_____________________________

No, it’s not what you think. I’m not packing the goats and chickens (I have a head chicken, I’ll have you know) and donkeys up for a caravan trip to Romania, even though that’s the legendary land that spawned Vlad Dracul.

Otherwise known as “Gapping and Yapping.” No scheiss, join The PPT and check it out. He’s the real thing.

No, no plans for Romania, just yet. Instead my title refers to the oft-promised Dow Theory Analysis of the Transports that I’d mentioned over last weekend. Despite the hotness of yesterday’s gold pick [[BBA]], I will digress in a wood less traveled by, and momentarily talk about the Dow Transports and how they are giving us nice signs, despite the prevalent gloom and doom.

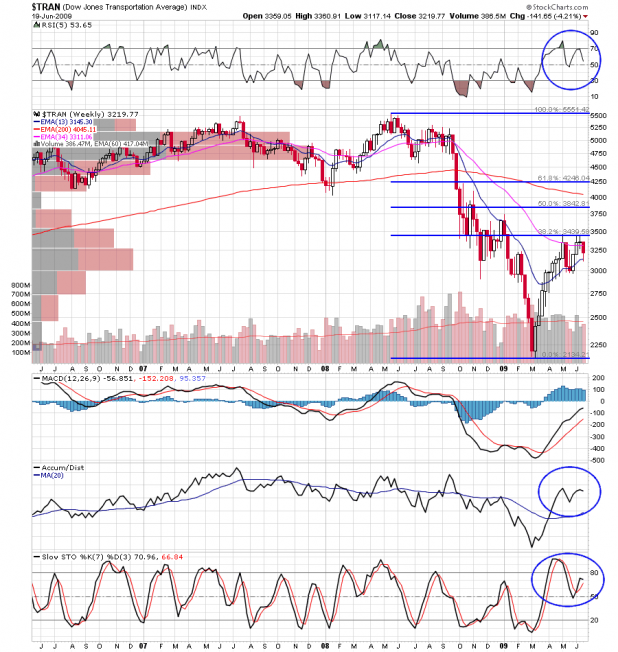

The Transports, as I’ve mentioned before, are the key to the Dow Theory. If they do not confirm, then there is no bear… yet. And thus far, the Dow Jones Transportation Index [[$TRAN]] has not confirmed a lower low vis-a-vis those February lows which we made on the SPY recently. Note how the weekly shows the non-confirmation:

As you can see on the weekly, the Trannies have gotten back above that very important 61.8% Golden Ratio Fibonacci Line. I believe that line will serve as support, even if we enter into a temporary oversold condition here, kudos to The PPT.

On the daily, it’s a similar exercise in rebuilding:

We’ve had five days of nice solid recovery, the last two of which have broken that downtrend line with some vim. Though today connotes a bit of oversold-ness, I’d contend we will find some support on that downtrend line, and better, that the Transports will lead us higher again.

Before you give me a rose tiara and call me Polyanna, please recognize there’s only one reason for the stock market to be rallying right now, and it stems from the sound of that “clacking” that you hear even more disinctly than the Vuvazellas (sp?) contributing to the beehive noises at the World Cup.

Remember that dollar weekly chart from about a week back? Well, coincidentally, Old Uncle Green-backs is still following that script… I touched nothing on the narrative here, just updated the chart itself…

I think we’re headed into more dollar doom. Probably not all at once, but herky-jerky, back down the pike. That means inflating asset markets, no matter what the CPI says.

Act accordingly. And for goodness sakes, get into The PPT so you can tell your grandkids about saving their college tuituons. Best to you all.

_________________________

UPDATE: Drunken Dem Congress Critters Gone Bad!! Time to Retire This Fist-First Nut, Tarheels:

[youtube:http://www.youtube.com/watch?v=_oqIP9yagkQ 450 300]______________________

Comments »