For various reasons, like a pullback in the U.S. Dolla Dolla Bill, the market bounced like a super ball today. No denying that. But I am standing behind my statement that we have seen the high for the year (SPX 1103). If I’m wrong, who cares, as we trade whatever ultimately happens the right way.

For various reasons, like a pullback in the U.S. Dolla Dolla Bill, the market bounced like a super ball today. No denying that. But I am standing behind my statement that we have seen the high for the year (SPX 1103). If I’m wrong, who cares, as we trade whatever ultimately happens the right way.

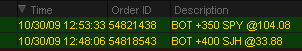

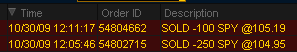

What is interesting to me is that we had 2 shorts going into today’s trading, and closed the day up quite nicely thank you very much. We didn’t fool around with Baidu.com, Inc. (ADR) [[bidu]] and exited within the first minutes of trading as prices were hopping around like kangaroos on crack.

What are we looking for now? Because we are operating off a thesis that the market will not make new highs, we are searching charts for stocks that performed horribly in the teeth of a buying wave the size of which you can only find at Jaws Beach in Maui.

[[dtg]] is a perfect example of the kind of stocks we are looking for. Damn thing skunked the bulls today and we actually like our short position more today than we did yesterday. There has to be a few more out there like this one, so we are off to The PPT to find some.

Don’t get me wrong, we have plenty of cash to grab some longs for short term trades too. So we may just post later tonight with one for the bulls and one for the bears.

Comments »

![]()

For various reasons, like a pullback in the U.S. Dolla Dolla Bill, the market bounced like a super ball today. No denying that. But I am standing behind my statement that we have seen the high for the year (SPX 1103). If I’m wrong, who cares, as we trade whatever ultimately happens the right way.

For various reasons, like a pullback in the U.S. Dolla Dolla Bill, the market bounced like a super ball today. No denying that. But I am standing behind my statement that we have seen the high for the year (SPX 1103). If I’m wrong, who cares, as we trade whatever ultimately happens the right way.