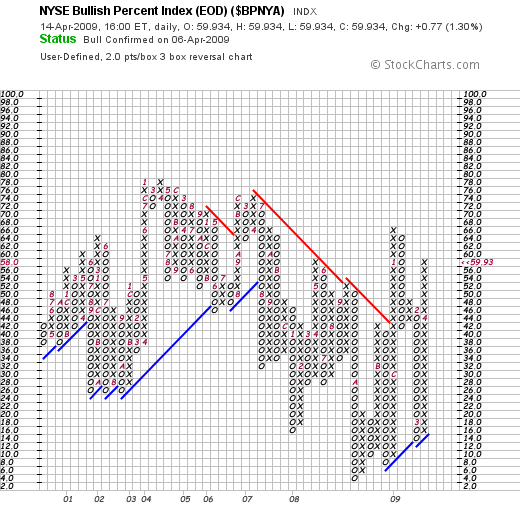

As of yesterday’s close, the NYSE Bullish Percent Index stood at just under 60%. This should start to raise a little bit of concern if you are a trader and have been milking this rally.

As you can tell from the above chart, the last rally that ended on 01/06/09, saw the $BPNYA top out at 66%.

Also, we should be watching the 15 day MA, as this is defining key trading support for many stocks and indexes.

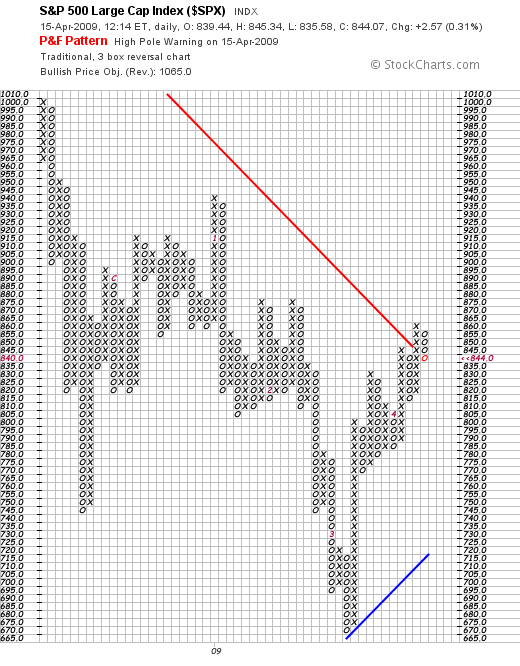

In addition, the SPX is working it’s way against resistance at these levels:

Clearly, this market has been in bullish mode, but a fall back to SPX 830 or below, could cause this trend to reverse itself.

By the way, the 15 day MA for the SPX is currently 829.60.

So bottom line, be careful on new ideas here. Many stocks are in advanced stages of this rally. That said, a number of positive divergences are currently characterizing this recent rally, such as what we are seeing in restaurants, retail, tech, metals, steel and energy. While this doesn’t mean we are starting a new longer term bullish cycle, it could mean that we are continuing the bottoming process here.

Don’t give up on this rally too soon. However, recognize that the outlook for this market is range-bound at best. This is good news for you gunslinging traders, but bad news for the “buy and hold” AARP crowd.

I think it is significant that XLF is now trading above $10. Further upside is probably coming in the next couple of weeks. Look for resistance in the $12-$14 range.

REITs are technically an interesting group, and many of you may have been following my hedged REIT strategy, featuring the egregious SRS as part of the mix. Although REITs have been lagging the financials in general, many of the names are exhibiting a bottoming out on their chart patterns and 30-day highs, as seen by AIV, AMB, CPT, DDR, and my favorite, CBL. Still, this remains a speculative sandbox to play in.

On the fundamental side, we should keep our eyes and ears open to the earnings front. My sense is that although earnings are probably still bad in absolute terms, the negativity and gloom that we saw in Q4:2008 is starting to subside.

I would pay particular attention to potential downgrades by analysts as compared to areas and sectors that could be potential upgrades. Right now, the only potential downgrade I see is for gold stocks.

Potential upgrades might be coming for retail apparrel, home improvement, O&G drillers, defense and cap goods. If we start to see more positive news in these areas, the rally will continue.

Look at that SPX point and figure chart again. Keep in mind that if SPX can break through 877-878 convincingly, there’s little resistance and a lot of upside until we get to 940.

Happy trading.

That is all.

If you enjoy the content at iBankCoin, please follow us on Twitter