Stay with me on this, it’s going to come off as flippant and senseless to most of you.

There is NO CHANCE this market is going down soon.

Guys, I know everyone is losing their shit about how the US economy is garbage, the possible “Brexit,” Chinese PMI, and the ever-present Oil fiasco. I get all of that. But if you think the market owes you a bear market right this moment, you’ve got it all wrong. I agree, the outlook is anything but exciting, but the amount of people trying to rationalize the next move is absolutely insane. If you haven’t figured it out by now, this market does not move on “common sense.” The second that we held 1800, sentiment changed. Believe me, I thought we were doomed as well.

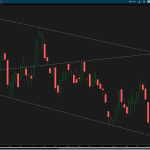

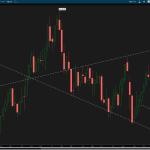

In volatile markets fundamentals are thrown out the window, as markets take time to normalize and adjust to fierce swings in supply and demand. Price action is the only way to navigate these markets.

We need to step back and look at longer-term charts and look at the damage that has been done.

Even considering our rally in late February, we still have a ton of stocks that are setting up for another relief rally.

All in all, if we do go up, we want to see all of the signals (below) trigger at the same time and push with authority. We want to see the bonds break lower with gold, financials push us higher, and then have a global push overseas. Yeah, this may be a tall order, but these charts are pointing to at least the possibility. Don’t count it out just yet .

If we take a look across the world into some of the foreign markets, the commodities, and then the US markets, it seems that the only way we go down in the short-term is if we have some disastrous event.

In the charts below we have a series of events lining up that not only show that we are not going down, but that this could potentially be the beginning of an epic bull run:

USO Oil: Monthly Hammer signal into support. USO has also now completed it’s measured move down – dropped from 40 to 20 (50% down move), then dropped from 20 to 10 (another 50% down move). Even the slightest short-covering rally in the oil patch will be a catalyst for this market.

FXI: China has been killed and has made a slight lower-low off of the October 2011 lows. At this point even a rest in the selling would be great for China.

GLD: Gold had an amazing February, but is putting in a reversal-setup on the weekly chart right into resistance. Inside week last week, countered with shooting-star sell signal could be putting the hurt on some longs below 115.

XLU: Utilities have been the safe play into 2016. But, similar to Gold, are going reversal-setup into resistance. Below 46 utilities could see some pretty quick profit-taking up here.

TLT: Bonds have also had an amazing run in 2016, a the risk-off assets poured in to start the year. However, coming into resistance we are seeing some selling pressure.

FAS: Financials are so frustrating intra-day, but the weekly chart is showing some promise with a weekly hammer into support.

EEM: The emerging markets have been a horrible investment for the last 5 years. However, they are inside month into support. A break above 31 could spark a rally most definitely.

If you enjoy the content at iBankCoin, please follow us on Twitter

Youngin with a gun. What could go wrong?

EVERYTHING

The market may not go down but I really don’t see anything that says it will go up unless people start ignoring everything like they did in 1999 or 1928. It could grind for a year or more until oil rallies.

Very possible, my point was that charts are showing a slow-down in selling mainly overseas and in the oil patch. If and when this sentiment changes, we have a large group of people short that may be on the wrong side of the next move. Propelling us much higher in March.

Rofl….THIS IS JUST WAY TOO FUNNY. Thank you for the laugh.

Funnier or less funny than the obnoxious looking website you run?

Mine is fun, lol. Yep I was a bit obnoxious but come on when you goat us bears we have to come to the party. Bottomline, It’s not hammers moving this puppy, it’s only what the Central Banks are doing. BTW, thank you for visiting my site and the shout out . lol.

Hammer’s may be not everything, but between that and time-frame continuity and broadening formation support (all noted above) – it’s what really matters. It’s how price works.

With the highest respect it’s quite hard 4 me to agree.

This is still a confirmed bear market with little to smile about except for the recent exuberance bid in Crude and the slight firming up of credit.

Treasuries and Gold still remain in high demand and the USD/JPY appears to have topped out last week.

In my personal acct I’m short quite a lot of Nikkei futures have have a small bit of weekly ATM puts i picked up this morning on S&P

The portfolio I manage is still 25 % cash and i’m against adding any more exposure to anything but REITS, Treasuries, Gold, and cash.

Like I said in the note, things look like shit and I agree. I was pressing short very early in Feb. From a psychological perspective your thesis is shared by anyone and everyone. Crowded trades like that seldom play out to be that easy. Further, the weekly/monthly charts I posted are signaling a stall and possible bounce overseas. If we get any type of bounce from them, and oil holds up, it seems like this huge group of people that is short is on the wrong side. Going down is the easy trade this point, and we may well, but I think the real risk/reward long term may be buying 1870-1900 this week and we take off in March. We’ll see.

True – I hate crowded trades but it’s hard to argue that there’s “panic” out here in the market yet. Vol just hasn’t been high enough. Maybe I’m talking to too many value guys, but they’ve all been telling me how irrationally oversold we are and how the’ve been buying retarded amounts of AMZN and TSLA these last few weeks.

Those type of idiot investors haven’t been smoked out yet 4 sure.

With oil not only do we have technical and quantitative bull signs, but a positive macro environment (debt ridden small and midsize players pump more to meet debt obligations, boosting supply, are now ceasing operation) suggesting it goes higher. $40-50 crude would boost our banks and the rest of the market with it.

I agree with your thesis