Let’s skip the new phones for a second and delve into the past:

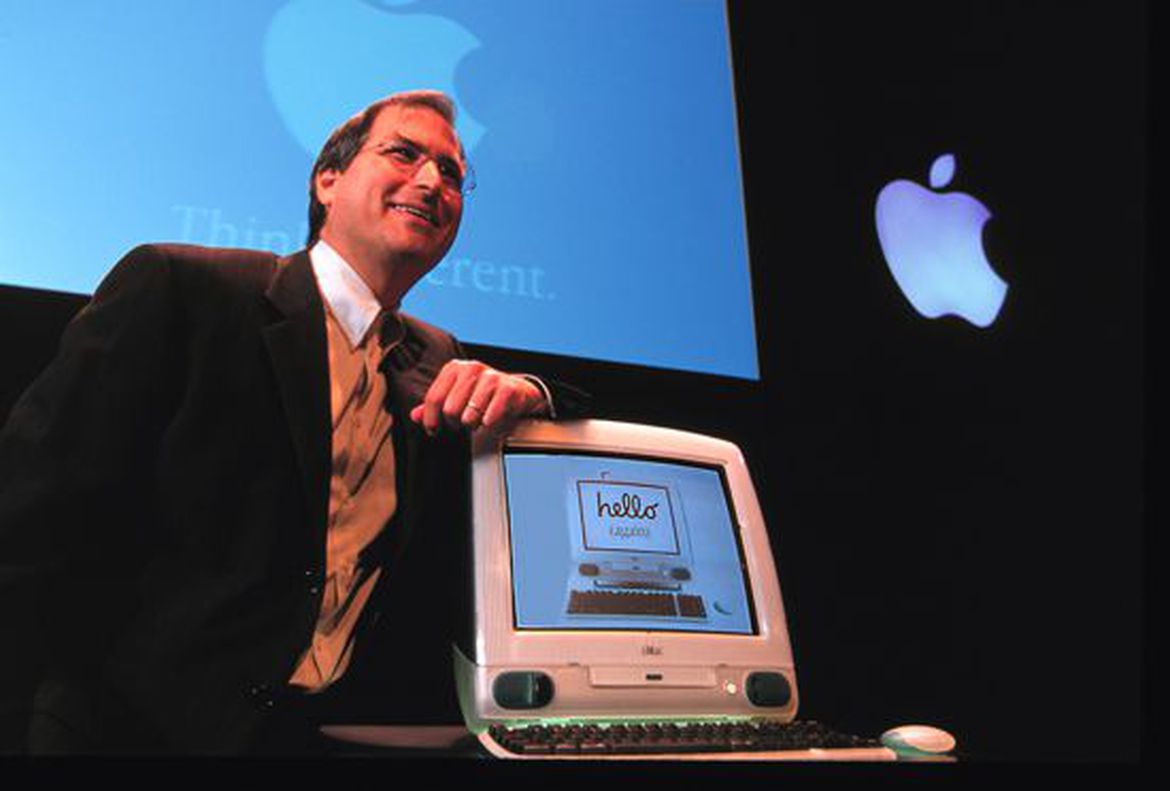

I have been beating the same drum for almost fifteen years. And listening to the same horseshit for the same amount of time. There were no iPods or iPhones in 1999, but Jobs was already well on his way in forging the behemoth we see today. In 1998 we had the new iMacs, which were far and away the epitome of Nerd Chic:

I always liked their products, in fact my first Apple computer was the Apple IIe Professional, which garnered the Professional label due to it’s TWO floppy disks – one for the OS and one for data. No longer would the user be burdened with the tedium of popping out the OS to load data. All that and MASSIVE memory…I forget exactly how much. It was an awesome upgrade to my Radio Shack/Tandy PC.

But I did not buy another Apple computer until the late 90’s when I bought a new iMac. It was translucent, it was colorful, it looked like a giant egg. It had a handle on top. It had a built-in CD-ROM reader. And horrors…it did not have a floppy disk. I still remember the wailing and the moaning…how will we survive without a floppy? But what it did have was Intel’s new USB interface, so if you still wanted a floppy drive, have at it, along with a whole slew of external devices that could also connect to the innocuous little USB slot.

Next came the G3:

and then the stunning G4 and the OSX operating system:

OSX was brilliant. I was running both a programming department and a graphic arts department at the time though my background was programming/I.T. There was the usual disconnect with the graphic artists and the nuts-and-bolts PC guys, where the former swore by the Macs while the programmers and analysts stayed in their IBM/MicrosoftSun Microsystems bubble.

I credit those graphic artists with my love for all things Apple. They refused to work on anything else as nothing could touch the Mac’s color rendering. And the new operating system GUI created by Jobs and Co reminded me of the powerful Sun Micro UNIX workstations that we used to power things like our super-fast, enormous Xerox “laser printers” like the 9700 Series.  OSX was a true multitasking OS, it ran on the Apple/IBM PowerPC platform (far superior to the Intel chips that would forever be beholden to the 8080 Windows-centric OS) – and the industrial design of the G4 was stunning.the OS was loosely based on a UNIX/LINUX kernel and directly attributable to the neXt platform that was bought by Jobs a few years earlier.

OSX was a true multitasking OS, it ran on the Apple/IBM PowerPC platform (far superior to the Intel chips that would forever be beholden to the 8080 Windows-centric OS) – and the industrial design of the G4 was stunning.the OS was loosely based on a UNIX/LINUX kernel and directly attributable to the neXt platform that was bought by Jobs a few years earlier.

In other words, groundbreaking and very cool stuff, mate.

So I dumped my full-service broker and started doing my own investing and started buying Apple stock. Every month for years. And through it all there was a constant…a shrill chorus of naysayers proclaiming the death of the company. When the first iPhone came out around 2007, it was proclaimed a worthless toy – by fucktards.

After all, what could possibly replace Muh Blackberry? A silly phone with a GUI? Haha. Nobody, and I mean NOBODY, could grasp the concept that this little device was a powerfull hand-held computer. “You are going to buy a phone to take pictures?”

The Shrill Chorus continues to this very day. A year ago I wrote this:

BUY THE DIP – while you can, under $115 Average down if further weakness tomorrow. See me in March for further discussion. The Tenth Anniversary iPhone Edition due in 2017 is rumored to be a game-changer. Everything this fine American company does is planned years in advance. Target $130 June 2017.

$130? Hee.

We are now at $160 and $200 is right around the corner. I also said this:

Beats consensus. IPhone7 above expectations. Ridiculous +24% beat on services, Second-Gen watch and iPhone7 will do well this Christmas, (not enough data to contribute to 4th-Q numbers), 10th-Anniversary iPhone in-queue, buybacks continue,

Right before that post, the noise was that the iPhone7 was nothing more than a revamped iPhone6. Read the comments over the last two weeks and you will see the same theme regarding the iPhone8. They just don’t get it. There is a reason Jobs hand-picked Tim Cook as his successor. Cook may not have the charisma of his mentor (far from it) but he has been nothing short of brilliant in his execution of the core mission of the company.

“The iPhoneX, as the latest iteration is called, will be a runaway success. It is truly a game-changer. “But it is $1000!”, you bleat. You bonehead. Who buys an iPhone when you can lease one with carrier subsidies at $45-$55 a month?

Wired Magazine states:

THE NEW IPHONE X packs more new stuff into any device since the original iPhone. It’s the most complete redesign of the product ever and even offers a glimpse at what the iPhone might become when the world no longer wants smartphones.

Remember that quote. We will revisit it sometime in the not too distant future. You can get into the nuts and bolts in Wired’s article here.

YOU UNLOCK THE PHONE, EVEN PAY VIA APPLE PAY, WITH YOUR FACE.

Augmented Reality (AR) and Artificial Intelligence (AI). The Billions being spent now and in years to come, funded by the Ever-Growing Cash Horde, on Future Tech is starting to show results. The Home Button is gone, sacrificed to the gods of the full-screen interface…you 3-D map your face to enable unlocking your phone. Slick.

The 3rd-Gen Watch is also imminent. The Apple Watch is now the best-selling watch in the world. Watch Gen-3 will ramp those numbers way up. I look forward to other wearables in the near future. Apple Shirt, anyone? I look forward to Augmented Reality displays hovering in space in front of me, fully controlled by my voice, eye movements, and gestures. This will all be brought to you by the fine folks from Cupertino, California. They might not be the first with the products, but they will be first with the ones you want.

And the growth will continue to be powered by Services. Value-added, baby. The ultimate upsell.

I’m getting tired of pimping $AAPL. Ignore at your peril. Rant to be continued, no doubt. We’ll revisit at $200/share. And that dividend! You are thick, man.

Comments »