Looks like the financials led the market. Down. As much as traders want to be all gung-ho long and everything, it’s important to keep an eye on the weakest sector. Take a look at C, JPM, WFC, BAC, and many smaller names. They all broke their uptrends. C, especially, formed a breakaway gap down on large volume. These types of gaps make it extremely difficult for a stock to recover in the short and intermediate-term.

So, what’s doing fairly well long-term? The utilities, because they haven’t been going anywhere. Other sectors such as the materials, industrials, consumer disc. & staples, among others, are threatening to break down. Yesterday, I mentioned that the market cannot rally without the financials. This remains true. The overall health of the market depends on this sector. In addition, we started making more new lows than highs. The $NYHL and $NAHL are negative once again.

As for index breakdowns, the DJIA is leading the decline, followed by the SPY, R2K, and the COMP. The important matter is how the market is churning at the 50-day MA. This has been going on for over a month now without much progress at this key intermediate support level. Usually, you want to see the market use the 50-day MA as a “springboard” to propel itself higher. It is presently not the case.

We still have one major support level at 855 to clear before we start a multi-day decline. The focus continues to be on the financials, especially C (and JPM on the 15th). The trend is intact until it isn’t. The financials have broken their trend and it appears that the market will follow for now.

SPX Initial Support: 860

Resistance: 20-day @ 892

Resistance: 30-day @ 885

Resistance: 50-day @ 882

Also, take a look at the VIX. It broke out via breakaway gap up:

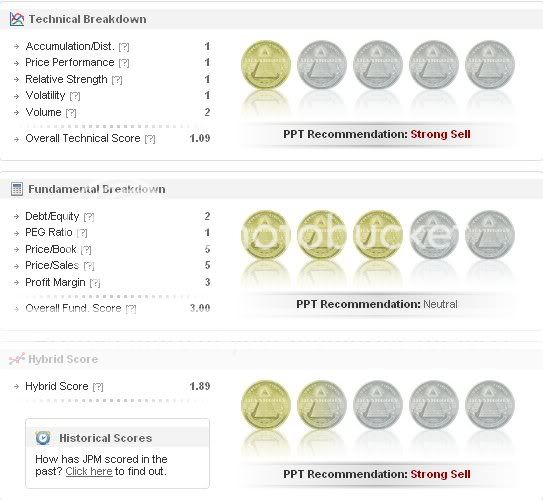

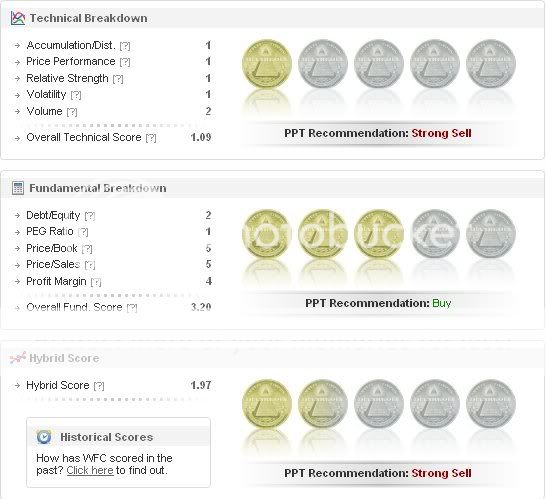

Here are the current PPT scores for select financials for anyone interested (historically, the big financials had “SELL” and “STRONG SELL” recommendations each day for the past 20 days):

In order (C, BAC, JPM, WFC, UYG)

————————–

————————–

————————–

————————–

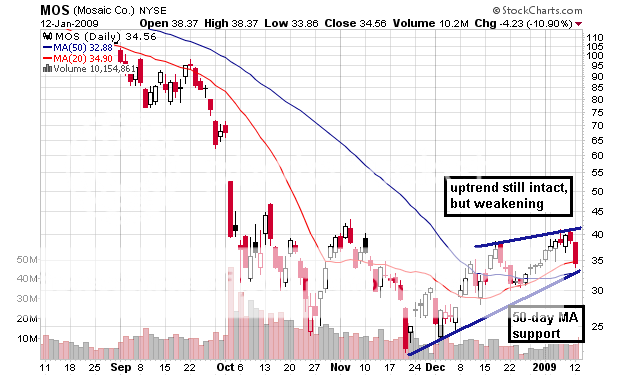

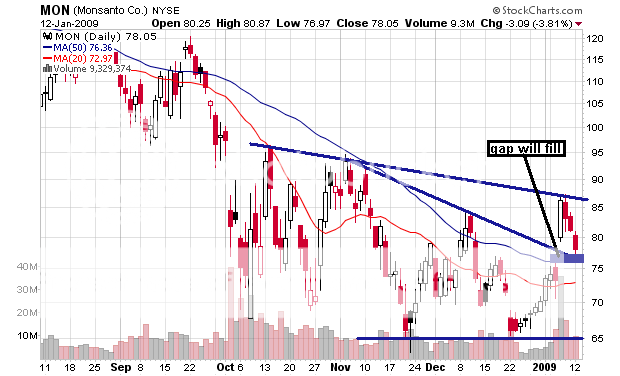

Also, Damon: fert/ag TA (POT, IPI, MOS, MON, CF, TRA, TNH)

A lot of these names are at their critical support levels, and may bounce. A breakdown from those levels is cause for concern. 1-2 days will tell. Cf & TRA are the weakest. POT & TNH were profiled by Cramer so becareful.

If you enjoy the content at iBankCoin, please follow us on Twitter

CA….you make the obscure obvious…thanks man

CA,

Great work again. I have not left comments before, but want to show appreciation. If it is not too much work, is it possible to keep market analysis and individual stock analysis in separate posts? The post is very long and my attention escapes me easily.

CA,

Great stuff!! Rock solid reporting compared to some of the irrelevant crap on your neighbors columns.

Japoe – Thanks. Ritalin works.

Snap – Thanks. The other tabbed bloggers are the best on the internets.

I fourth that. Excellent commentary, analysis and charts. Clear, to the point, substantive. Solid.

Prediction: We’ll see CA on CNBC one day. (And in case that there’s any question about that, I mean it as a compliment.)

Very thorough, very well done. You own charting, my friend.

Hey, Man:

THANK YOU for doing the TA for me and your readers on the Fert/AG plays!

Very cool.

The one question I have is:

On a gap down like today (1/14/09), how does it technically affect the trend/MA short-term?

Thanks again for your charting expertise.