Over the last year and a half, I did my best to give warning that the market was prepping for significant upside. I’ve been talking about 1998 style correlations in all asset classes, and they’ve all followed that outline in impeccable fashion. Most importantly, I shouted this info from the depths of major market volatility (August & February). I was so far ahead of this move that most of you have no clue what type of analysis and predictions were made on this blog. Most of you newer readers show up to wonder why the fuck I’m not blogging about what Hillary ate for breakfast or why Anthony Wiener’s wiener is in the news again.

While I see it’s become socially acceptable to participate in stocks again, you must keep in mind that this was a metric I mentioned that the market would impose on those that opted to raise cash rather than participate in one of the most incredible investment years I’ve ever seen. We saw stocks in the energy and materials space and the cheapest values they’ve ever seen. I’ve walked traders through some of the most epic long term entry points I’ve ever encountered in equities, and it seemed to have fallen on a crowd that slowly lost interest. Which is even better having been in the drivers seat with a message that proved to be right.

I’ve always likened this blog to Shawshank. I feel like Andy Dufresne – who crawled through a river of shit and came out clean on the other side. Lol.

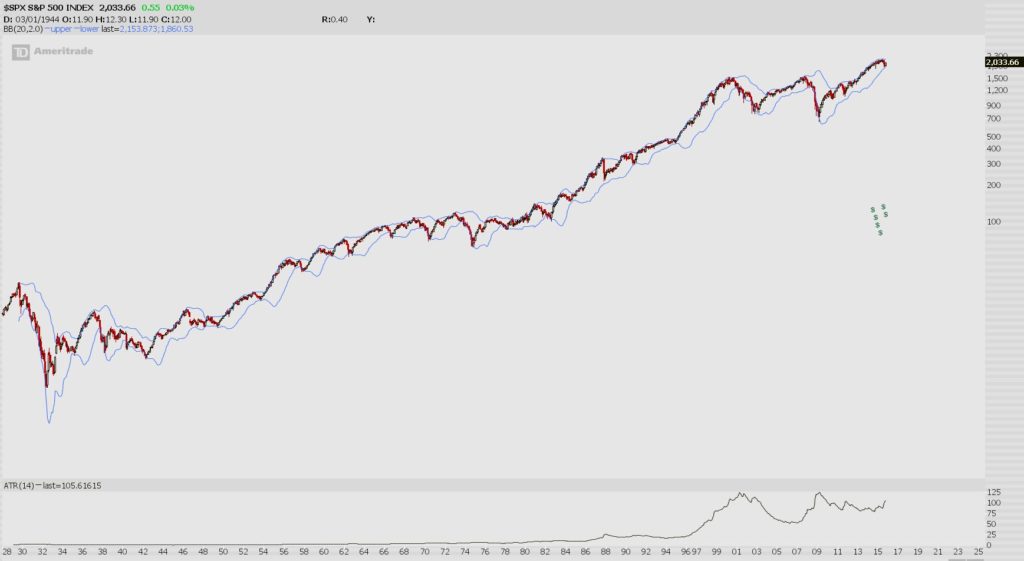

Anyway, remember my chart of the year this year?

The volatility squeeze on the monthly chart. Combine that with the elevated cash levels held by Global Fund managers. Combine that with the horrific year for Hedge Funds and their overwhelming lack of performance. Don’t forget the year long redemptions in equities and hedge funds. The historic run of bearish sentiment, and two bearish sentiment extremes this year. The lack of interest and overall negativity in the public towards stocks. Now, the removal of uncertainty in the elections…coupled with the lack of a crash post Trump elect, which was guaranteed by so many professionals.

Folks, we’re now in a chase. Which, I told you would happen as far back as last year.

We’re already starting to see melt-up style movements in stocks. However, I am going to point out one more chart to watch. It’s a monthly chart of the Russell 2000. The Russell was the biggest beneficiary of a Trump win, with its amazing 15 day win streak that racked up a 16% gain.

Last week, I diagrammed this same chart in the $COMPQ, which is breaking out today. While the daily NASDAQ composite suggests that 400 NASDAQ points be added from here, the monthly chart of the Russell calls for another 430 points of upside (+30%) should we break higher.

This is all on tap for next year my friends. Should you want to see what I have in mind to catch it? Grab a seat at my Boot Camp next week.

If you enjoy the content at iBankCoin, please follow us on Twitter

Much appreciated Jeff and Happy Holidays!

You might see another move lower from here first, but there’s potential for a massive move above 1400.

Wow. Russell is seriously unreal. Relentless

Richard shaker would be proud

Danny .. the world needs ditch diggers too .. sorry couldn’t resist

Easily the best Trader I follow. Congrats not only on being right, but seeing what so many others couldn’t. Hat Tip

Outstanding work. Eager to participate in this bootcamp.

Jeff get this I bought 100 strike jan 18 tna calls for .39cents and have been selling in the twenty dollar range over the past week.

Thanks for your insight. I will be joining after hours asap! Thanks again your blog is the best on the street. Fat pitch would be second. Happy holidays!

First TGT then LULU. Can’t help myself now, I’m stalking BABA and PANW.

China been sucking ass. Maybe it’s time for catch up

OA – Thoughts on GNK and RBS here?

a couple notes of caution I’ve observed scraping around the last 2 days.

1. Vix up two days in a row on this break out.

2. A lot of the setups that caught my eye ended up being REITs in utes

I watched Shawshank the other day and finally figured out where you got that “I can be a friend to you” line lol

In case anyone else still wonders about that line, here is a clip from the movie. A great movie, if anyone hasn’t seen it.

https://www.youtube.com/watch?v=7jKCa54blg8

$adro is doing the same thing to me sentiment-wise as $blue did earlier this year. Hopefully the outcome ends up being the same too. Considering an add

Thinking jan 10’s today.

flipped ANF for a quick 100%.

Democrats are fearful of Republicans in power because they don’t want the middle class to know that capitalism works. For 8 years all they’ve heard is this is the new normal, slow growth, retarded wages, don’t count on miracles happening.

Now imagine the market with 4-5% GDP. That will blow the millenial’s minds.

There are no Dems or Repubs here, just traders. You can find Fly and Zero two aisles over to the far right.

I thought it was funny of all the spots to post this comment he picks the one blogger who actively stayed away from political commentary.

So you’re butt hurt, big deal, with 4-5% GDP this rally is only in the 3rd inning.

Very true.

nope. I just go to OA for stock picks.

We’re concerned about portfolio growth more than GDP growth here. GDP growth is not very correlated with stock market growth, historically.

Being partisan is fine, but when it comes to your trades, you have to try to remove your bias from the markets. Otherwise you’d be be short all throughout the Obama administration or you’d miss out on the Trump rally.

Well, if you were long throughout both Obama administrations, and will exit the market when Obama exits the White House, that wouldn’t be such a bad deal.

At least for the past 8 years, it’s only if you are Republican that you needed to remove your political view from the markets.

Stock market and economy, on average, do better under Dems.

THEY’RE NOT EVEN CLOSE: The Democratic vs. Republican Economic Records, 1910-2010

https://www.amazon.com/THEYRE-NOT-EVEN-CLOSE-Democratic-ebook/dp/B008DZO7C6/ref=sr_1_1?s=books&ie=UTF8&qid=1481236886&sr=1-1&keywords=They%27re+not+even+close

That’s average performance, of course. So it is not a prediction of how the market will do under a particular president.

Dollar signs don’t have a political party

Kudos on the market calls Jeff. You deserve them.

A few names that caught my eye for some reason.

http://finviz.com/screener.ashx?v=211&ft=4&t=AWK,MSCI,DLR,CALM,REG,ISRG,WMT,Z,KO,AAPL,EA,GILD,BIDU,TSLA,MYL,MCLY,NTES,GG,NQ,KNDI,ENDP&o=-high50d

Unreal calls OA. How do you figure there may be around ~30% more gain in the Russell? Not trolling at all; just asking for my knowledge and my skill set. Thanks.

430 RUT points is 30% of the index price.

Did you follow how the targets are derived from the charts I’ve been posting?

I was buying VBK for $100 in Feb.- bought more at Brexit 117.

Crikey. I can’t touch it now so I’ll have to stock pick, sends shivers up my spine.

You could go back to bitching about day traders?

This year I made day trader chump change on EXK and CMG and TSLA money with FB on swing trades.

I’ll be interested in TWLO on the 20th.

And while the market makes new highs the garbage portfolio FIT, GPRO, CMG makes new lows. But wait, UA is at 25, it was such a steal at 32.

And who wants to buy TWTR?

But these are all old economy names, this is a whole new ballgame. Look at SLB or HAL, incredible.

How about the DDD chart set up? A good trash lights on fire trade?

What are your top picks heading into year end?

My portfolio

Thanks man. You’re awesome

$EAT $SUM $DKS

lol. no wonder its a ghost town here.

Lol. I’m advertising an event where I give out my best ideas, and you roll up like “hey man give me some picks.”

Fuck you.

Thoughts on TWLO these days? Expiry is soon, but sentiment is terrible, and shorts have been piling on.

My association with this stock was like getting an STD.

While they’d both be with you the rest of your life, an STD never pays off. Hopefully TWLO eventually will.

This is the first Fed meeting in a very long time where no one is expecting a volatile response. I wonder if it’s the instigator for near term weakness. Perhaps a “sell the rumor, buy the news” moment for those terribly boring utes and REITs. If a rate hike is 100% certain, then it’s 100% priced in. I don’t see those as sustainable near term plays due to the nature of risk appetite right now, but I’m starting to work through the idea in my brain.

Uranium up huge over the last 2 weeks. It’s gone parabolic now. It looks like this run is going to stick. I plan on buying some Uranium companies on the pullback, most likely late next week.

Jeff, over the course of the full year I positioned to be long in all my retirement accounts through July. This was based 100% on your trend predictions which I’ve learned to trust. I’m having the best year in many, many years in my long accounts as I was ahead of the curve. Have a great Christmas and thanks!

I might save this. Thanks Mike. Merry Christmas.

OA, your Christmas calls on AAPL, was your target the 52wk high?

No, it was over $114. Booked em.

Jeff,

Liking IPI

Did you follow me into that at $26? Epic trade!

standing ovation on that WYNN trade, sir.

Thanks man. You were right about the indicator. Ping me when to GTFO.

initial upward thrust confirmed and magically now 48 comments in a day old blog post. I’d be aware for a small retrace now before we get extreme upside. The profit potential will be life changing for some though….like early 2014 style.

BABA calls. Like the price and chart location and the fact it is a highly liquid name during a time of trying to increase performance on the long side.

$CMCM price action – zzzzz

I like the look of $QIWI still