This from Condor Options (hat tip Abnormal Returns).

While the VIX isn’t actually a random number, it certainly is just a statistic, and that means many of the traditional tools of analysis simply won’t apply. And the VIX has definitely received too much attention of late, and is being asked to perform too many roles – market timer, sentiment indicator, and even trading vehicle.

The real question now is: has the VIX jumped the shark? Try as we might, it’s getting harder and harder to find a source whose daily market commentary doesn’t feature at least a casual nod to VIX action, and more importantly, those passing references almost always describe it one-dimensionally as “the fear index.” A Google Trends analysis suggests that the VIX has become a permanent fixture in both financial journalism and among the terms for which punters like us regularly search ………… The ubiquity of the VIX is as recent as early 2008: while spikes in searches and in news coverage matched spikes in the index itself during 2007, what we’re seeing now is a fairly steady stream of stories and searches even during a market rally. This may mark a fundamental shift, in that the story used to be, “market selloff = VIX spike = people are scared!” but is now “hey, look how low the VIX is going!”

There is a lot of merit in this, although I would suggest the infestation of the VIX into everything has gone on for much longer.

The Pundit Class discovered this thing in earnest during the tech bubble meltage and have overanalyzed it ever since. And I plead guilty to participating in this overparsing.

The VIX is just one tool in the shed., and a very imperfect one. It is an estimate, and as such, there is a boatful of noise in the number any time you look at it. At the end of the day, it tends to confirm something you already knew. Back in January and March the VIX spiked as the market got plowed and peaked on those big down gap days. Guess what, emotions got extreme.

What about now? Do we need a VIX chart to tell us the market has traded within very tight ranges, and options have sensibly gotten way cheaper? Or that a bull move got a bit extended and complacent?

I would suggest not.

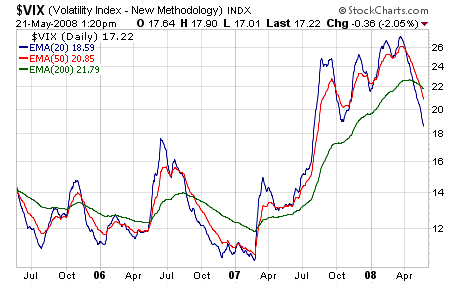

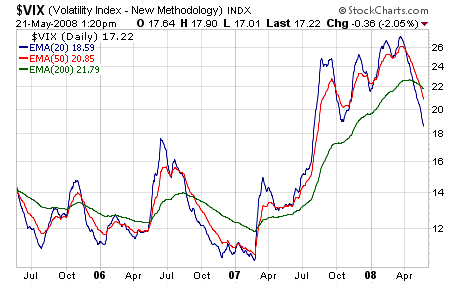

Going forward, we should forget about the blips, myself included. A move from 18 to 17 is utterly meaningless, as is a move back to 18, et. al.. The charts here are for 3 pretty basic EMA’s without the actual VIX.

And we should concentrate on looking for divergences, subjective one’s. Yes the VIX is very weak now, yesterday excluded. But it should be weak now given the backdrop of a slow-moving up market, holiday week, little news flow, et. al. And if/when the market stops this little dip, the VIX will get blasted again.

We need to stand up and notice if the VIX holds firm in the next hint of rally, until then it does not tell us much.