So when a stock sees some options pumpage, time to go a Buy-Writin’. Right?

Not really.

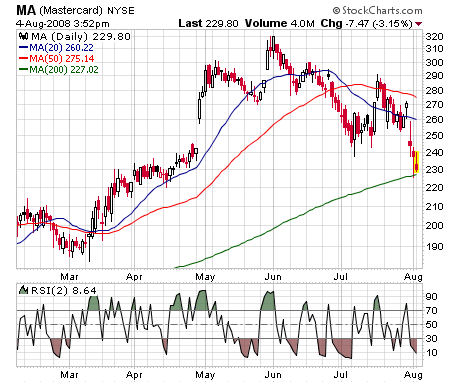

The other day MA options were hot ahead of the earnings. Roger caught some guy on TV recommending a purchase of stock around 255 vs. shorting the Aug 270 calls around $12. Why? The stock was going to lift after the blowout earnings, and the calls were fat.

MA is near 230 now, clearly not the best idea from any standpoint. And not just because it didn’t work out. Gaming the direction of an earnings reaction has extremely little edge. And those options premiums were high for a reason; earnings were due.

Roger added this.

That the stock so quickly moved beyond the amount of the fat premium as I suggested as being possible does not represent any sort of knowledge about the stock or its earnings but very simply this is a frequent occurrence in these sorts of situations. It will repeat many times over.

Buying a stock because it has a lotta option juice is probably the wrong way to come at this. If a stock you like has a lot of juice and you want to take advantage of that, ok, you are coming at it from owning the stock and selling an occasional option as opposed to saying to yourself ok, where can I find some juice.

Yes, zactly. The point being that hunting down fat premium to sell and stumbling on the MA’s of the world is a recipe for disaster. Particular ahead of earnings. Of course you’ll see fat options, they’re always fat at that time.

If you happen to own MA and want to write a couple calls, maybe that makes a little more sense. But I would suggest there are no favorable odds in that either. It is still correct to look at the call sale in isolation. You’re already bullish on the stock, based on the fact that you actually own it. There’s just as much chance that you give away nice upside with the call sale in return for saving a few bucks on the downside. That’s a zero sum expected gain over the course of time. More often than not your position will “work”, i.e. the volatility will come in and the stock won’t move much and you’ll be happy you did it. But that will be offset by the occasional disaster where the stock gets plowed and the call premium barely eats into it, or the stock explodes and you kick yourself for the upside you left on the table.