin and it’s progeny will throw the banks into the meat-grinder because cryptocurrencies are not just currencies, but also a means to track and transfer value – more easily, more reliably and at significantly lower cost than banks.

Don’t listen to Jamie Dimon.

http://thenextweb.com/insider/2015/03/03/why-bitcoin-is-changing-how-banks-do-business/

I added to my VXX position today and bought puts on Intel, as I think that company is very vulnerable to losing at beat-the-number this quarter. I also plan to buy other PC-oriented puts as events develop. (I also bought puts on Oracle.) Bill Fleckenstein

http://kingworldnews.com/now-set-one-spectacular-collapses-history/

rogue wave,

saw that. thanks

Markets will only top when there are no more greater fools. ECB hasn’t started buying yet.

the profit,

yes that is consensus.

Blue, I don’t see how it can be a good timing signal considering Fly and I have been criticizing your Uber bearishness for over a year now and we just hit all time highs. I’m not interested in calling tops to make 5-10% on a short, only to see the market levitate without me a month later. The thought of not being invested in this market makes me cringe just thinking about the poor bastards that have been sitting in all cash because they were convinced the central bankers “lost control.” I can see it now, the swath of investors who’ve lost money during one of the best equity markets in decades wake up one day and can’t take it anymore and dump their worthless put options and pick up a bucket of beta. Which, of course, will be the absolute worst time to do so. And that is why I think shorting every rally in anticipation for the next “big one” makes zero sense. Even though you will be inevitably “right” at some point, the financial and mental stress that you take along the way simply isn’t worth it. The intellectual reward of being “proven right” can’t compare to peace of mind that being responsibly long this market. Will we go lower at some point? Of course. But I have no idea when, no one does. Sure you can get lucky and hit the top right on the nail on you’re first try, but that is pure luck. As you can attest, one is more likely to not only miss the 1st attempt at calling the top, but also miss the 2nd, 3rd, 4th, 5th, 6th….

Forget alpha,

I made up the previous post. Knowing your personality and huge chip on your shoulder and inability to take criticism I knew you would waste your time composing some worthless diatribe. And I see that I was right and you did waste your time. I have not even read it. You fell into my trap. I think you should get some counseling on your serious character flaws.

I’m a newbie to the market world I need a suggestion as to which direction I should go in my investing future? I’ve talked with a jp Morgan advisor And I want to know is that a good way too start your portfolio. Our should I be going a different direction?

tom,

if you are a newbie i am loathe to give advice. this is a blog not financial advice. I share my thoughts. that is all.

Ah I see, how convenient for you

forget(tom)alpha,

Dude I am just messing with you. You know I love you.

Blue

They have gotten into your head.

breathe,breathe. now go find some lava

and play hop scotch.

gorby,

who are they?

The bull gods who have taunted you

mercilessly causing a doubling down

and costing future you money.

Forgetalpha,

Don’t you think that you are harboring an equally large bias? I also have no idea when we top or what the downside might look like, but implicit in your comment is that whenever we do eventually top, it will only be a run of the mill 10-20% decline. You seem to have written of the possibility of another 2008 or worse considering that central banks have fewer tools at their disposal now. What percentage decline would change your mind about being mostly long? Say hypothetically that you knew there would be a 2008 event (just for thought experiment purposes) sometime in the next 12 months, would you change your mind about being long and not worrying about downside?

Of course if I knew that we were about to have an 2008 event I would sell everything and buy as many puts as I could…but that unfortunately only happens in a dream world. In reality, events like 2008 don’t happen very often, at all. If you were lucky enough to be fully short in 2007, then 2008-09 was great for you. For myself, 08-09 sucked, but thankfully I didnt have much exposure to equities which permanently impaired my capital (because I didn’t sell off the majority of my exposure + no exposure to bankruptcies). Did I make dumb trades on the way down and on the way up? Of course. But I didnt move my entire portfolio into a short position. Now, my portfolio is worth multiples of what it was back in 08, and anyone could have done that if they just didnt let fear of another 08′ happening dictate their asset allocation. If I was net short, the best I could have possibly done would have been +50%-100%, because no one in their right mind would put their entire portfolio into directional options one way or the other and thats the only way to get better than a 100% return on a short (yes some hedge funds posted +100% returns back then but they were involved in incredibly complex securities, highly levered…not a comparison to what we’re talking about). I’m not arguing against shorting individual stocks by the way, I think that’s a great way to create some alpha. I’m also not against hedging risk in a long portfolio, that makes total sense. But to be aggressively short the market at large is just a really difficult way to make money through almost any timeframe in history. So why should I try so hard to take those odds on?

forgetalpha,

I never short all my capital. long lots of treasuries.

Tom,

Your best investment right now is educating yourself. You’re not ready for an adviser like that yet. Their job is not to educate you. They will simply take your money; put part of it in their pocket and speculate with the rest. If you get lucky or lose, you haven’t learned much.

Think of your financial adviser as a car mechanic. Let’s say you know nothing about cars. He can tell you anything. You say uh-huh.

Start reading everything you can.

Anecdotal and Tom,

As an advisor for one of the big wealth management firms, i agree and disagree.

If you are just getting started with investing, I wouldn’t recommend an advisor nor would I recommend following most of the trades on this site. Average into an index fund ETF over the next few years. Anecdotal – advisors are not just about taking their money – it is about educating them. A client called the other week freaking out wanting to sell because his stock (~2% of his portfolio) dropped 10%, (= -.2% loss) only to see it regain its lost ground and then some recently.

It is about preventing your clients from doing stupid things with their money that they would do if they didnt have you.

That being said, if your financial situation is not super complicated/ if you have decent amounts of free time, an advisor is most likely not right for you.

Blue, do you think the yield curve has merit as a top indicator anymore? It *seems like* it wants to flatten but can’t with the short end pinned down. Just curious as to your view of things. Thx

thegametheorist,

Agreed, there are some excellent financial advisers out there who are worth every penny. And good car mechanics too, but also bad. Like any professional, finding a good one that matches your approach would be tough to find for a newbie who’s not sure of their approach.

Tom,

I am not from the financial industry, so my advice is worth exactly what it cost.

Question to the board: Where do you get your financial news?

PS for your entertainment (song)

https://www.youtube.com/watch?v=TWPcid4l74U

gopro competition?

http://finance.yahoo.com/news/xiaomi-ceo-lei-forecasts-revenue-020357985.html;_ylt=AwrBEiSBDflU_TUAHceTmYlQ

Not coming to a store near you, at this time. Private company. No doubt their firmware is not nsacompliant.

Concerned about 10yr/30yr long bond or is this the washing out of weak hands? Thank you for your opinions.

Tempo Bear,

I think it does. Watch High yield spreads as well.