In 1999/2000 the refrain was “It’s The New Economy”, in 2007 it was “The Great Moderation” and today we have “The Fed Has Our Back!”. The omnipotence of central bankers has become supreme. I would say 90% of the people I talk to, read about or watch on TV believe that the Fed is prepared to put a floor on the stock market. What if the Fed’s omnipotence is an illusion? Much of the power of the Fed comes from the belief of the participants in the market. They do have the ability to coax the herd into one side of a trade. However, once that process is complete they can’t prevent the inevitable contraction and bear market. The Fed knows this but they dare not let the market in on that fact. In the prior two corrections the Fed was easing aggressively and yet the stock market went down 50% both times. Once we have a trend change I believe that the Fed will be powerless to stop the correction.

The pavlovian worship of the Fed reminds me of Ancient Egypt where central bankers have become the new High Priests. In Egypt the role of the priest was very important in society. The Egyptians believed the gods lived in the temples. Only the priest was allowed to enter the sacred area of the temple and approach the statue representing the god or goddess. The people could pray at the gate or in the court to the Pharaoh where the Priests acted as a go-between the people and the gods.

Today in this market the most important day has become the FOMC meeting. Most active market participants drop what they are doing and listen to the woman pictured above talk about dots. Yes we talk about dots! It is absolutely absurd when one steps back and watches these proceedings. In Egypt the power of the Priest came from the illusion that they talked to the gods. Today the Fed’s perceived omnipotence comes from the belief that these people actually know what they are doing and the misguided belief that they can prevent a correction from occurring. The longer they stretch this market’s uptrend without a meaningful correction the worse the fall out from the inevitable correction that ensues. These people do not posses magical powers and they are not able to warp nature and cycles. As long as the stock market has existed we have had cycles. This is currently the longest 4 year cycle advance in the history of the stock market clocking in at 66 months. The two prior record holders were 60 months apiece in 2007 and 1987.

If you want to worship at the feet of the central banks be my guest. I choose to be a heretic. The marginal return of QE is diminishing and the Fed knows this to be true. Remember they are ending QE in a month. They need to pull back now so that when the collapse occurs they can step back in and be the saviors yet again. The illusion of power must continue.

We don’t have a confirmed top yet but all the signs are there from divergences, declining breadth…etc, etc. There are three ways this goes down:

1) We continue to push higher and everyone tells me I am an idiot.

2) We have seen the top and we are beginning an 18 month bear market.

3) We have seen the top or get a top soon that initiates a crash sequence like 1929 or 1987.

I vote for #3 because of all the central bank manipulation, leverage used to extend this advance and the lack of a meaningful correction to unwind sentiment. A crash is defined as greater than a 20% correction within a two month timeframe.

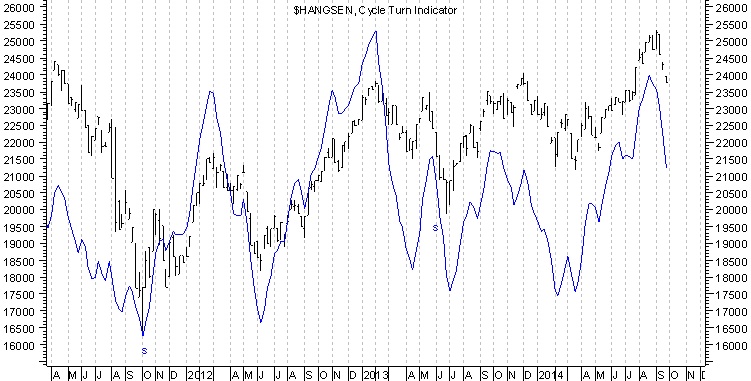

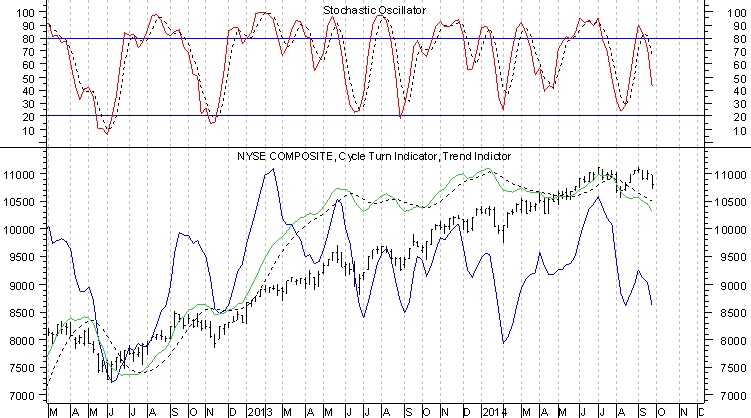

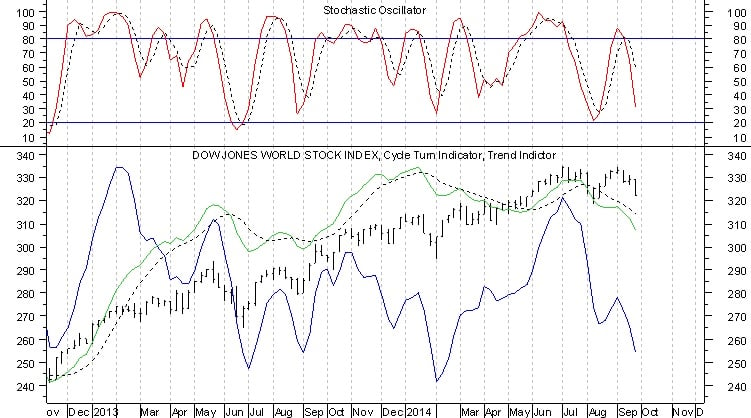

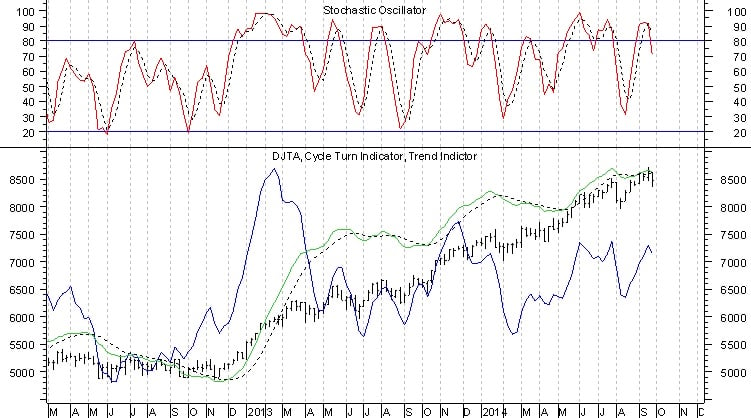

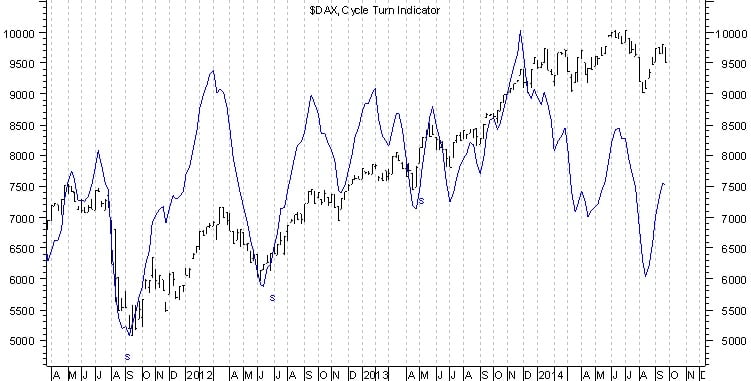

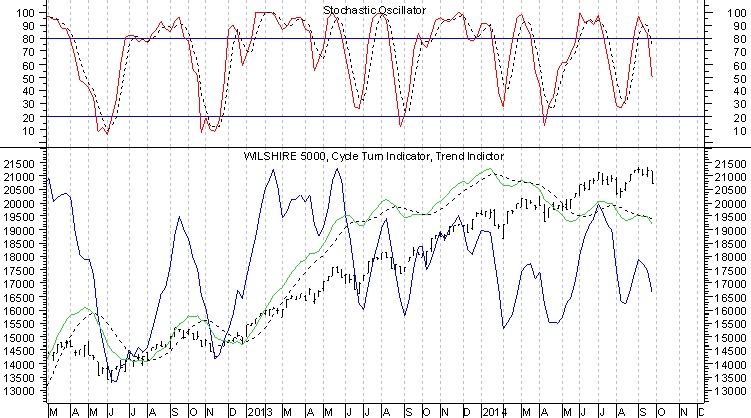

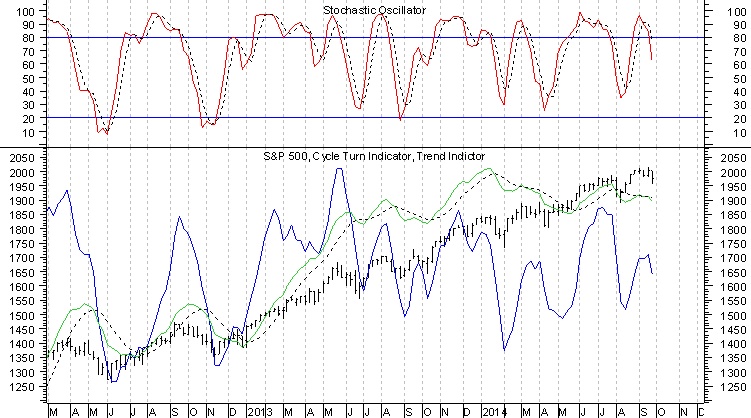

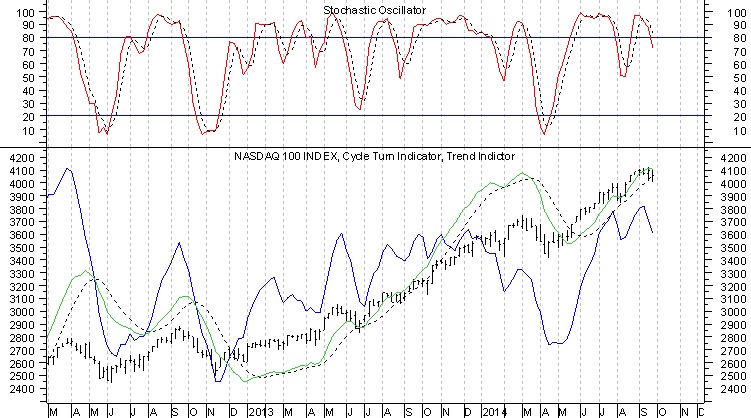

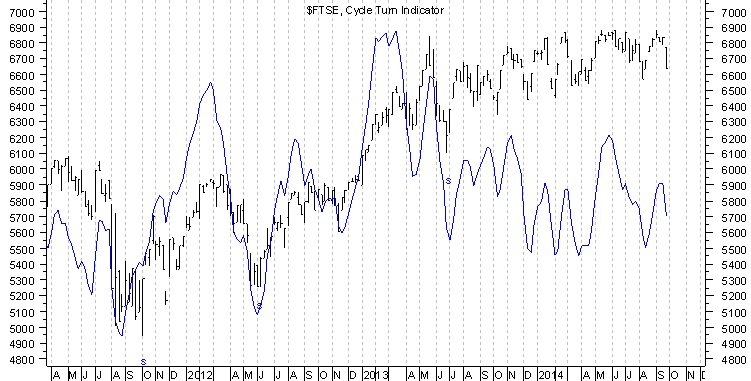

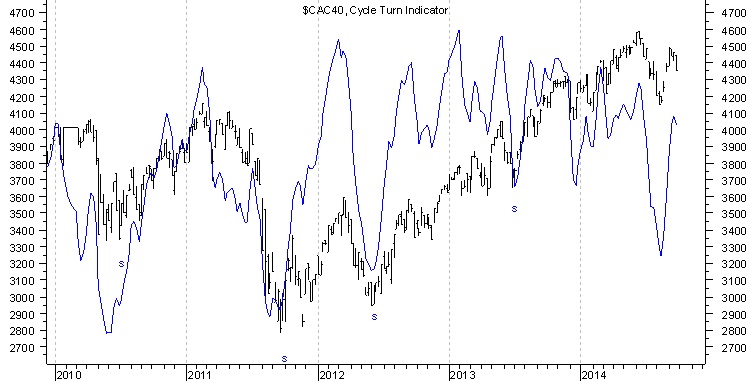

On a side note I was talking to my good friend Tim Wood today who pointed out to me that the Hang Seng, NYSE Composite, Dow Jones World Stock Index, Dow Jones Transports Average, DAX, Wilshire 5000, S&P 500, Nasdaq 100, FTSE, and CAC40 all have intermediate term sell signals. The DJIA is yet to give us an intermediate sell signal but my guess is that is not far behind. Additionally, the emerging markets equities look like death. The punchline is we that haven’t seen this many intermediate sell signals across different markets in awhile. It may mean nothing or it may mean something. Again I vote for the latter. My guess is the torrid advance in the $Dollar has something to do with this worldwide action. This is the longest stretch of weekly gains in the $Dollar since 1967. A ten week advance! The beach ball has been held underwater for 6 years by the Fed and it is starting to come up fast. The release valve is the currency market and the $Dollar is the tell that a major regime change is under way. The charts below are courtesy of my buddy Tim. Enjoy the rest of your weekend and remember to go pay homage to The New High Priestess tomorrow.

If you enjoy the content at iBankCoin, please follow us on Twitter

Totally agree on USd. Deflation is coming.

Randomness,

This deflation will be bone crunching.

It seems like I have seen this before. The one thing that’s worse than what you describe is stagflation. I’ve seen that rodeo and it’s scary. From the government’s p.o.v. Though, it solves the problem of monetizing the debt while having plausible deniability in the off chance anyone points a finger in its direction.

CatM,

Bernanke essentially tossed yellen the keys and said good luck I am outta here. Train wreck coming and he knows it.

BEHOLD! /GC to $900. But the low isn’t due until 2016/2017. Bone pulverizer indeud.

Blue Star –

Yup. And amazingly, Janet Yellen evidently didn’t see that she was going to be cast as the person responsible for the implosion that’s coming. She should have understood that the light at the end of the tunnel came from the oncoming train.

“Bernanke essentially tossed yellen the keys and said good luck I am outta here. Train wreck coming and he knows it.”

As did Bernanke’ predecessor, The Master of Disaster-Greenscam

PelicanBrief,

Good point! I forgot about that.

FYI, none of your pasted chart images appear to be loading. I tried three different browsers (Chrome, IE, Firefox). The image links have a URL of https://mail.google.com/. Not sure if anyone else can see those images if linked directly to your email box, which requires your login (of course).

Ultramarine,

Thanks. Let me look into it.

Ultramarine,

I believe it is fixed.

Blue, where do you put your money if deflation is coming? Where should we be investing?

The GameTheorist,

Treasuries, cash are best. Shorting if its your full time job otherwise cash. Step back in once the damage is done.

The average length since the 1800’s was 67 months I thought? And wasn’t there one in the 90’s that was almost twice as long?

Margin debt is pretty insanely high though.

Bruce,

I am talking 4 year cycle. Its complicated but trust me on this one. This is the longest 4 year cycle advance on record. Also the average cycle from higher degree low to higher degree low is 48 months on average. You can see how the PTB have been perverting the cycle. They can stretch but they can not put off the inevitable.

Bluestar, thanks for the link fix, I can now see all the charts you posted and will review.

Ultramarine,

The main point is we are seeing a global risk off. Some charts look more developed to the downside than others.

I vote Number 3 too. Yep, USD right after ECB announced has been giving this Bear Girl a lot of hope. Yet, still worried about our Alter Worshipers are going to sniff more possible Global Central Bank Action somewhere..

Can you explain these charts Bluestar? Because its not clear to me where the sell signal is considering how noisy the stochastics have been over the last few years.

Forget Alpha, The Blue line is his CTI (cycle turn indicator) When it begins to roll you have an intermediate sell signal. The real point is that we have not seen this many signals on this many different indexes at around he same time in a very long time.

Gotcha, thanks