Listen Peasants, I’ve had enough. You Puritan fools have yet again failed to do much of anything of value; sitting there helpless, weak, feeble. Just as the original settlers perished during that first winter in 1620, you all are well on your way to following in their footsteps. Lucky for you imbeciles though, John Smith, being the true bad ass that he was, decided to grip life by the balls and settle the shit out of Plymouth Colony. From there, he hired himself Squanto (technically he kidnapped him, but that’s neither here nor there), an interpreter that was the only reason that greedy white bastard accounted for much of anything. Therefore, call me Squanto, because I’ll be leading you worthless schmucks out of the woods into glorious national dominance:

Listen, it’s really not that difficult to understand what’s going on right now in the markets – NOTHING. After the “mini-flash crash” that we had in August and the subsequent October rally, the absolutely glorious annihilation in the commodities, the Chinese flatline, and the mixed bag of crap within the other dozen or so sectors – it is expected to see the market not doing much of anything.

The trading/investing industry is full of “pros” that will tell you exactly what the market is going to do one month, three months, nine months from now – but the facts are that price is NEVER guaranteed. These fools, the serfs that will shine the dung off your boots, provide you no value. And as such, you much approach the market lightly.

In this environment we MUST treat the market as if it was a series of “If/Then” statements. If the market goes up, then we do “X.” If the market goes down, then we do “Y.” Stop risking your life trying to be John Smith when you can just as easily be his neighbor and reap the benefits of his shitty judgement.

==================================================================

That being said, it’s time for a down and dirty Pilgrim Style analysis of what’s going on:

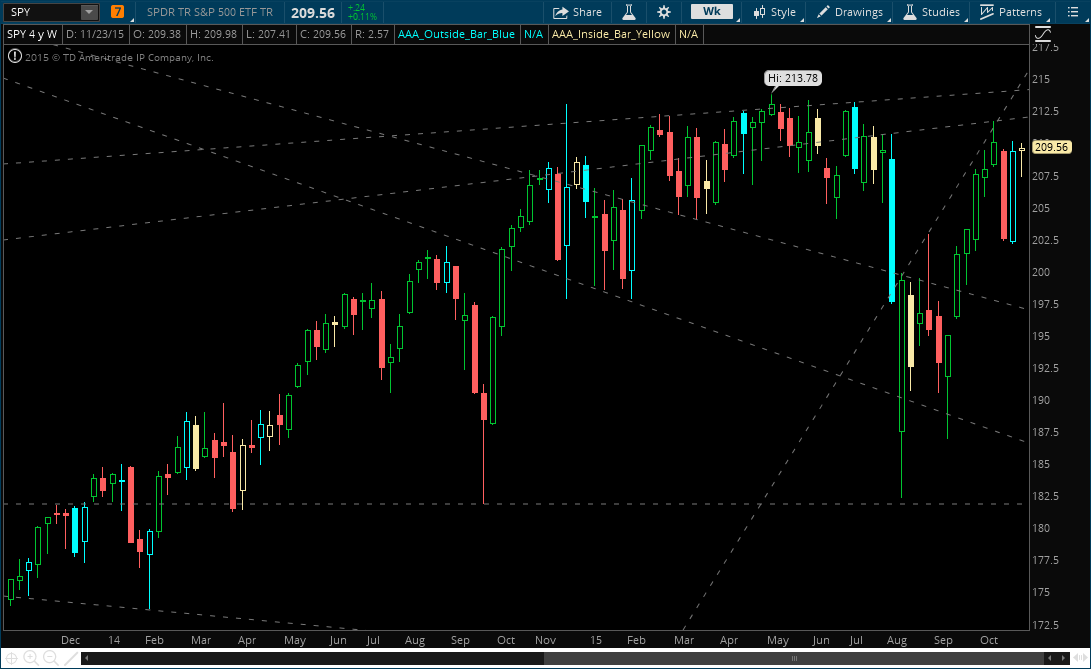

- SPY: SPY goes inside week into the first week of December. The weekly highs/lows (209.98/207.4, respectively) should be your trigger longs/shorts if we get a clean break either direction.

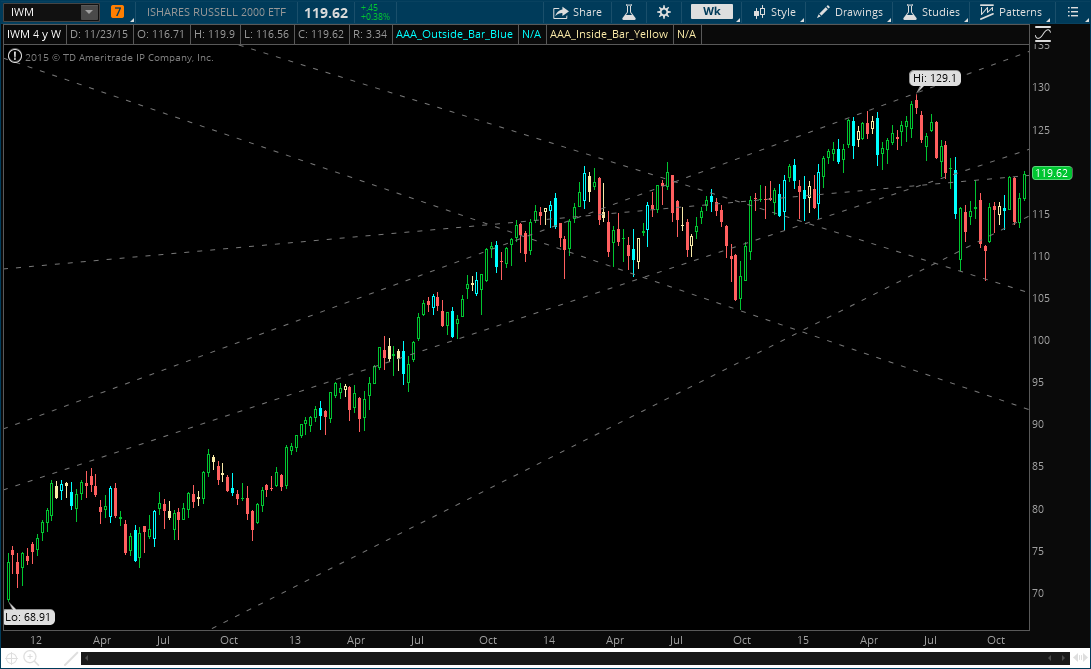

- IWM: IWM has been much stronger of the last few sessions, and if we see the SPY go inside week and up, this is where you pour your money.

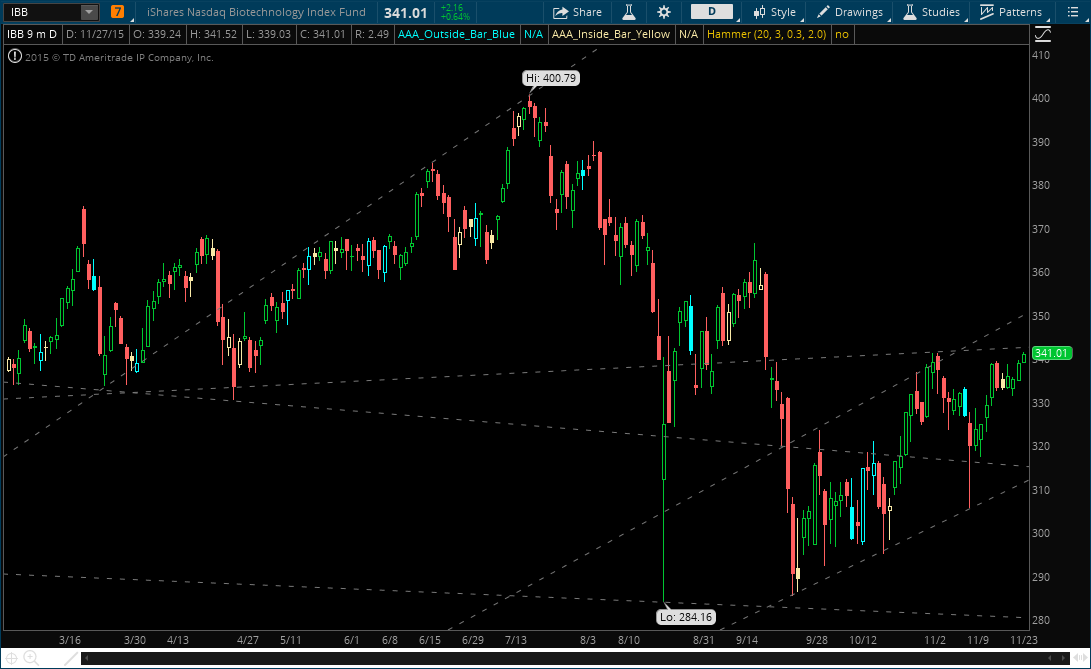

- IBB Biotech: Biotech (and small cap) look absolutely phenomenal. A slow month of November is coming to a close, but if we can stay above 340 look for this to be a leading sector.

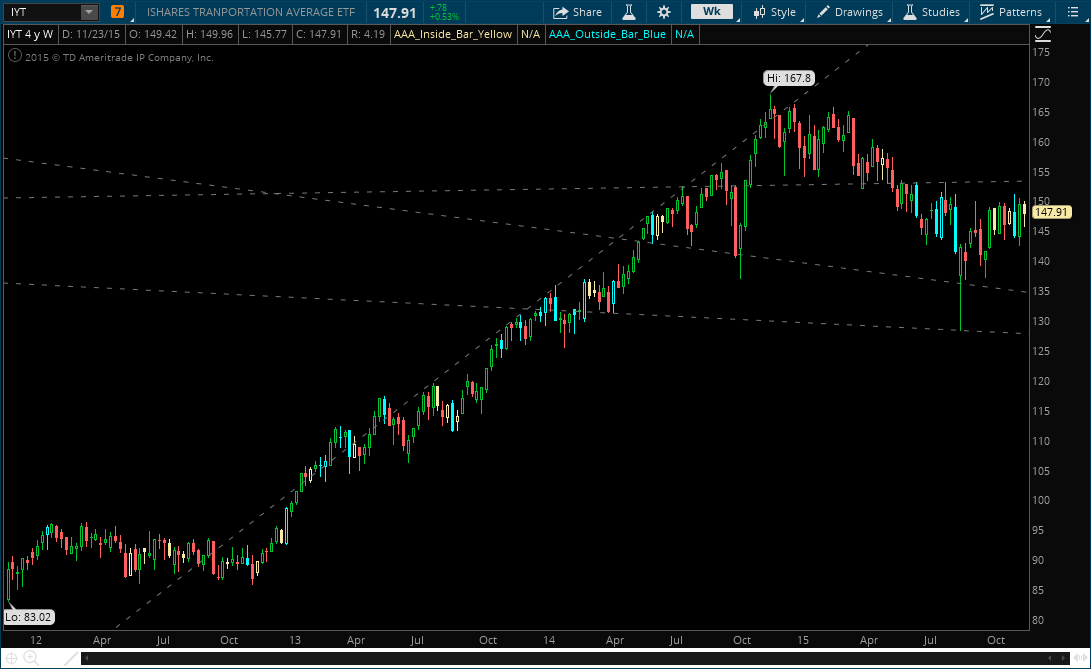

- Trannies are also inside week and the jury is still out. Above last weeks high we may want to test a few longs, but some of the rails are still looking weak:

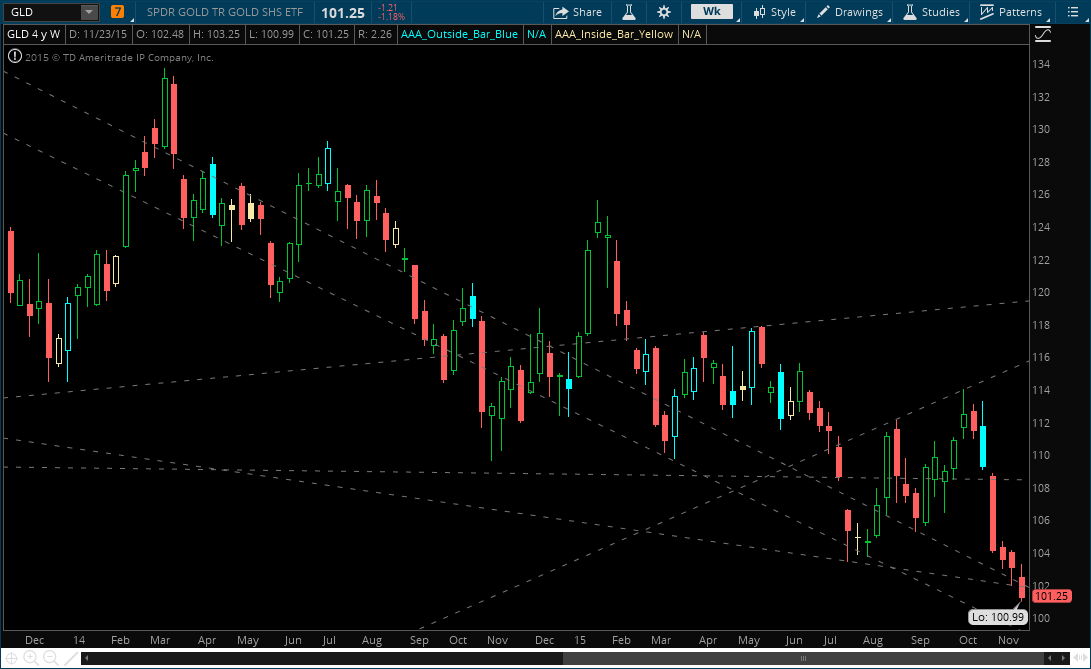

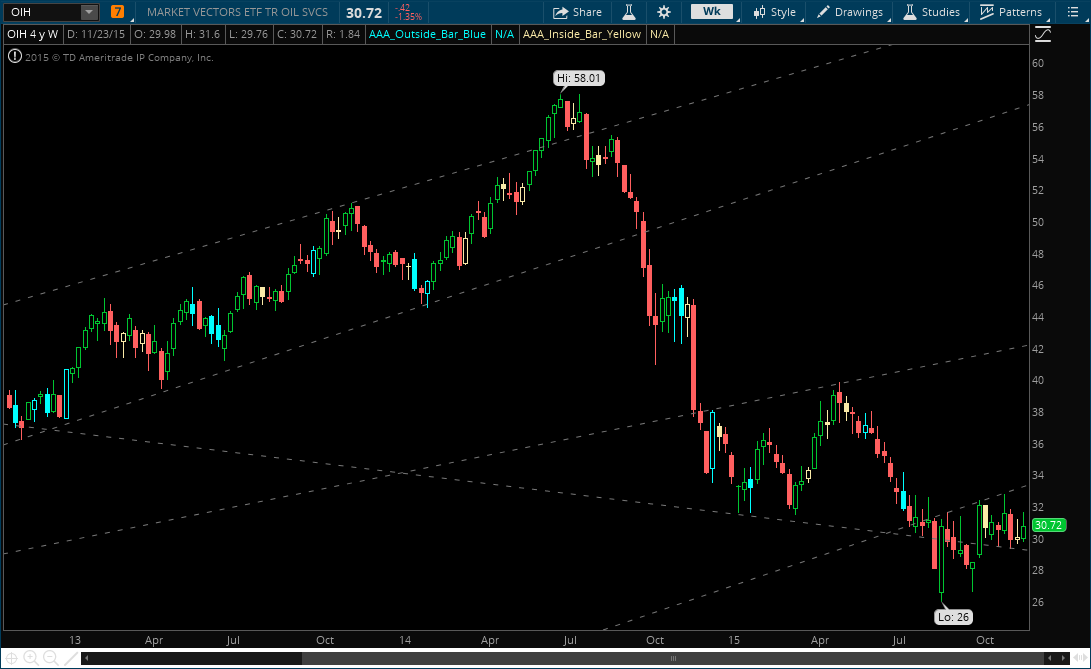

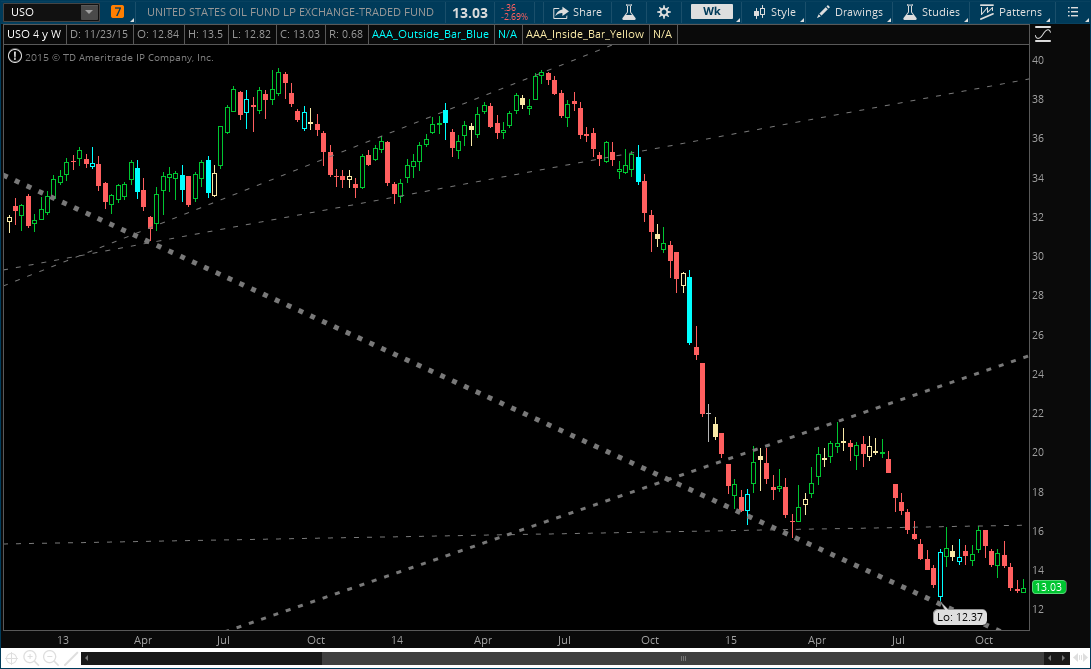

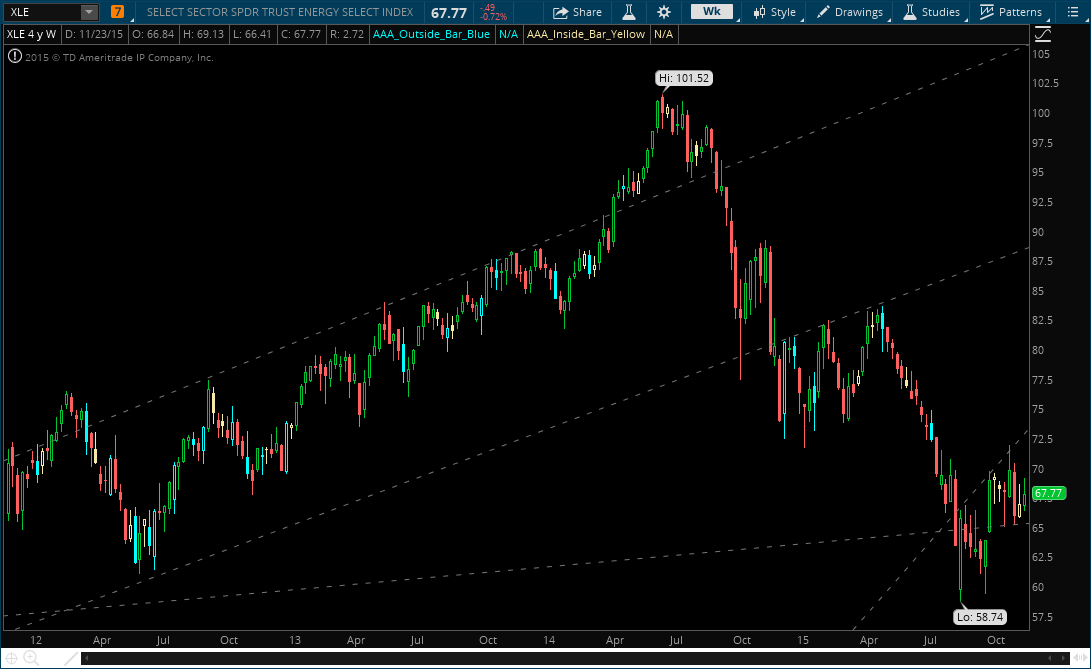

- Oil, Oil Services, Natty Gas, Gold, & China: all of these are absolute garbage. I have nothing to say besides these are dead shorts. If you are long these sectors you are an absolute fool and deserve nothing but the guillotine:

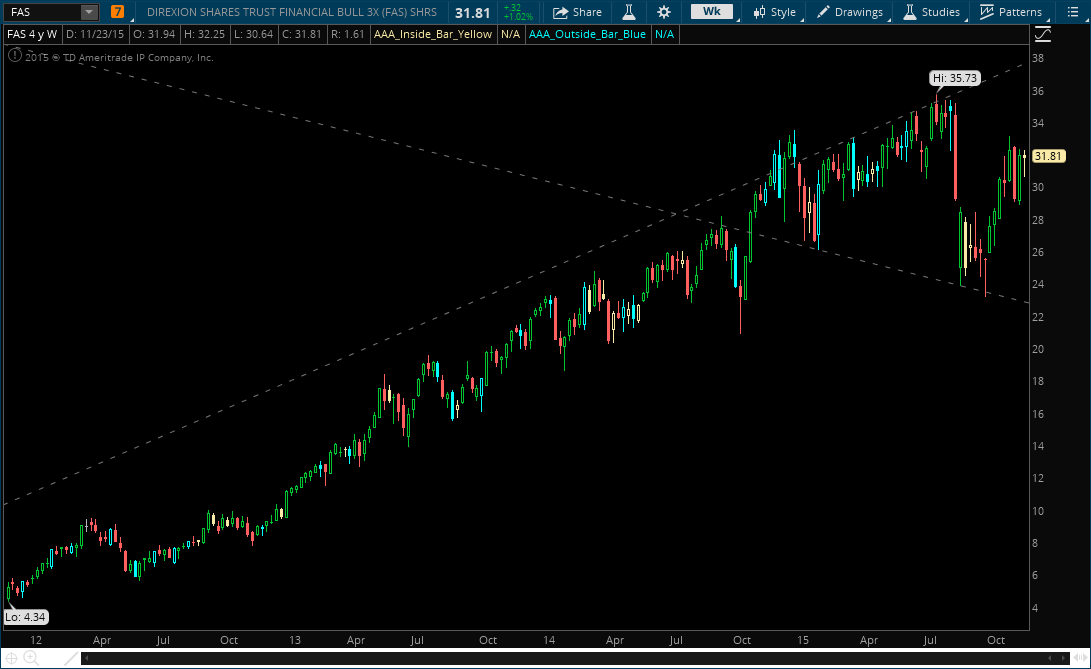

- FAS/XLF: Financials are also inside week, weekly hammer, into December. Above 32.25 for FAS we trigger the long bias for financials. Let’s see if the buying into the rate hike is a real thing.

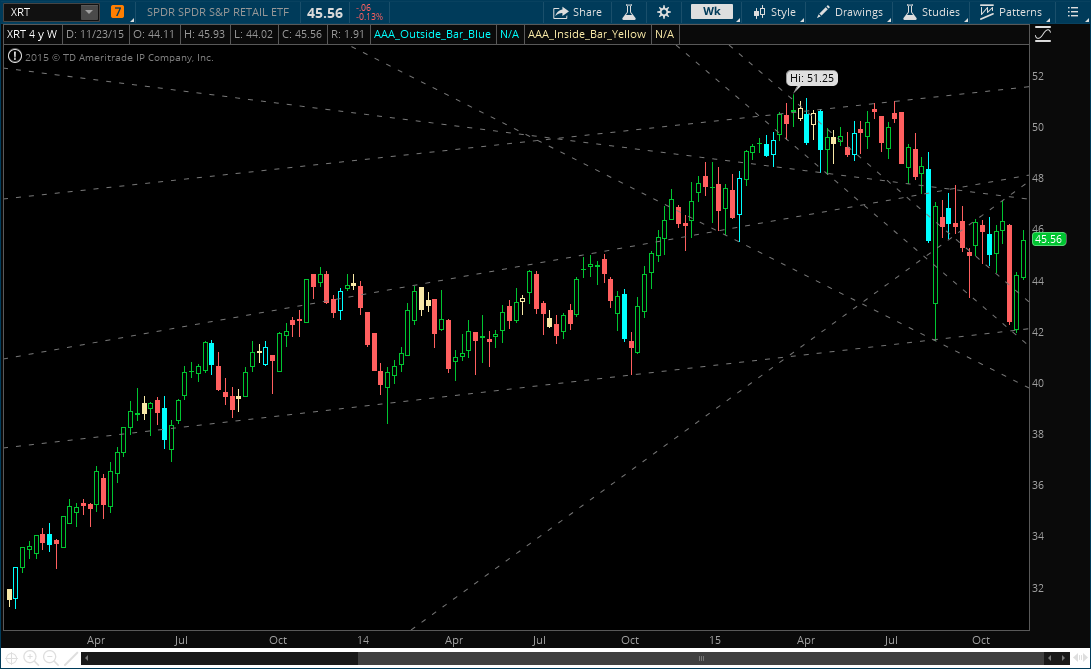

- XRT Retail: the retail sector has been VERY strong these last two weeks. No signals from our charts, but a few individual stocks may provide alpha into the end of the year (ROST, TGT, EXPE, etc.)

So, for those of you that can follow along Mr. Rodgers style, IF the market goes up we want to hammer the Small Caps (including Bios), Financials, and possibly select Retail stocks. If the market goes down, we will be hammering the commodities and some of the Trannies. Here are a few charts along those lines that we are looking at:

If you enjoy the content at iBankCoin, please follow us on Twitter