OK, here’s a vaguelly interesting comparison.

OK, here’s a vaguelly interesting comparison.

On bottom we have the 10 day historical volatility of the SPY. It is a noise-filled reading designed to capture the volatility feel of the market.

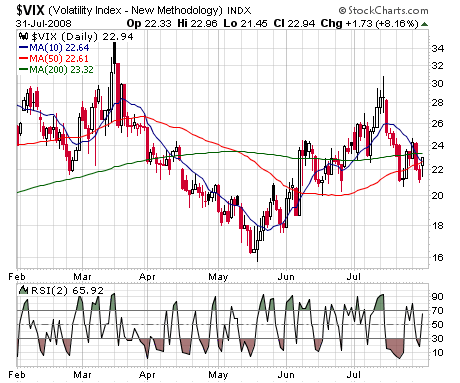

Up top we have the VIX, the option guestimation of volatility going ahead 30 days. Obviously you can have divergence, as one looks backwards and the other forwards. But clearly there is quite a bit of correlation. And that makes sense, as you project the volatility you feel now when you decide how much to pay for options that go forward.

So what’s vaguelly interesting? Well look now. On the top graph you can see actual market volatility creeping up ever higher. Yet options don’t actually believe it. Nice pop yesterday, but in general it has a bit more work to do to even get up to where the market is trading. Much less go higher and show some sign of actual Fear.

If you enjoy the content at iBankCoin, please follow us on Twitter

Can one reconcile the fact that overall sentiment is very bearish on a historical basis and yet there doesn’t appear to be much fear? Do you think we need a test of the recent lows with capitulation and a VIX shooting into the mid and upper 30s? Or perhaps we just keep grinding lower in the averages until we get the capitulation which could take months. I recall the early ’90s where we didn’t have the fear and we kept grinding lower in the face of bearish sentiment.

IMHO the average investor has “given up” instead of being fearful. It’s overwhelming when almost all the news is bad, people just shut down on the input. Like deer caught in the headlights but resigned to the fate of being run over.

yeah, if I had to guess, I’d kind of agree with Boca. It’s more apathy than fear. We probably never see some grand capitulation.

Adam,

have you noticed the yearly lows so far for isee numbers today? any input?

looks like a huge reverse/conversion trade went on in KFT Aug 35 calls and puts. ISEE only measures customer opening purchases, so dollars to donuts (MMMM donuts) the customer bought puts, sold calls and bought stock. Ergo a huge relative spike in put volume the way they measure it.

Yada yada yada, i wouldn’t read anything into the ISEE today.

thanks

Yes!! I like Vix-Watchers! Great blog, this one and your original. I too think the fear in the market is way too low. I think I’m going to plot a chart from the previous crashes and their Vix readings.

… oh yeah, wazzzzup Adam!