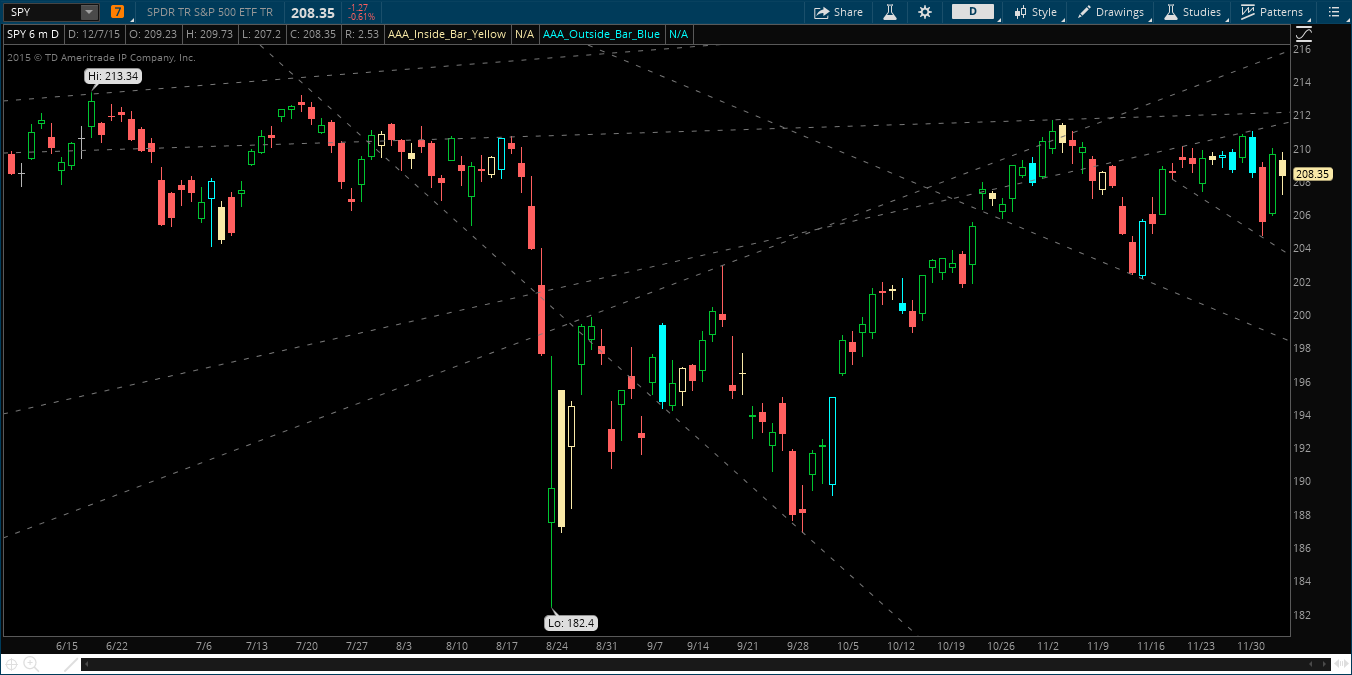

The action the last three to four sessions is great for day-trading, and that’s about it. Hypothetically yes you can put on long/short positions based off of this recent range, but you have no edge at this point, it’s a straight up gamble. It is very easy to get caught up in the wild gyrations of intra-day madness, but if you look at the daily chart of the SPY you can see that we are still trading in a +/- 2% range in the last month.

That being said, I think a little advice is due here for traders. In this environment, if you’re going to trade, make sure you are trading in the direction of the SPY for that day AND (most importantly) you are trading a position that is not inside on the day. For example, today we opened at 209.23 and almost never traded above that price (red on the day all day long), additionally we were inside all day long. As we know, inside days are actionable signals that represent an equilibrium between buyers and sellers — this type of environment is very choppy and very difficult to trade. Further, as long as we were below 209.23, we are trending to the short side and want to look for stocks that are taking out the prior sessions’ lows (aka they are not inside day). For example, OXY and BLUE were very tradeable:

On the other side of the coin however, we have the ‘natural buying’ that is very easy to identify on days like today. While SPY sat inside day all day, stocks like LULU and MOS painted the tape all day and it was very obvious that someone in there had a huge buy order. From a psychological perspective, if you are short these names you are scrambling – as the market isn’t doing shit and your stock is getting run up your ass. Finding these types of setups are huge on days like today. Natural buying is different than a stock that is trading above the prior days’ high, though (see AAPL below). So make sure to try and identify the difference. These stocks are obviously very tradeable and should be a high priority on days like today.

The moral of the story here is to have a very keen eye on what the SPY is actually doing on a larger time frame: NOTHING. Do not get caught up in intraday volatility, and focus on relative strength/weakness throughout the day. Side note – take time every morning and follow a list of stocks that have gapped up/down on news. These stocks are Alpha-generating machines as natural buying/selling must occur.

Hope this helps going forward.

If you enjoy the content at iBankCoin, please follow us on Twitter