A Few Words Regarding Inflation

Inflation is the most misrepresented phenomena in Economics. Today, it’s most often considered a rise in prices, specifically those used in the measure of inflation: CPI. Most of the population of modern day economists are Keynesian in nature, and this definition allows them to validate easy money policy to fight deflation, no matter the circumstances. This, however unfortunately, confuses cause and effect.

Rising prices is the effect of inflation, the cause being an increase in money supply. Let me be more specific: Inflation occurs when the increase in money supply is too rapid, unsupported by the specie backing the money or productivity in the economy. That is to say that inflation is not always bad. For example, should the amount of USD circulating the economy increase, backed by an increase in gold (if we were on the gold standard), then inflation is good. Likewise, if the increase of money supply is concurrent with productivity (and thus, demand), then inflation is good. This misunderstanding is why Milton Friedman proposed that inflation is a phenomena constantly occurring. That we no longer operate on the gold standard, and thus have money backed by nothing but faith, nor do we respect when demand is not increasing, still raising the supply of money, is why inflation’s presence is permanent.

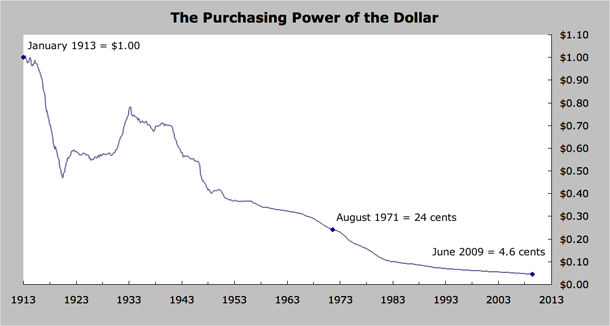

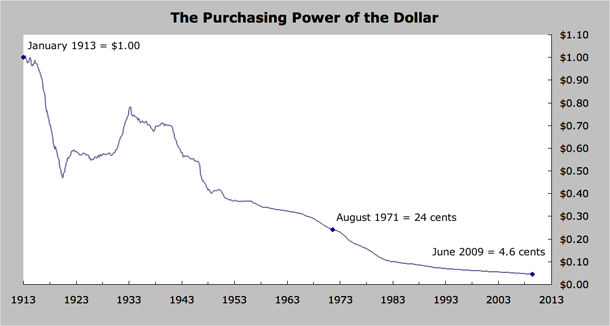

If the assumption is accurate that inflation is always present, then it’s simply a matter of diagnosing where it’s currently being exhibited. This is another reason why the CPI is a misrepresentation of inflation. Inflation can be seen in arenas of the economy not taken into account by the CPI. Likewise, it can be exported outside of the country, where CPI would ignore it again. Indeed, as America’s productive capacity has dwindled over the last half century, the supply of money has not. This lead to Americans looking to purchase goods produced outside of our borders, exporting inflation (more money) to the nations that produced the goods we purchased. Moreover and more recently, as of today, I reckon that inflation is still present and higher than ever, thanks to recent monetary policy. The malfunction of the CPI would never report it, but take a look at this chart (and recall that yields move inverse to prices):

It is my belief that inflation is present in unprecedented amounts, being exhibited in the fixed income markets. As it’s hidden afar and domestically in treasury markets, the CPI may not acknowledge it. But the potential energy of the money created over the last half century is high, and inflation is ready to pour out all over the economy. The worst part is, the federal reserve is continuing the same policies that have led us down this path of dollar devaluation, despite the dollar being worth 4.6% of its value in 1913. It is of my opinion that the Fed caused the dot com bubble by positioning interest rates too low around 1999. To cure the recession (read: bust) caused by malinvestment and misallocation of resources, they lowered rates even more. This caused the housing bubble, another recession (read: bust). As a side note, I’d like to state that I believe the housing bubble is one thing, the near full collapse of the financial system was an exaggeration of the housing bubble caused by immoral behavior. Getting back to my point, the Fed has since decided to attempt to fix the housing bubble by lowering rates, yet again. Unfortunately, the increase in money supply goes hand in hand with lowering rates, as they’re both “easy money policy.” As I’ve already explained, this is inflation at its very core (no pun intended). Likewise, inflation is always present, it’s just about determining where it’s present in the economy. The final frontier is when inflation presents itself in the value of our currency, perhaps forming a bubble, but definitely destroying whatever faith still exists in the USD.

Why I’ll Buy Gold

I believe that gold is a quality hedge of inflation. However, I do not believe it should be bought frequently or with a limited time frame. I do not believe it should be compared to, nor is it a substitute for equities or treasuries. Gold does not pay an income, like fixed income or a dividend does. Rather, I will invest in gold due to the central bankers around the world’s war on their own value of currency. Gold is the perfect substitute for fiat currency, because the assumption is that they’re both monies. Let’s recall the definition of money and its four qualities:

1) Medium of Exchange

2) Unit of Account

3) Store of Value

4) Standard of Deferred Payment

I don’t think anyone would argue as to the validity of any fiat currency, or gold, in qualifying as a money with respect to qualities 1, 3 and 4. But with regard to store of value, there are lots of arguments to be had. The key aspect of a store of value is that it must remain stable over time. In reference to fiat currencies, I believe that recent central bank policies make my argument for me. The example is simple: if at point x in time, there are y monies, and at point x+n where n is some amount of time there are >y monies, then that money’s stability is questioned. If this scenario recurs constantly throughout history, then that money’s store of value is severely diminished. Should anyone question my argument, then allow me to present another chart:

How stable does that look to you?

I’ll approach my investment in gold logically. That is, I have decided gold a quality investment based on how I’ve decided to profit from the possible choices policy makers have and the costs & benefits of each. My investment in gold has no timeframe and uses two assumptions as the principal foundation:

1) Past policy action: As explained above, the supply of money has been increasing far too long, and there exists an abundance of dollars around the world ready to drive up the prices of goods and show the true strength of inflation they possess

2) Future policy action: As explained above, Keynesian economists wearing central banker clothing have made it fully clear how they intend to battle recessionary forces; they intend to print, print and print. Helicopter Ben to the rescue, and his imitators world-wide that follow.

In my best Jim Rogers impersonation: “I don’t know when gold will trade higher, I just know that it will.”

I’d be happy to further argue my point of view or have any worthwhile discussions in the comments section, so please, let’s converse!

http://www.chivotrades.com @chivotrader facebook.com/chivotrader

Comments »