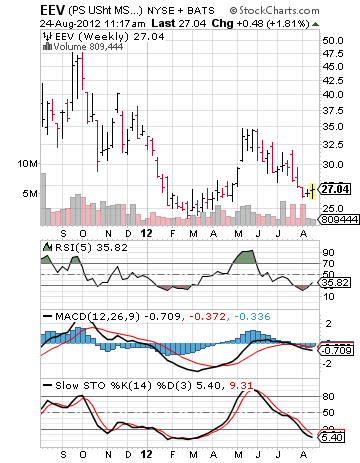

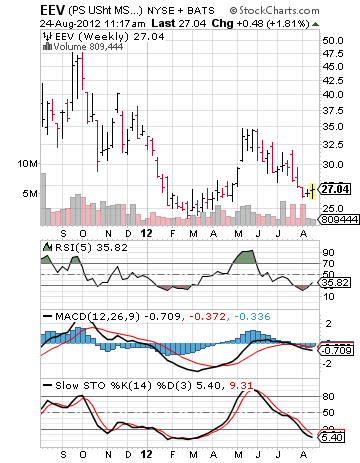

I don’t like the news I’ve been reading about Taiwan, Korea, Australia, and China. It looks like the recession among the EuroPeeOns is spreading and therefore I need to hedge my longs. The price of EEV might go lower so I only bought a partial position today. I like where the RSI(5) and Slow STO are on the weekly chart. Let’s see what happens.

Scavenger

Scavenger

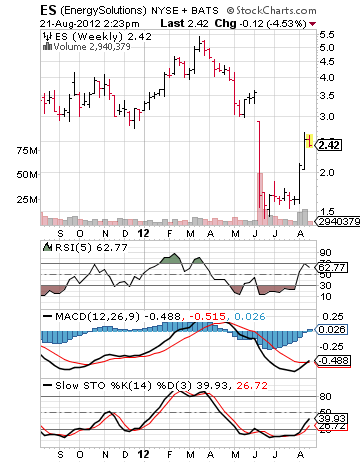

Bought EnergySolutions (ES) Bond 292757AB7

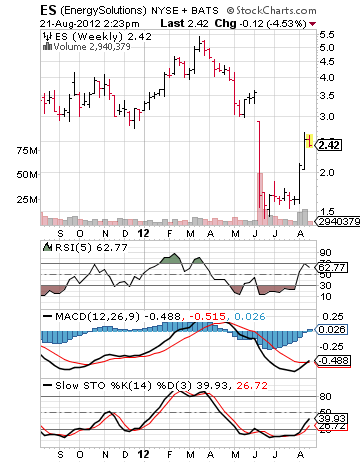

Continuing my efforts to move from stocks to bonds, today I purchased a junk bond from EnergySolutions, Inc. Here is their stock chart:

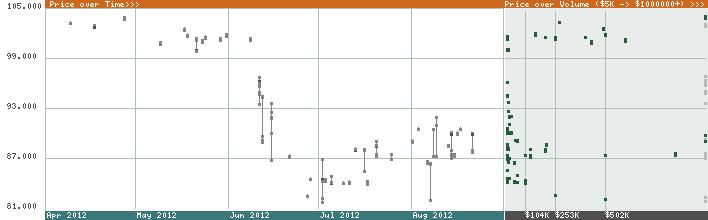

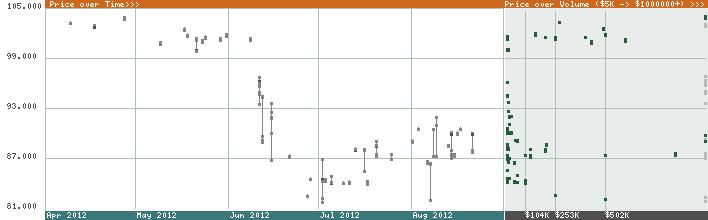

Here is the bond chart:

The bond was downgraded recently and this was reflected in the price of both the stock and the bond. This company works in the waste management field, specializing in nuclear cleanup and decommissioning nuclear power plants. The CUSIP of the bond is 292757AB7. It is also labeled as ‘ENERGYSOLUTIONS INC/ENERGYSOLU 10.75000% 08/15/2018 SR NT’ and I paid approx. 90 cents per dollar of face value (thus yielding 13.2%).

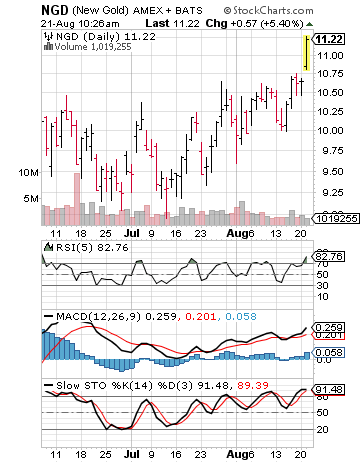

Sold NGD +11.4%

Stocks Will Follow Junk Bonds Down

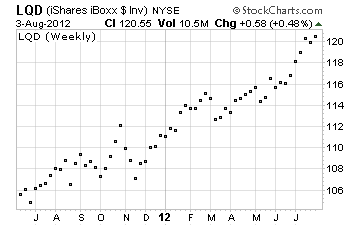

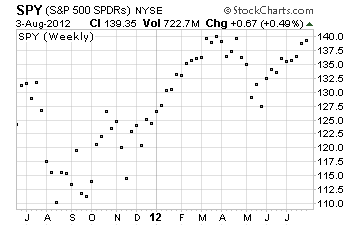

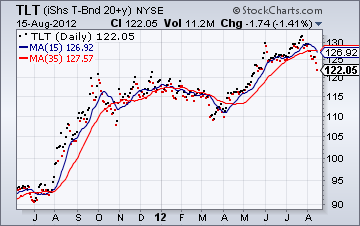

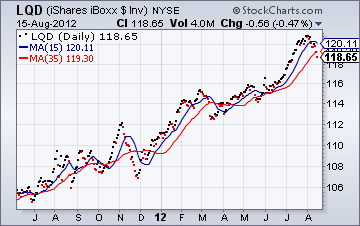

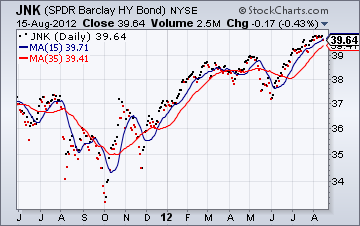

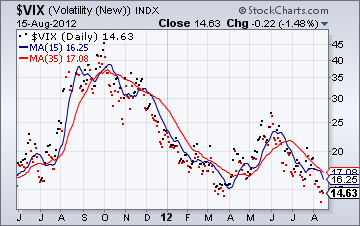

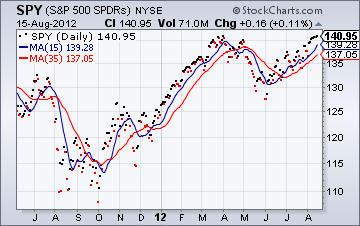

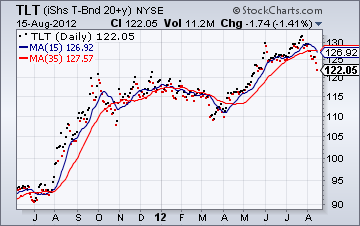

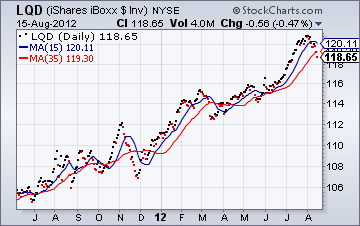

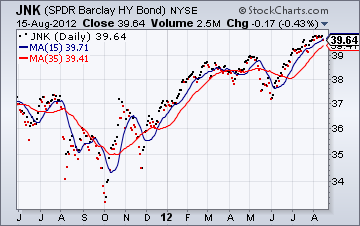

In the recent past, the stock market and corporate bonds have moved up/down together. This has included LQD and JNK, but especially JNK. These also have moved opposite TLT (fed govt long bonds). Very recently money has been moving out of safe havens and out of risky bonds. Perhaps the risk on/off trade no longer applies? Is money now leaving all bonds and moving into stocks? Or are bonds being sold in order to buy other bonds at lower prices (risk on/off trades within bond markets, ignoring stocks)? A lot of money moved into Agriculture futures recently, perhaps from bond sales. VIX is very low and the news from Europe has been muted for a few days. Angela Merkel is back from vacation and Europe will grab the stock market’s attention again. I suspect that stocks will follow JNK down soon. I will purchase some VXX today to profit from the coming correction in stocks. UPDATE: I bought VXX @ 11.72.

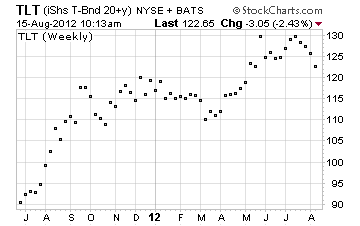

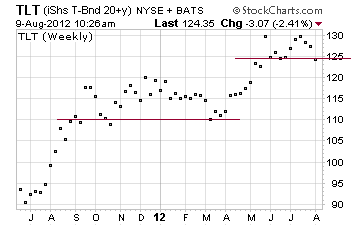

Look at SPY above and TLT below. SPY should be going significantly higher as TLT goes lower, but it isn’t. This is a warning to me that the money leaving long term Treasuries has not been going into stocks. As the price of Treasuries drops, they become more attractive safe haven investments.

Below are investment grade corporate bonds (LQD) and junk corporate bonds (JNK). SPY should have followed these down, but it didn’t.

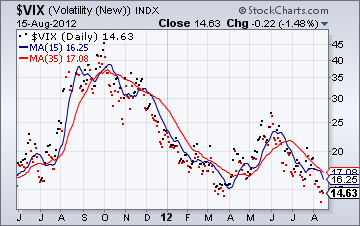

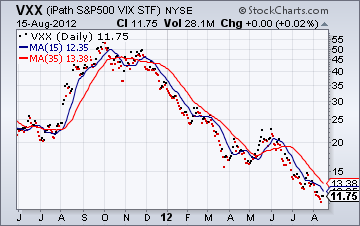

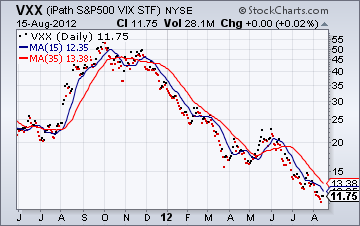

Below are the volatility index (VIX) and the infamous VXX. Note how low volatility is currently. I think now is the lull before the storm. Enjoy the lull while it lasts. We can count on the EuroPeeOns to increase stock market volatility and investor uncertainty.

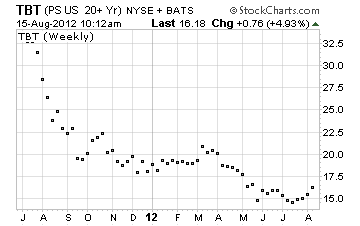

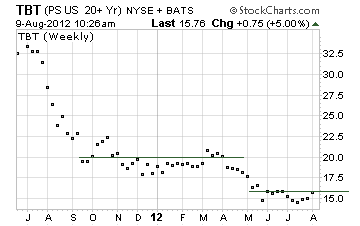

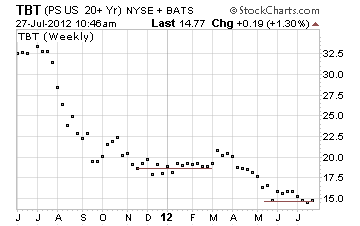

Sold remainder TBT (+9.4%)

Sold 1/2 of TBT holding +6.5%

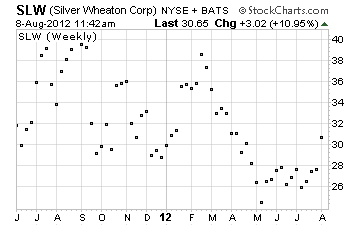

Sold SLW +6.8%

Investing in Bonds vs. Stocks

TBT bottom?

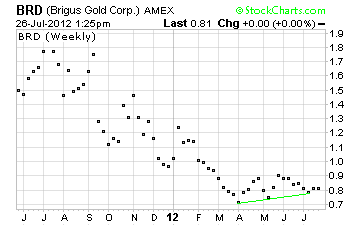

Bought back the BRD

Scavenger

Scavenger

Bought EEV (ultra short emerging markets)

I don’t like the news I’ve been reading about Taiwan, Korea, Australia, and China. It looks like the recession among the EuroPeeOns is spreading and therefore I need to hedge my longs. The price of EEV might go lower so I only bought a partial position today. I like where the RSI(5) and Slow STO are on the weekly chart. Let’s see what happens.

Bought EnergySolutions (ES) Bond 292757AB7

Continuing my efforts to move from stocks to bonds, today I purchased a junk bond from EnergySolutions, Inc. Here is their stock chart:

Here is the bond chart:

The bond was downgraded recently and this was reflected in the price of both the stock and the bond. This company works in the waste management field, specializing in nuclear cleanup and decommissioning nuclear power plants. The CUSIP of the bond is 292757AB7. It is also labeled as ‘ENERGYSOLUTIONS INC/ENERGYSOLU 10.75000% 08/15/2018 SR NT’ and I paid approx. 90 cents per dollar of face value (thus yielding 13.2%).

Sold NGD +11.4%

Stocks Will Follow Junk Bonds Down

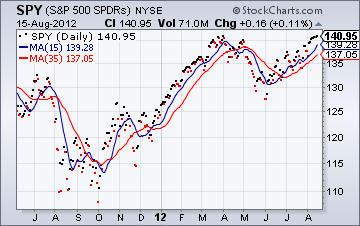

In the recent past, the stock market and corporate bonds have moved up/down together. This has included LQD and JNK, but especially JNK. These also have moved opposite TLT (fed govt long bonds). Very recently money has been moving out of safe havens and out of risky bonds. Perhaps the risk on/off trade no longer applies? Is money now leaving all bonds and moving into stocks? Or are bonds being sold in order to buy other bonds at lower prices (risk on/off trades within bond markets, ignoring stocks)? A lot of money moved into Agriculture futures recently, perhaps from bond sales. VIX is very low and the news from Europe has been muted for a few days. Angela Merkel is back from vacation and Europe will grab the stock market’s attention again. I suspect that stocks will follow JNK down soon. I will purchase some VXX today to profit from the coming correction in stocks. UPDATE: I bought VXX @ 11.72.

Look at SPY above and TLT below. SPY should be going significantly higher as TLT goes lower, but it isn’t. This is a warning to me that the money leaving long term Treasuries has not been going into stocks. As the price of Treasuries drops, they become more attractive safe haven investments.

Below are investment grade corporate bonds (LQD) and junk corporate bonds (JNK). SPY should have followed these down, but it didn’t.

Below are the volatility index (VIX) and the infamous VXX. Note how low volatility is currently. I think now is the lull before the storm. Enjoy the lull while it lasts. We can count on the EuroPeeOns to increase stock market volatility and investor uncertainty.