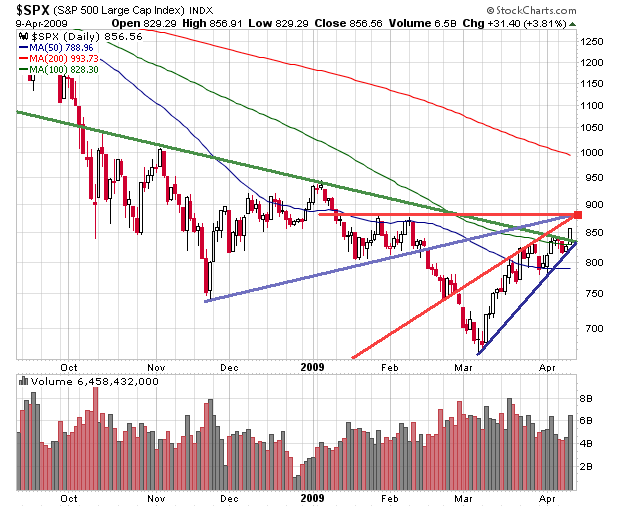

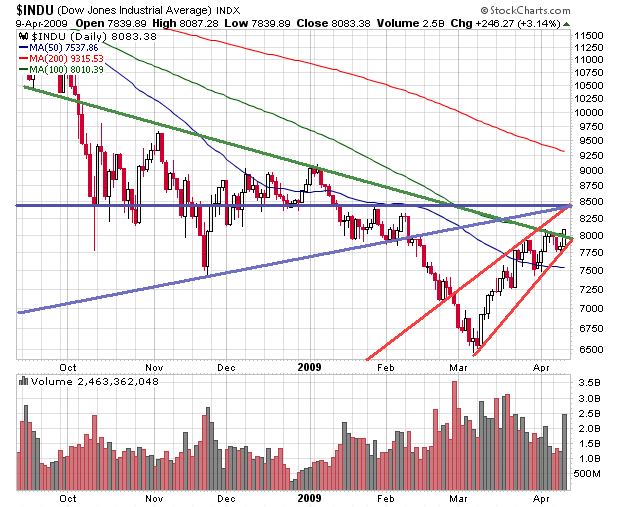

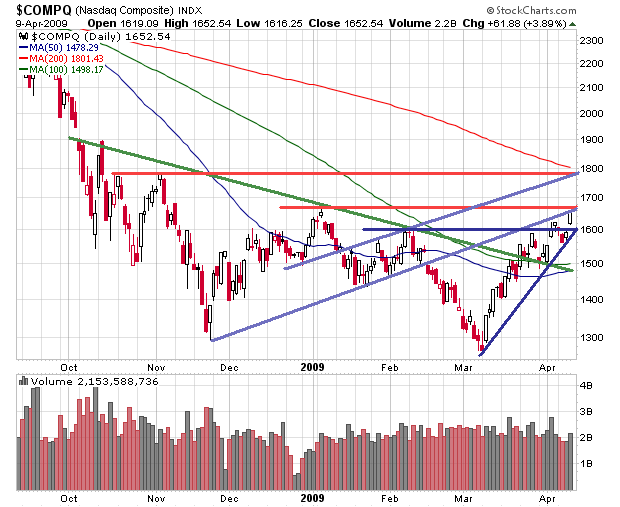

875 is the top range of the mid-Jan to mid-Feb SPX consolidation area. So far, all indices have hit resistance areas but continue to push forward. Bad news is considered good news and good news is considered great news and the market rallies every chance that it gets. At this stage, the Nasdaq actually has a really good chance of reaching the 200-day MA, something that was quite unheard of a few months ago. The problem is that not all indices are following each other perfectly, so you are seeing divergences between the SPX, DJIA, and COMP.

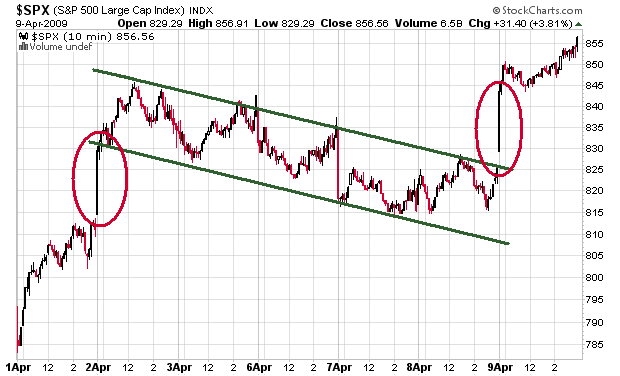

It will take some seriously terrible news to bring this market down, and I think it would take a massive pre-market gap down, sustained with follow through, in order for a downtrend to emerge. The last breakaway gap down at the end of March actually failed, which was a signal to go long. Those gaps have a 1% failure rate, so it’s important to pay attention to them.

I didn’t want to hear any bullshit from anyone, so I just posted on my other blog and told just a few people of my long swing experiment. The experiment was to open large long positions before last Friday’s close, hours before I left for my trip. The purpose was to prove that TA still works and that it is not “dead” when it comes to swing trading. I’m up +8.7% as a result. Prior to leaving, I was down -2% for April. The decisions made last Friday had to meet several criteria:

1) The breakaway gap down fails and fills to the upside within 5 days, breaking the 1% probability. Check.

2) There needs to be a equal or greater-sized upside spike than the gap down spike. Check.

3) The market needs to be consolidating or flagging for a potential breakout. Check.

4) Individual names must be setting up in high probability consolidation patterns. Check.

This is the rare Rising 7 Method.

I know that the Ragin and I are in several names together, but I also added MI, HBAN, and SIRI to the overall mix, which includes TSL, JASO, FEED, and LDK, which was actually bought on 4/7. I still hold everything cause I got back well after the mkt closed. 875 will be an initial sell point. Some stocks, such as FEED, and SIRI did not breakout while I was away, which was frustrating. I’ll give them just a bit more time to cook in the microwave before deciding their fate. Another promising wave 1 symmetrical triangle? FIG. I’m not in it, but I will likely add it into the bunch.

Just a personal experiment for my own benefit since I never left so many positions open while at the complete mercy of the market. I did not want people following me on this, since I know there are people that just blindly follow other people without any good reason. It was just a test and yes, TA still works so don’t worry.

If you enjoy the content at iBankCoin, please follow us on Twitter

CA,

Welcome back, sorry to hear about the illness and camera. Told ya it was a long ass ride to chitzen itza, and hot,,oh ya.

Look forward to your posts again..will read this one tomorrow…just a welcome back.

CA, your TA is killer. i’ve learned quite a bit from your blog, and it always provides ideas for further exploration.

zmoose did a great job holding down the fort, though. he’s a great blogger.

Welcome back. Posting great stuff since your return, right in stride.

Glad they just stole the camera and you weren’t drafted into the new Mexican pastime of “kidnap the tourista.”

Feel better soon.

875 is my number as well. SKF is looking juicy.

welcome home- zmoose did a good job covering for you

SIRI? That’s a hell of an interesting buy. I would love to see your TA for that, I hope that trade works out for you. I don’t have the balls to chase that company.

Question: Did you set up a Fibo Fan @ $SPX 900 in order to get those trend lines or was that the way the cookie crumbled for the $SPX?

(Btw, big thanks to all who enjoyed my blogging while CA was gone).

awesome, wonderful charts. in addition to the graphics, this was a substantial post.

Welcome back CA.

Do you prefer the actual index to the tradeable ETF for purposes of TA?

I have vacillated between both over the years.

Some recent testing we’ve been doing shows that sometimes it is more profitable to use signals generated from SPX to trade on the SPY rather than signals from the SPY on the SPY.

Thx for the welcome back all.

Yes, I’m proud of ZMoose. I picked him because I can’t think of any other 18 year old with his knowledge level.

SIRI & FEED should b/o imminently. If not, oh well. We’ll know very soon.

I mostly try not to use fib fans, retracements, arcs, etc. They complicate the already busy chart. All lines are drawn as I visualize them & many coincide with respective moving averages (15, 20, 50, 100, 200). These lines, esp short-term ones, are responsible for the intraday/ multi-day bounces + pullbacks that occur. When they do happen and people are confused as to why, then they should look at the lines first. Knowing Why, Where, and When a bounce + pullback will take place is a powerful TA tool.

I use both the SPX/SPY, but the SPY more for intraday. I find some divergences between the index ETFs and the actual index. A good example is the COMP/QQQQ. What’s interesting is that even though sup/res levels are slightly different, you can actually see the struggle between that micro divergence. For day traders, they should make note of both key index and index etf levels. For swing traders, it doesn’t matter.

Glad to hear swing trading is still in vogue! Never really gave it up.

875 was my number when the rally began as I posted several times, however, I believe we will retrace to the 50D at a minimum from here before we get there.

Thanks for the explanation and compliment CA!! I enjoyed the time spent.

devildog i actually like the way you think as i see something very similar to what you see

I LOVE MY FEED.

Great call on FEED. I have been holding FEED, SEED, GRO and HOGS for two months now. Extremely happy atm.

Cheers!

That was some full moon back on March 6 th……