With the launch of the new VIX exchange traded funds ( ticker VXX, VXZ) I wanted to find a way to work them into an asset allocation mix. The VIX has historically had a very strong negative correlation to the S&P. When the S&P goes down the VIX usually goes up. This strong inverse relationship makes volatility a great asset class for diversification.

The problem with typical asset allocation proposals of stock, bond, international, value, growth, large cap, small cap, etc is that in times of panic when you need the protection the most, everything gets perfectly correlated and all the asset class’s go down at the same time.

Due to the large negative correlation between the VIX and the major equity indices a relatively small allocation to the VIX would have significantly improved the risk-return profile of the S&P 500. In the 2006 paper “Improving Risk-Adjusted Returns of Fixed-Portfolios with VIX Derivatives” Gang Dong writes “that by allocating approximate 7% portfolio weight on a hypothetical derivative linking to VIX index, the portfolio approaches its optimal risk adjusted return ratio.” This optimal 7% allocation is based on a fixed portfolio that doesn’t get rebalanced. The full paper is here.

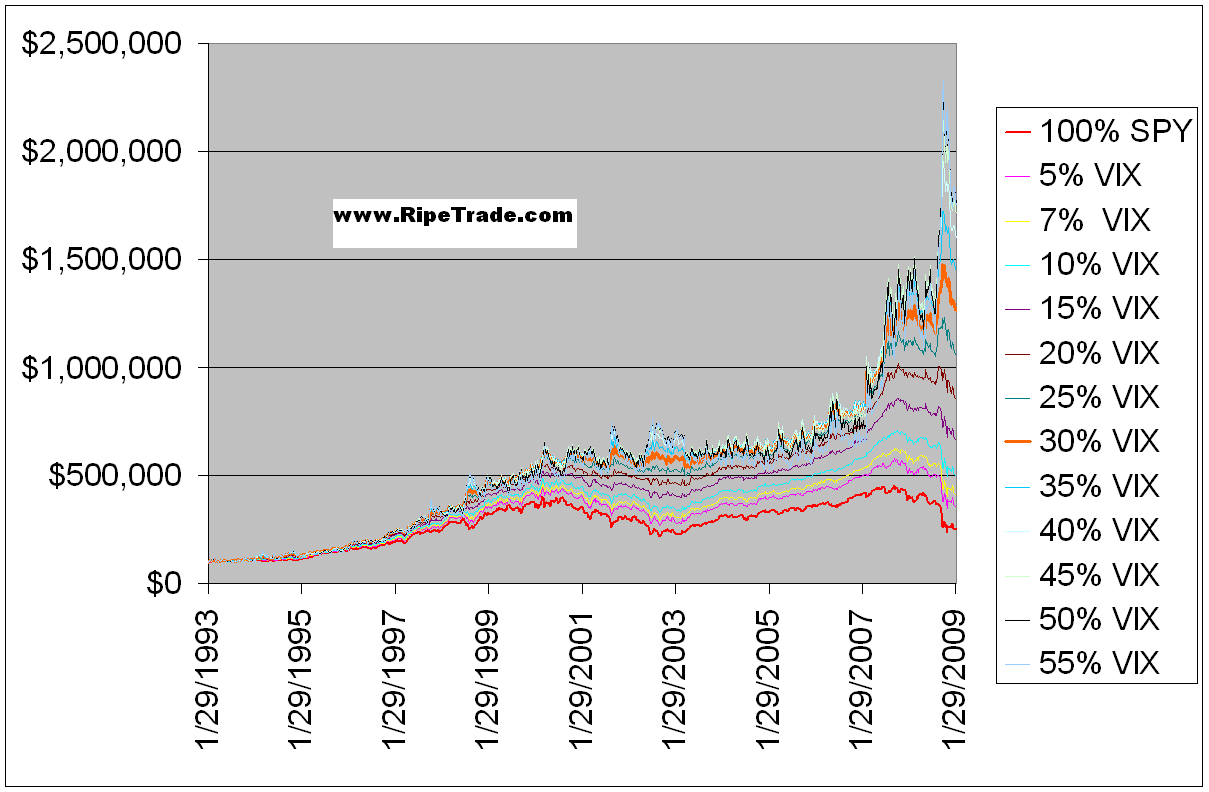

The VIX is a mean reversion machine so a weekly rebalancing seems like a more logical approach than a fixed portfolio. I worked up a rebalancing strategy to allocate X% in VIX and Y% in SPY then rebalance to the same X/Y allocation percent weekly. Below is a chart that shows how the various allocations would have grown since 1993, based on a $100k account. A 30% allocation to the VIX and 70% allocation to the SPY would have only suffered a maximum 14% peak to trough drawdown and grown a $100k account into $1,261,750 which is a 17% annual growth rate. As a comparison a $100k account invested entirely into SPY would have suffered a max 48% drawdown and would only be worth $250 k which is a 5.89% annual growth rate.

So will these vehicles allow for control over direction of the Vix ?

Only time will tell. The VXX would be the better one of the two to trade on a short term basis. And it tracks the VIX futures not VIX cash. I expect a lot less volatility in VXX vs VIX .

Boycott Barclays!

I have insufficient data to trade the Vix ETN, but looking forward to see what you come up with.