Did you catch it? Hope you did! We had a number of signals that alerted us for a squeeze. If you missed my last post on “How to spot a rare day-trading day, how to trade them”, then you may want to take a look at it. Today (Wednesday’s relief rally) was another wonderful example of a rare, powerful, and day-tradable squeeze day. Let’s go through those steps:

Step 1: What is the state of the market (premarket): Market sold off big time on Tuesday on news of bank weakness; perhaps selling was accelerated by news of new president. We took out Thursday’s lows, so it’s NOT a good idea for swing longs ( low probability). However, leadership sectors still held ground despite selloff. Noticing strength in school stocks and medical stocks, therefore, as concluded during yesterday’s selloff, it was NOT a good idea to enter new swing shorts. In fact, I issued a “you better hedge your shorts” warning.

Going into the market…

Step 2: Check volatility- VIX is red! Reversal from yesterday’s test of 55, back under 50 we go.

Step 3: Find the sector influencing the market and the VIX. Answer: Banks. Find the stock or stocks in that sector that dominates investor sentiment. Answer: BAC

Step 4: Did banks hit an intraday bottom? Is stock from step 2 (BAC) squeezing? Yes. Probability for squeeze up.

Step 5: Find the intraday “relief point” (check technicals on market). Got it, near 8000 or 8050! (there was actually a lower “relief point” but, I didn’t trust it. Went for confirmation. Actually, 8050 was from Agwarner, our old tabbed blogger Adams Options guy. We both went long FAS).

Step 6: Make the call! “BAC > 6 = market new highs = FAS new highs” … FAS was up about 8% when I made the call.

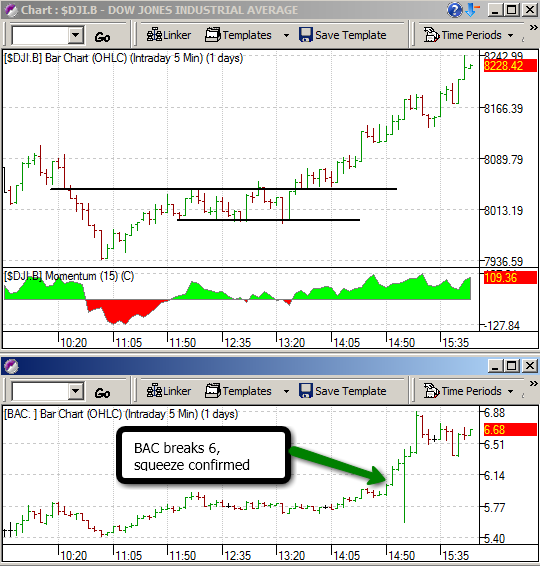

And here’s how everything played out…

- Vix reversal (Step 2)

- Breakout above relief point (technical confirmation; Step 5)

(Step 3, 4)

- Same Dow Jones chart, but compared with BAC since that was our stock we were using for direction. Remember, above 6, market explodes!

- The relief point / breakout point again. Notice the channel that was broken to the upside. Bears don’t like quiet channels, especially after a big down day.

- And, make the trade. I got long FAS, but capped my gains at 5%. If I let them run, it would have been another nice 15% day. Once again, “rare day trading days”.

(Step 6)

… what a crazy and volatile market! I warned about not picking a side just yet. We have to let a few cards come down first before we place bigger bets on the swing trade.

Again, don’t worry that you missed an opportunity, or try and force a trade. The next one is coming to you as we tweet.

Aloha!

-gio-

Good stuff Gio.

Thank you for taking the time to publish your thought process…very helpful.

Badass

Gio, nice job. thanks for the Tweet updates. once again, your analysis was right.

Keep it up, looks good Gio.

Great post Gio! I was stuck in a training class and had to sit this one out while quietly watching it play out on my iPhone. I definitely felt like I missed out today. I’ll have to wait for the next “rare day-trading day”, although I prefer a better swing trade setup which lends itself to a more normal family life. Keep up the great work and fresh perspectives!

Mahalo!

-Eddie

@Fasteddie …right now, our market is moving in a very strange way, which is giving us more of these day-trading days than what we usually see… don’t worry, you’ll get more of them. I too rather swing trade, but understanding the game and play by the rules… the game is not to swing trade (see my Poker analogy post. No huge edge yet). anyway, I’m not really a daytrader either, more of a volatility trader so until we get a direction. Hopefully you didn’t miss too much of your training class!

i feel like i’m sitting next to you in Ms Robinson’s Math class, “pssst, G-dog, what did you put for #4?”

… NICE POST. 😉

WILL RKH ( regional banking index) kill the VIX?

for the answer click here—

http://zstock7.com/wp-content/uploads/2009/01/rkh-1-21aaaa.jpg

You have the VIX by the balls. Awesome job.

Gio

You should be givin an award for something. How does one person get it so right.

Im starting to think that YOU control the market.

What do you think of my PALM short? Started 2 days ago at 8. I think the I phone will own the pre and appl may defend their software in court. Also think I am early on this trade.

FWIW — the $VIX closed just below it’s 61.8% fib retrace (of the move from 16.22 to 95.66, which is $46.57), which could indicate further downside action.

The one caveat is that it didn’t crack it by much (closed yesterday at $46.42), and in times when it only breaks a strong line by a little, there’s almost as much of a chance for a bounce, in the near term.

________

Well lookee thar — bounced right off that line, and (temporarily?) stalling at your “magic fitty” line.

_________