[[ICF]] Broke a double top at $81 on Friday, and has now formed an ascending triple top breakout today above $82. I closed on this property at $82.21. The tide has turned on the REITs.

Price objective is $108, with a stop at $76.

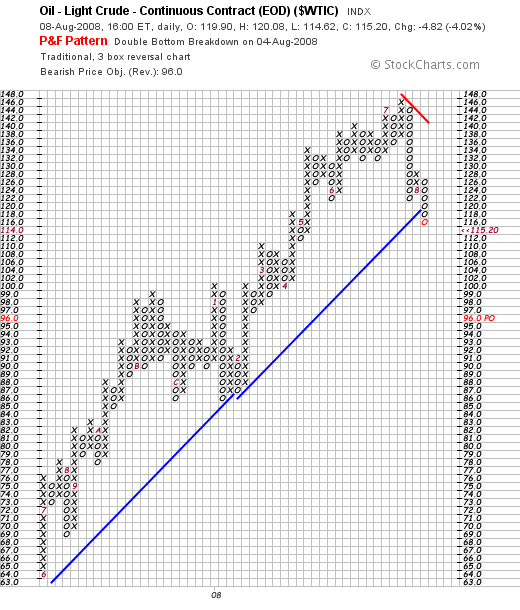

The crude oil price trend is clearly down, and oil is off again today. The dollar is starting to strengthen, and money has been rotating into formerly beaten down sectors like banks, healthcare and REITs. Even gaming is showing a pulse.

The picture is getting clearer, no?

Disclaimer: No real estate was foreclosed on, or lazy tenants evicted, with this purchase. The purchase of real estate, using REITs, involves risks, too numerous to mention. Consult your financial advisor for his/her worthless and irrelevant opinions before taking action.

Comments »