I was right in my wrongness. These losses are actually wins as far as today goes.

Today’s Market Stats & Tomorrow’s Key Pivot Levels

Post Game Market Stats for 11/04

| Ticker | Closing Price | Price Change | % Change | |

|---|---|---|---|---|

|

Dow Jones Industrial Average

|

DJX

|

9802.14

|

+30.23

|

+0.31%

|

|

S&P 500 Index

|

SPX

|

1046.50

|

+1.09

|

+0.10%

|

|

NASDAQ Composite Index

|

COMPQ

|

2055.52

|

-1.80

|

-0.09%

|

|

NASDAQ 100 Index

|

NDX

|

1680.67

|

+1.47

|

+0.09%

|

|

Russell 2000 Index

|

RUT

|

563.12

|

-7.50

|

-1.31%

|

|

CBOE Voatility Index

|

VIX

|

27.72

|

-1.09

|

-3.78%

|

|

E-Mini Gold Futures

|

GC

|

1092.40

|

+0.69

|

+0.71%

|

|

E-Mini Lt. Sweet Crude Oil Futures

|

CL

|

80.26

|

+0.83

|

+0.90%

|

|

Total Vol.

|

% Change

|

Adv./Dec. Issues

|

Breadth

|

|

|

NYSE

|

1,350,116K

|

-2.22%

|

228

|

-1.16

|

|

NASDAQ

|

2,230,601K

|

+3.52%

|

-574

|

-1.01

|

|

|

Sectors

|

||||

|---|---|---|---|---|---|

|

Best Performing

|

% Change

|

Worst Performing |

% Change

|

||

|

Home Construction

|

+1.92

|

Banking

|

-2.14

|

||

|

Healthcare

|

+1.25

|

Biotechnology

|

-1.71

|

||

|

Pharmaceutical

|

+1.19

|

Oil Services

|

-1.19

|

||

|

Software

|

+1.06

|

Insurance

|

-1.10

|

||

|

Gold

|

+0.78

|

Transportation

|

-0.93

|

||

|

|

Key Daily Pivot Levels for 11/05 |

||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Level

|

[[SPY]]

|

[[QQQQ]] |

[[IWM]]

|

||||||||||||||||||||||||||||||||||||||

|

Resistance 3 (R3)

|

107.63

|

42.29

|

58.64

|

|

|

Resistance 2 (R2)

|

106.98

|

42.08

| 58.16

|

|

|

Resistance 1 (R1)

|

105.95

|

41.70

| 57.21

|

|

|

Pivot Point (PP)

|

105.30

|

41.49

| 56.73

|

|

|

Support 1 (S1)

|

104.27

|

41.11

| 55.78

|

|

|

Support 2 (S2)

|

103.62

|

40.90

| 55.30

|

|

|

Support 3 (S3)

|

102.59

|

40.52

|

54.35

| ||

|

|

Key Pivot Levels For Week Of 11/02 |

||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Level

|

[[SPY]]

|

[[QQQQ]] |

[[IWM]]

|

||||||||||||||||||||||||||||||||||||||||

|

Resistance 3 (R3)

|

116.15

|

45.68

|

64.87

|

|

|

Resistance 2 (R2)

|

112.73

|

44.72

| 63.02

|

|

|

Resistance 1 (R1)

|

110.40

|

42.84

| 59.68

|

|

|

Pivot Point (PP)

|

106.98

|

41.88

| 57.83

|

|

|

Support 1 (S1)

|

104.65

|

40.00

| 54.49

|

|

|

Support 2 (S2)

|

101.23

|

39.04

| 52.64

|

|

|

Support 3 (S3)

|

98.90

|

37.16

| 49.30

|

|

| ||

Covered PALM Short for 8.35% Gain

If we weren’t an hour from the FOMC announcement, I would have let it run. But we are still very pleased with the 8.35% gain on the Palm, Inc. [[palm]] short. We are now 100% cash going into 2:15 announcement.

![]()

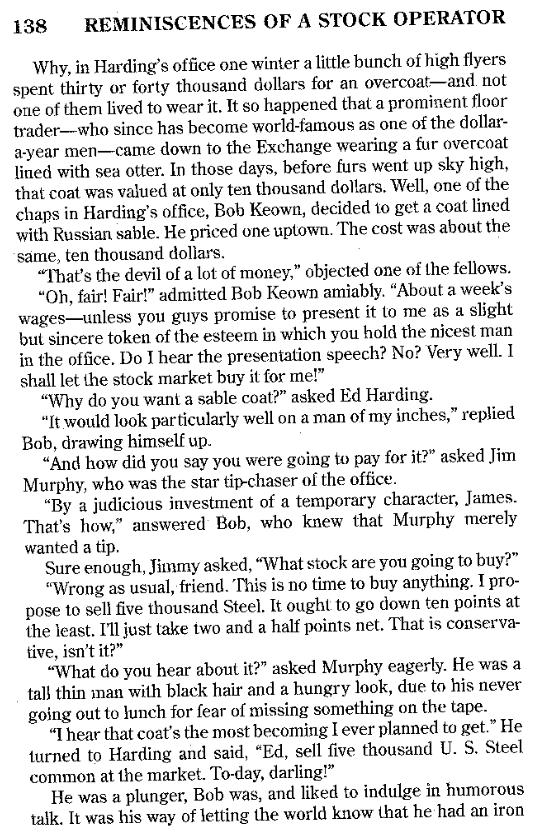

1.5 Hilarious Pages from Reminiscences of a Stock Operator

Rules are Rules

I needed losses this morning like a gaping whole in the head. I was going to come up with some clever rant about this, but it’s no use…the rules are the rules. I was forced to cover my [[spy]] chart for just over a $480 loss. While I was standing there with a knife after killing off the SPY trade, I made a judgment call to slit the throat of my [[pay]] and [[ing]] shorts as well for a $207 loss and a $390 loss respectively. It’s striking how violent my posts have become, no? Better I think in terms of killing positions than using the aggression to fight the market. The market always wins fights because it has way more money than any of us. I am still holding the ever cooperative Palm, Inc. [[palm]] but have placed a stop at break even of 11.64 and a target of 10.04.

I needed losses this morning like a gaping whole in the head. I was going to come up with some clever rant about this, but it’s no use…the rules are the rules. I was forced to cover my [[spy]] chart for just over a $480 loss. While I was standing there with a knife after killing off the SPY trade, I made a judgment call to slit the throat of my [[pay]] and [[ing]] shorts as well for a $207 loss and a $390 loss respectively. It’s striking how violent my posts have become, no? Better I think in terms of killing positions than using the aggression to fight the market. The market always wins fights because it has way more money than any of us. I am still holding the ever cooperative Palm, Inc. [[palm]] but have placed a stop at break even of 11.64 and a target of 10.04.

I am completely uncaring about the next direction of the market. I don’t care about my predictions being right. I will move heaven and earth to be on the right side of the trade. I will come on here and bare my losses, I don’t care damn it…just give me the right side of the trade!!

And if you read this post later tonight and the market has tanked on the Fed announcement and you think, “coach, you idiot, you should have held onto those shorts”…I will say that you my friend are wrong. I will tell you, Mr. Standing In The Future, that if this market decides to tank, I will get short with the fury of a hungry pit bull. You see, by cutting those positions, my mind is now not consumed by their fate going into the Fed announcement at 2:15pm. To have done so would have been nothing short of waiting to see what color the roulette ball would land on. Instead, I have given myself the gift of a clear head to make the decision of whether to get long or short after 2:15pm. Regret will not play a role in the future regarding any of these actions.

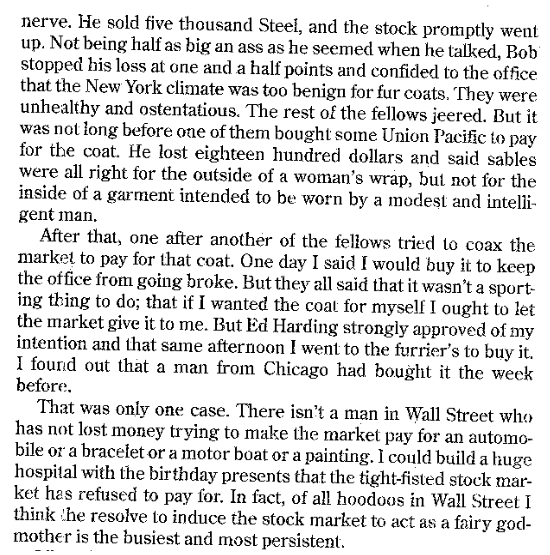

Here is the dirty work performed this morning.

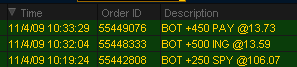

Coach’s Updated iBC Account

I’m moving past the RIMM trade (which in retrospect I totally forced). I have studied it and understand my mistakes. I will never forget this day.

Back to work !!

Comments »