I just got done rebalancing my portfolios over the past three days—hence, my silence. It is golden.

Let me share with you my current positions and basic methodology for one of my three portfolios—what I call the “Global Allocation” portfolio. This portfolio was up 24.20% last year, (or, more than yours) with just 37 trades (or, less than yours). No individual stocks—-only ETFs, and on a longer time frame. Why would I do this? Why share such valuable information? Because,… I’m a good man, just touting success.

Plus, I’m tired of hearing how much money people have lost. Enough, already.

See, what Joe Public doesn’t realize, (that many of you already do), is that, when you are trading, it should not matter which direction the markets go. What matters is being on the side of the trade that makes you profits, and when you’re not, repent! (change direction). Therefore, do not limit your ETF investment universe.

‘Nuff said.

Current positions (approximate percentages):

Equities: 5% SH, 5% EEM, 5% ILF, 5% FXI

Fixed income: 10% HYG, 10% TFI, 5% TBT

Currencies: 10% UUP, 10% FXB

Commods: 5% GLD, 5% SLV

Cash: 25%

No frills. Keep it simple.

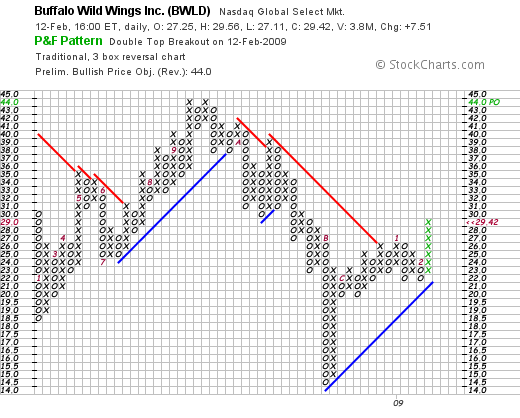

I will probably move out the short S&P position ( SH) and go long SPY by tomorrow. We shall see. The trading system works off of end of day data, so I don’t try to second guess things intraday. Nothing fancy. I just use a momentum indicator with RSI, throw in some PnF analysis and apply some basic relative strength comparisons. No big deal.

Come tomorrow, I may deploy more of that egregious, no-yielding cash on the long side if the stock market continues to run, or on the short side if we start to sink again.

The basic idea with running this money is that the major asset classes are very non-correlated, or even negatively correlated, especially when you use the inverse ETFs. By allocating a percentage of your portfolio to each of these areas, you assure yourself that you will be afforded opportunities, all the time. Since you have the ability to go long and short with ETFs, have computerized charting software, and read IBC religiously, you have no excuse not to make money, no?

Now, go make some money and let’s spend our way out of this recession.

That is all.

Comments »