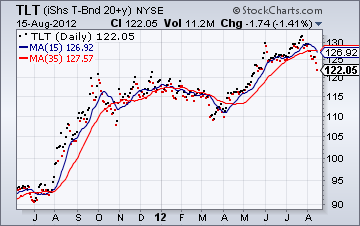

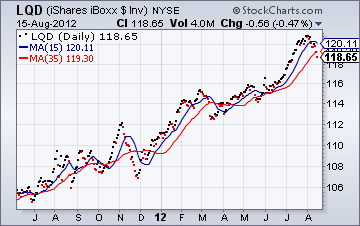

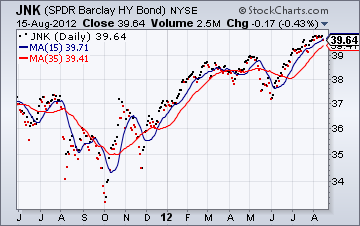

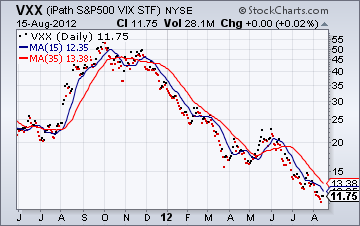

In the recent past, the stock market and corporate bonds have moved up/down together. This has included LQD and JNK, but especially JNK. These also have moved opposite TLT (fed govt long bonds). Very recently money has been moving out of safe havens and out of risky bonds. Perhaps the risk on/off trade no longer applies? Is money now leaving all bonds and moving into stocks? Or are bonds being sold in order to buy other bonds at lower prices (risk on/off trades within bond markets, ignoring stocks)? A lot of money moved into Agriculture futures recently, perhaps from bond sales. VIX is very low and the news from Europe has been muted for a few days. Angela Merkel is back from vacation and Europe will grab the stock market’s attention again. I suspect that stocks will follow JNK down soon. I will purchase some VXX today to profit from the coming correction in stocks. UPDATE: I bought VXX @ 11.72.

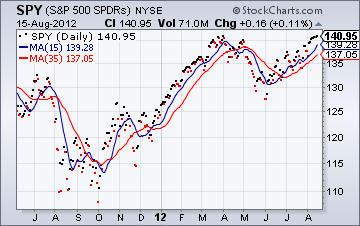

Look at SPY above and TLT below. SPY should be going significantly higher as TLT goes lower, but it isn’t. This is a warning to me that the money leaving long term Treasuries has not been going into stocks. As the price of Treasuries drops, they become more attractive safe haven investments.

Below are investment grade corporate bonds (LQD) and junk corporate bonds (JNK). SPY should have followed these down, but it didn’t.

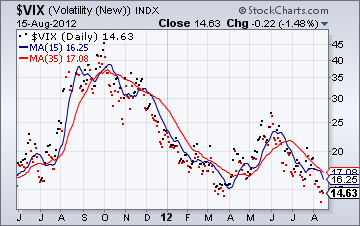

Below are the volatility index (VIX) and the infamous VXX. Note how low volatility is currently. I think now is the lull before the storm. Enjoy the lull while it lasts. We can count on the EuroPeeOns to increase stock market volatility and investor uncertainty.

Scavenger

Professional grub and insect eater attempting to adapt his innate skill set to personal investing in stocks, ETPs and bonds.

One Response to “Stocks Will Follow Junk Bonds Down”

dublin

like your work…

JNK hasn’t started down ‘yet’, tho momentum is slowing…