With the summary dimissal of [[TSO]] this week, I have an opening in the ranks I’d like to fill. In fact, I may open the barracks to two or more if the stars align properly and there are attractive combatants ready to take the pledge to hard money and portfolio longevity that our General Jackson demands.

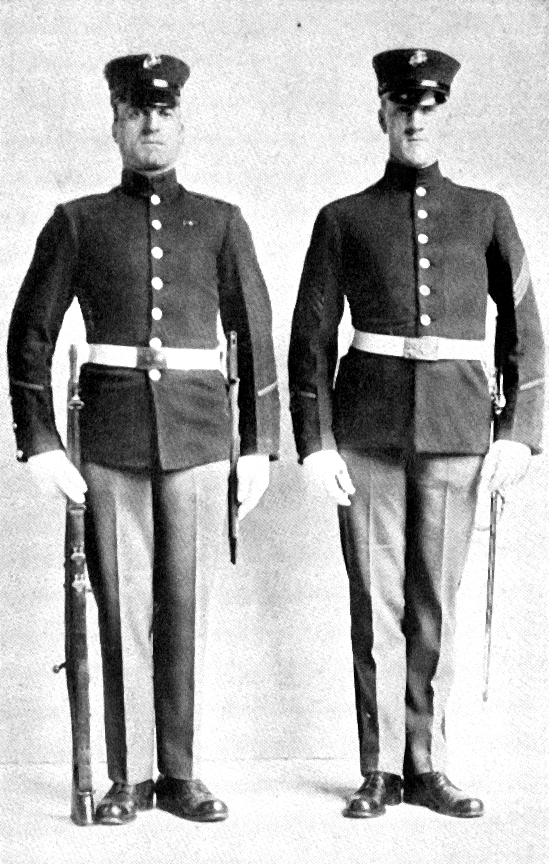

One course I’m considering is having the Jacksons act as a 20-man platoon, with certain soldiers being held either partially or fully in reserve during times of either overvaluation or imminent reversal, whilst the others take up the battle against the Federal Reserve and it’s 12-battalion band of Redcoat brigands. I believe I will represent this through a “going to cash” metric that I will include in my daily reports.

For example, my sale of TSO resulted in a net cash position of $9,357 (a little more than a $640 loss from the original $10,ooo invested). While TSO will soon come off the roles entirely, I will keep that cash for reinvestment purposes going forward, thereby keeping the Jacksonian Portfolio to the same accounting I’m using in my own portfolio.

This method will also help better track my partial sales, like my “one third” position sale in [[TC]] the other day at $11.21, which would have yielded me an additional $5,250 in cash (keep in mind, the original $10,000 in TC was invested at $7.11 on May 1st. Therefore, even after having sold a third, I have over $11,000 in value remaining ).

So given those two sales, my cash position is up to $14,600, and burning a hole im m’ pocket.

I will work on adding these cash parameters so you can have a better idea of what I’m doing every day in my portfolio, and a better view on how I’m hedging the port against cyclical downturns.

In the meantime, I welcome suggestions with regard to additional Jacksons. I can tell you now that the precious players will have a leg up and [[GG]] and [[AUY]] remain in the top contenders. That said, I will look forward to your calls here. Remember that I like liquidity, and volatility is not a plus in the Jacksonian fold. Long term value trumps all, however, especially in the context of an inflationary or continuing deflationary market.

Best to you all.

___________________

Addendum: Forgive the indulgence. I have one last tribute for my girl’s nativity. Appropriately, it’s a song about a heart-stealing Kentucky woman, from the master himself, back before his voice went out altogether:

[youtube:http://www.youtube.com/watch?v=Iq7ZkdNNPKI 450 300] If you enjoy the content at iBankCoin, please follow us on Twitter

Jake,

Consider in a domestic natural gas exploration and production company. There are plenty to choose from that are over 10 billion dollar companies with lots of liquidity. Some of the energy pipelines like ETP that pay a fat dividend will provide support in a volitile market. Just something to consider I think nat gas is about to blow up and could be a steller buy and hold situation getting in during the early stages.

Don’t replace a oil stock with metal stock ova here ova hea’

Shroomz– I’ve got a couple of natty plays, but the question was what do you like?

___

SWN LINE ETP CLNE EOG I own long term, NOV for a trade, also I own ACI, for this country runs on Coal power. I of course own 2 silver stocks and a regal gold stock.

You really helped me get over a hump with your metal ideas, thanks JG!

Jake, I’m hardly qualified to give suggestions but I’m eager to see what you choose.

Maybe something exotic to add some life to the list

PS. Best wishes to your lady for her birthday

Hopefully she’s happy so she can keep you happy so you can continue to offer your guidance on the blog.

Thanks.

I like UPL to 60.

http://stockcharts.com/charts/gallery.html?upl

SUN looks interesting at $26.Jack,any thoughts on SUN.

crude,

My 2 cents

SUN has heavy 2 year downtrend resistance at approx $38 but currently printed a spinning top off of support formed in March (buyers saving the day?)

Looks like a bearish descending triangle forming now with lower lows in June vs May

Could be a trade towards $30 if it bounces here

Longer term more resistance is at approx $47 which is coincidentally also the 38.2% Fib line

crude,

My 2 cents

SUN has heavy 2 year downtrend resistance at approx $38 but currently printed a spinning top off of support formed in March (buyers saving the day?)

Looks like a bearish descending triangle forming now with lower lows in June vs May

Could be a trade towards $29 and change IF it bounces here

Longer term more resistance is at approx $47 which is coincidentally also the 38.2% Fib line and more support for a final stop at approx $22.50

majesty, thanx bro

you mean 30 to 40-man platoon

fm Barrons … Marc Faber on NG

You’ve been a big fan of resource companies. Are you still?

Mining companies such as Switzerland’s Xstrata are good trades. The company got hit hard last year because it operates on leverage, but the concern was overblown. I like NovaGold Resources . Barrick Gold [ABX] tried to buy them for about $15 a share a year ago. There was no deal and NovaGold fell below 2, although it has rebounded to 5.50. NovaGold has enlarged its asset base significantly. Today it is even more valuable than $15

CA — your correct definition aside, this is a non-traditional platoon… think War of 1812 mounted Dragoon-style.

_____________________

Crude — I thought we’d talked about SUN last week? I’m not so high on the refiners right now… I don’t like how they’re taking this rise in earl.

I may be wrong, but I had a pretty fat profit on TSO, having bot most of my position under $10, so I figured taking the money and running was the best option here. Also, refiners don’t really meet the strict guidelines of the Jacksonian profile.

___________

Your Majesty — Sorry about the spam filter here, it’s something Jeremy is (allegedly) working on.

If it makes you feel any better, my own comments get caught in the spam filter all the time.

One suggestion, use a real e-mail address, or at least one that doesn’t have “ibc.com” attached to it, as that may be getting flagged by the system.

Also — and this is for everyone — if you see your comment getting kidnapped, or not showing up, it’s likely that it’s in the spam filter. If you leave a message (even “test” will do), I can go and retrieve it from my blog-deck.

I wouldn’t have seen yours, YM, if I hadn’t had my last one kidnapped myself.

_____________

Bruce as you know from here and on the PPT, I have a load of NG (and NXG and NGD). It’s just not big or stable enough to be a Jacksonian.

I have absolutely no problem joining in your recommendation, here, however.

______________

I like water stocks for the long term. Consolidated

Water (CWCO) and Cascal N.V. (HOO). Water stocks would be a commodity play, wouldn’t they? (I’d also like a good geothermal for a long term green energy play, but haven’t really found one to buy yet. All though micro cap HTM did just BTFO.)

HOO not big enough for the Jacksonian, but I think it might be getting ready to break out. CWCO is one of my favorites. I owned it once, but sold out way too soon. Looking to get back in soon.

PS Happy Birthday Mrs. Jake! Your husbands’ post about your family trip to Disney World was hilarious. Unfortunately for me, I am bound by love for my daughter to take her and a friend there next month for MY birthday, if you can believe it. I like going around the Christmas holidays, but a trip there in July has got to be right up there next to a sentence in hadies. Haha

Jake, I like the idea of adding a uranium play. As far as a good one I’ll leave that to the better stockpickers. I also like chanci’s water stock idea.

Yes, a water stock is a good idea, and I have been watching CWCO. In fact, back in the day, one of my previous firms had considered following them, so I’m familiar w. them.

However, they may be a bit too volatile for a Jacksonian, though I might include it in my personal port.

I will give strong consideration to a water stock, however… maybe CWT or AWK?

______________

Jake, actually I wasn’t recommending NG as a Jacksonian .. just passing on what I read, knowing that you & others are in NG.

But I have read good stuff about MSFT lately & windows 7. MSFT may fit the bill for Jacksonian status.

Jake,

Take a look at the junior Australian iron ore miners – Fortescue Metals Group (FSUMF) being one that I own in bulk and one that gets talked about a lot. As you know the Chinese get a large percentage of their iron ore from Australia so you have that angle, they are severely p.o’d with BHP and Rio forming a joint iron ore venture and torpedoing the Chinalco deal so the Chinese customers are looking for acquisitions and investments in the juniors.

So you have:

China play

Australian dollar play

Commodities play

Potentially buy-out play long term

As for volatility, FSUMF was down 10% Friday…after having multiple up 20%+ days on two breakouts. The stock had been $12 before the collapse. I started acquiring at $1.72. Its in the mid $3’s now. One advantage to the junior ore guys is that they likely will not trade in tandem with the precious guys which reduces portfolio volatility. I was up 3.5% this week and it sure wasn’t thanks to my DGP, AGQ, GDX, or NGD positions.

Here is the company website

http://www.fmgl.com.au/IRM/content/Home.htm

As i say, there are a number of others.

Kel — could not agree more, as TC and TIE helped out my port this week.

Also, we have been discussing FSUMF in the PPT all week… I like it a lot.

If you have others, perhaps more liquid (maybe BHP?) that you like, let me know.

______________

Jake,

I like BHP and own it. I think it has a lot of additional upside over time but not nearly what a FSUMF does obviously. It is a core holding for me. I have been meaning to look for others and I need to do that. I’ll pass on what I find.

swc Stillwater Mining Company is engaged in the development, extraction, processing, refining and marketing of palladium, platinum and associated metals from a geological formation in south central Montana known as the J-M Reef and from the recycling of spent catalytic converters

Jake,

Gold is common trash compared with the rarity and industrial necessity of palladium.

If I could buy bars of something for the future value, it would be palladium. Of course platinum could be my second choice. SWC is all American just like Jackson!

TD

Jake, how about the Van Eck Agribusiness ETF (MOO)?

(1) not directly tied to prices of depletable resources, as are mines, but does supply picks and shovels (Komatsu), as well as tools for renewable-resource work (Deere, Kubota)

(2) has the whole Jim Rogers grand-commodity-cycle / demographic / emerging market thing going for it (MON, SYT, POT, ADM), which has ways to win other than just inflation

(3) exposure to non-US-traded agribusiness, like Singapore-traded Wilmar International

(4) didn’t do as well as MON on the way down last year, but since it bottomed in October, has methodically ground upward, including a string of 12 consecutive green weekly bars after March

If the ETF itself isn’t interesting, one or more components might be.