This morning, I sold shares of Petroleo Brasileiro SA (ADR) [[PBR]] , @ $52.74. Stop loss triggered on this “fuckus” stock.

I will post an update on that group of stocks later today.

******************************UPDATE********************************************

Re: The Most Egregious Stocks on the Planet, aka “Focus Stocks”

After the sale of [[PBR]], there are nine stocks remaining, post-carnage.

Since Inception (05/12/08):

Focus Stock Strategy: + 1.71%

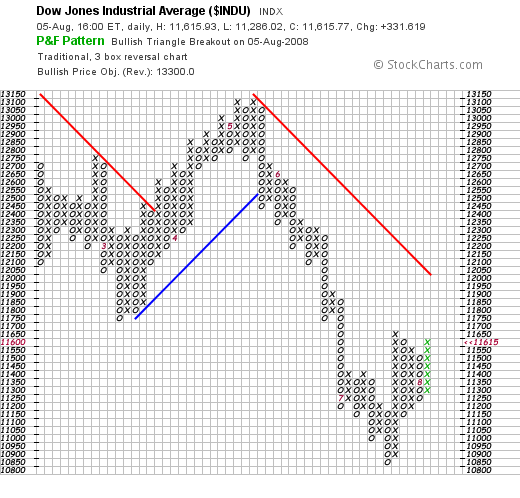

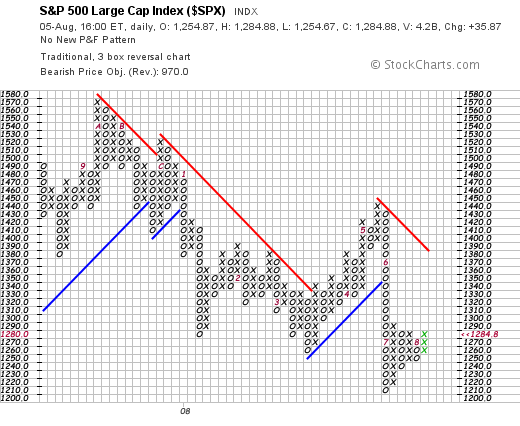

S&P 500: -9.94%

Dow: -11.41%

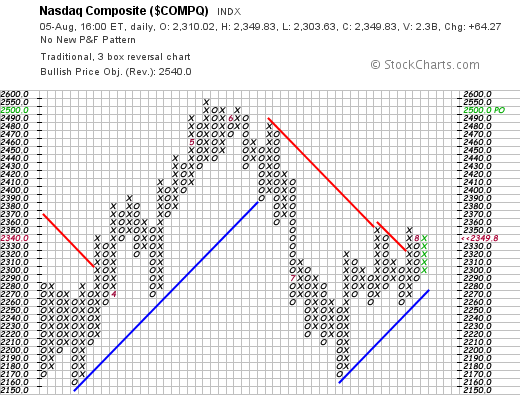

Naz: -5.38%

Current Holdings: (08/07/08) and original purchase prices:

(AGU: 82.13 -1.57%)@86.26

(BIG: 31.31 -2.37%)@ 29.05

(CLF: 90.74 -4.60%)@89.40

(CNX: 65.53 -0.43%)@91.41

(FDG: 85.85 -0.49%)@69.30

(FLS: 121.63 -1.53%)@121.10

(POT: 178.39 -1.20%)@199.26

(WFT: 38.79 +3.00%)@41.99

(WLT: 88.26 -4.90%)@83.87

Top three winners:

MEE +49.60% (realized)

EAC +26.67% (realized)

CLR +26.58% (realized)

Top three losers:

PBR -21.33% (realized)

GLW -11.98% (realized)

POT – 10.81% (unrealized)

These stocks don’t get kicked out until they individually experience a 30% drawdown. Otherwise, they are free to roam.

Still looking for a slot to fill to round out the group at 10.

Comments »