In their article, Education Stocks Make the Grade, they mention “Education services are hitting high marks as more workers, including the newly unemployed, look to enroll in classes to upgrade their skills.” That sounds familiar, no?

Just kidding. They didn’t quote me, but that would have been cool. But really, I read that article and it felt like I was reading myself.

From a post in early January:

“I would be cautious shorting education stocks here, especially if STRA can hold the 189 area. There’s actually one education stock I want to get long, ***E. It’s too early to call a top in APOL, so until you see STRA and APOL both reversing, then the dips must be bought in this sector.

… I’m trying to figure out why education stocks are in their own bullish cycle? My guess is that there must be some kind of correlation between our rising unemployment with the demand for higher education. Which makes sense a little… people generally feel that if they have extra education, then their chances of getting a job will be better. I could be on to something.” – http://ibankcoin.com/gioblog/?p=2656

…here I ask, “why.” Why is a bull market a bull market? With some homework, a day later we found out why:

Post: “Smart Money in Edjewkayshun”

I was sitting in the doctor office today watching random stuff like Family Feud, and during the commercials, I would see a bunch of “go back to school” commercials. Have you noticed this too? They really are pressing it! Notice the air time they are picking to post these ads… during work hours. Obviously there’s an unemployed target market here.

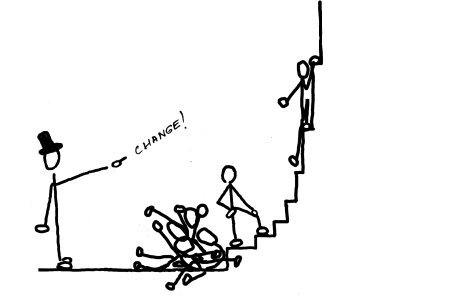

Anyway, it was a topic that caught considerable interest in Twitter land, and in my comments section a few posts ago. And what we came up with makes sense… in a recession, people tend to change jobs and careers (thanks Dogwood), and in order to do so, you need education!

Another trend I brought out, was that there must be some kind of correlation between unemployment numbers going up with demand for education going up. And that makes sense too, because when you think about it, the higher the unemployment pool is, the more the pursuit of higher education to bolster one’s chances. Survival of the smartest. Enrollment grew 18.4% at APOL, and I would pay close attention to this type of data (source).

It will be interesting to see how the education stocks perform in the weeks to come. With APOL, a leader in the industry.

Okay, now after reading those two post, go and read Fortune Magazine’s bullish article on education that came out today. Biters! Lol. It’s fine… it just illustrates a fundamentals approach to investing. Find out which sector is moving, then find out why. Look for trends in society, and see if these trends are fueling a certain sector with cash. Every time you go shopping, hang out at the mall, surf the internet, watch TV- constantly ask questions (in your head, and not out loud please) about why things are moving in a certain direction. Ask, “are people willing to spend money on this? Are people still willing to spend money on this?” It’s a great way to use fundamental principles in investing, and I got that idea from Mr. 10-bagger, Peter Lynch. I remember way back when I used to go to the local convenience store to count the number of rows Monster energy drinks were taking up. I went from Green Monster, to Khaos, to Low Cal, to the coffee mixes… then the competition started to come up, like RockStar… throughout all those observances I was long HANS… until the coffee mixes came out, then I knew they were over-diversifying their product portfolio.

… anyway, that is how you invest (not trade). Keep your eyes open to trends, and if you spot one, let me know! You may have found the next bullish, or bearish, sector before Fortune or WallStreetJournal does.

aLoHa!

-gio-

P.S. Now that education stocks are getting attention, I’d be careful with going long here. Bullish sectors tend to suffer profit-taking when news highlights them.

If you enjoy the content at iBankCoin, please follow us on Twitter

I like them for shorts, specifically APOL.

ESI reports tomorrow! Will keep an eye on the sector.

Hey, I quote you all the time! I think my hubby is sick of your name. LOL. No, he loves reading here now, too.

I’m om my blackberry, so can’t go into in depth, but I am buying up NTRI and SBUX for the long haul. Also seriously considerin CEDC. I don’t think people will give up good coffee, liquor or vanity/health for the depression. Also all good business models.

Any stocks specialize in racism? Because I am hearing a lot of egregious shit around town. Seems like a macro trend to me.