Yeah, right.

I know,…..it sounds like “get ready for an “ass-beating” time.

The financials have obviously been beaten very severely with diamond axe handles (the hardest material I could think of) with many names losing multiples of ten, like 30%, 40%, 50%, 60%, 70% etc., of their value. Financial related ETFs are off multiples of ten, or even more (if that’s possible). On top of that, Ben and Hank are ready to kill the next guy who sells even one share of bank stock.

That said, over the last couple of days financials have started to behave like a confused old man in a stairwell. Up and down, back and forth. Will The Fly kick him down the stairs, or not? Will he drag him to an elevator shaft and THEN kick him down to the bottom? Will the old man punch The Fly’s mustache off? What are the odds? So many questions…..

Nonetheless, this has created some potential buy signals off the bottom with potential reversals up. As you can see, “potential” is the operative word here. That’s a polite way of saying you may be able to bank coin, or you may get gang raped. Sorry, I didn’t make the odds.

But, there are always those of us who like to play with fire. When I was six years old, I once set a vacant lot across the street from where I lived, on fire. I thought matches were very cool and playful things. Unfortunately, my dad didn’t. That was my first ass-beating, as I recall.

Anyway, some things never change. You can still play with fire as an adult stock trader / professional gambler / ass clown investor.

So, for a fireball of laughs, try a trade called:

“The Long Tail Down”

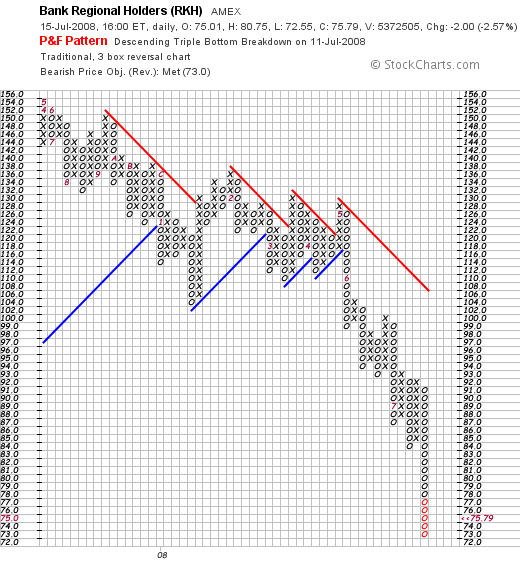

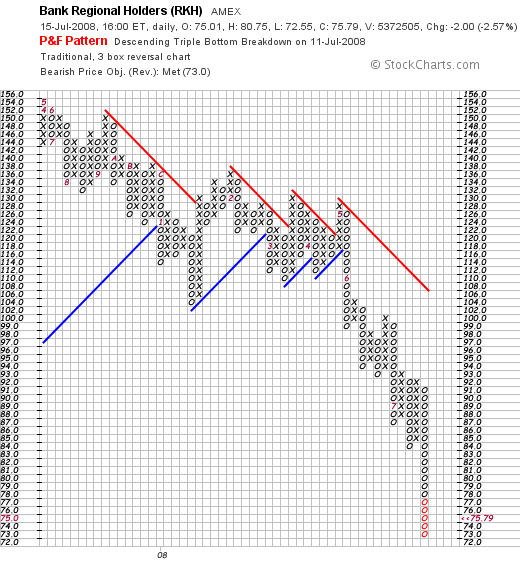

This chart is uglier than sin with a cherry on top. You can tell immediately that whoever was long this bad boy from the beginning of the year, got robbed and sodomized by a goat.

However, this is a new day, and the goat is still hung over. So, it might be worth sneaking a peak at it.

For the aggressive, thrill-seeking trader, here is a trade that works more often than not. First, you ID a stock that has had a long trip straight down in a column of eighteen “O’s” or more, and then experiences a 3-box reversal on the PnF chart from the “long tail” down. Once you see the 3-box reversal, you can buy it for a trading move back up. (Hint: it hasn’t occurred yet, so don’t get all worked up).

The idea here is that the stock has gotten hammered and has quickly dropped for whatever reason. It becomes very oversold and is due for a reflex bounce back up. So goes the thinking. All we’re doing is trying to capture this “potential” bounce.

You want to wait for the reversal because it tells you that demand is starting to come back into the stock, at least in the short term. The lowest point at which it reverses up serves as the stop loss point—which ends up being a double bottom breakdown, should the trade not work.

Finally, be willing to take profits if there’s a quick move to the upside. Since [[RKH]] is in that “unfavorable” group of “F” stocks, you can also look to short it once it reverses back down. Or, jump on the bandwagon and buy [[SKF]].

WARNING: Those of you who are hard of hearing and who do not read charts, for the second time, may I point out that RKH has not experienced a three box reversal into a column of X’s? Just thought I might mention that again, so you don’t get all giddy and shit and buy RKH with your Kruggerands.

Comments »