I’ve been holding GDX for a long time and hope it’s finally going to go up for a change. Perhaps the ECB will help out with some fresh new Euros.

Nice big triangle for GLD and looks like an important bottom has held.

False bottom in early form of triangle did not hold. Maybe the recent bottom is the real one. We’ll soon find out.

Scavenger

Scavenger

BZH Bond vs. Stock Volatility

I’ve been holding Beazer Homes bonds (CUSIP 07556QAV7) for a while and watching the market value gradually go up along with the improving sentiment in the home building sector. I also like to watch the price action in the stocks of the junk bonds that I own. Beazer demonstrates the often big difference in volatility between junk stocks and junk bonds. Note especially the trend in the month of July in the charts below:

Busted Mirrors (TLT, VIX, SPY)

Bought TBT (short long term treasuries etf)

My Junk Bonds Still Trading Higher Today

Today is a weird day. All of my stocks and funds are down, so I’m thinking ‘risk off’. All of the junk bonds I hold (that have trades today) are trading up. Normally these all go up and down together in the ‘risk on’ or ‘risk off’ market moves. The junk bond ETFs (JNK and HYG) are down with the stock market, as expected. I have no idea what this means, if anything. It’s weird and it has me scratching my armor against a tree!

Before Fed – junk bonds going up

Yesterday was a ‘risk on’ prophecy

Junk Bonds Steady Today

I took a look at the market action on each of my junk bonds today. They are doing just fine and performing better than the stock market averages. From my vantage point it appears there is no HFT in the weeds of the junk bond market that I sniff around in. I note that even the popular junk bond ETFs are holding their own. Normally these ETFs move in sync with the stock market:

Sold BRD (+18%)

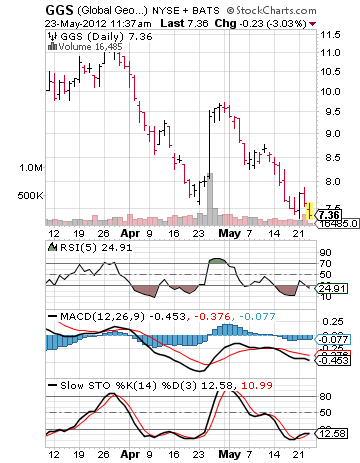

Bought GGS Bond 37946SAB3

Scavenger

Scavenger

GLD vs. GDX (time for a move)

I’ve been holding GDX for a long time and hope it’s finally going to go up for a change. Perhaps the ECB will help out with some fresh new Euros.

Nice big triangle for GLD and looks like an important bottom has held.

False bottom in early form of triangle did not hold. Maybe the recent bottom is the real one. We’ll soon find out.

BZH Bond vs. Stock Volatility

I’ve been holding Beazer Homes bonds (CUSIP 07556QAV7) for a while and watching the market value gradually go up along with the improving sentiment in the home building sector. I also like to watch the price action in the stocks of the junk bonds that I own. Beazer demonstrates the often big difference in volatility between junk stocks and junk bonds. Note especially the trend in the month of July in the charts below:

Busted Mirrors (TLT, VIX, SPY)

Bought TBT (short long term treasuries etf)

My Junk Bonds Still Trading Higher Today

Today is a weird day. All of my stocks and funds are down, so I’m thinking ‘risk off’. All of the junk bonds I hold (that have trades today) are trading up. Normally these all go up and down together in the ‘risk on’ or ‘risk off’ market moves. The junk bond ETFs (JNK and HYG) are down with the stock market, as expected. I have no idea what this means, if anything. It’s weird and it has me scratching my armor against a tree!

Before Fed – junk bonds going up

Yesterday was a ‘risk on’ prophecy

Junk Bonds Steady Today

I took a look at the market action on each of my junk bonds today. They are doing just fine and performing better than the stock market averages. From my vantage point it appears there is no HFT in the weeds of the junk bond market that I sniff around in. I note that even the popular junk bond ETFs are holding their own. Normally these ETFs move in sync with the stock market: