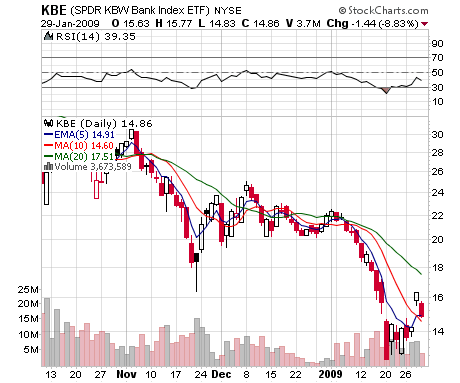

There has never been, or ever will be, a sustainable rally in the market when financials, particularly banks, are falling in absolute terms. (I know, never say never). But clearly, take a look at this:

The banks will not have a sustained rally as long as RSI is below 50, either. Not happening!

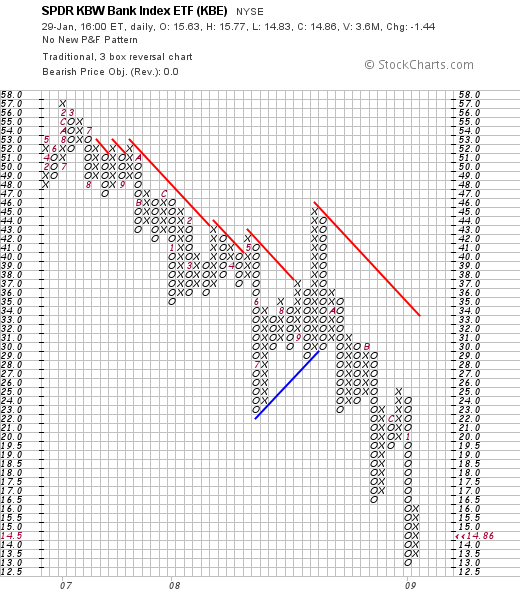

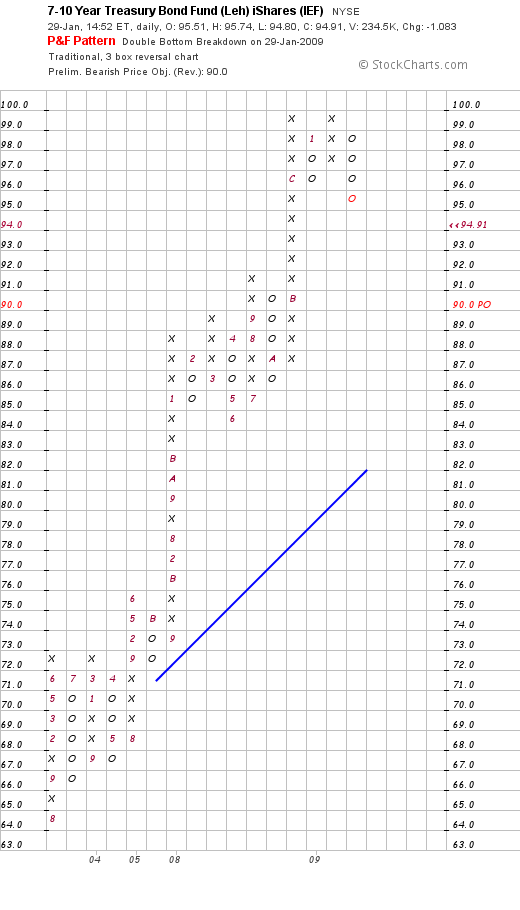

Also, check out the PnF chart:

There will be a confirmed reversal of the recent uptrend on a print of 14.50 tomorrow. This doesn’t look like strength is coming into the banks to me. Again, there is weakness overall, and the market will continue to use that as an excuse to sell down stocks on the backs of the banks.

On what should be a continued note of concern for the stock bulls, gold is seeing a resurgence that will take it to new heights. With the exception of the Yen, gold is hitting at or near multi-year highs in all the major developed world currencies. Don’t kid yourself. People smarter than you or me are buying the shiny stuff.

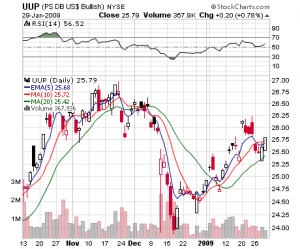

Keep your eye on the major currencies, because they may hold the key as to the direction of the US stock market very soon. As these currencies fall, gold and the US dollar index will melt up.

………….and currently, both GLD and UUP are showing relative strength and are non-correlated to US stocks.

That is all.

Comments »