_____________________

I have a daughter who was born in 2000. She’s going to a classmate’s party today, and you guessed it, the classmate is also 11, on 11/11/11. Pretty cool. Of course my daughter also knows kids that were in 10 on October 10th and 9 on September 9th, and almost all the way down the line. I guess that’s one of the hidden perks of being a Millenial Baby.

Of course all that fun ends next December on 12/12/12, which will not coincidentally also soon after auger in her first year of teenagerdom. Teenagerhood? Teenagedness?

In any case, I’d better gird my loins.

But let’s not lose sight of the importance of the Day itself, written into history in 1918 as the end marker of “The War to End all Wars” — WWI. Unfortunately that was a bit of hubris, wasn’t it? The very Treaty (Versailles) signed that day in fact set the groundwork for an even worse World War only a little more than 20 years later.

The study of history shows that human nature is cyclic, and that we tend to make the same mistakes, no matter our careful plans to eradicate them by mutually agreed consensus. There will always be those who seek to take advantage of said consensus, just as there will always be those claiming we’ve finally arrived at the “End of History.”

To expect otherwise in future is a fool’s game. We can only do the best we can, and improve ourselves individually and as a society by gentle consensus, and with a constant and humble awareness that we will backslide. That knowledge, that humility, will allow us to rebound all the quicker.

I would humbly suggest we hold then to our accumulated traditions, our respect for others, their person and property and our fealty to consensual agreement over forced autarchy. For these are the traditions that set the Free People of the West apart from civilizations of the past, and from the failed societies of the present.

But let’s also be most cognizant that these traditions are under fire from many quarters, and that in many cases, all that stands between them and the less enlightened cohorts of the past are the blood of those willing to defend their preservation.

So let’s raise a glass to our Veterans, and to those who carry the sword — voluntarily — into battle for our civilization today. And pass that good word to a soldier in uniform not just this day, but from this day foreward.

_______________

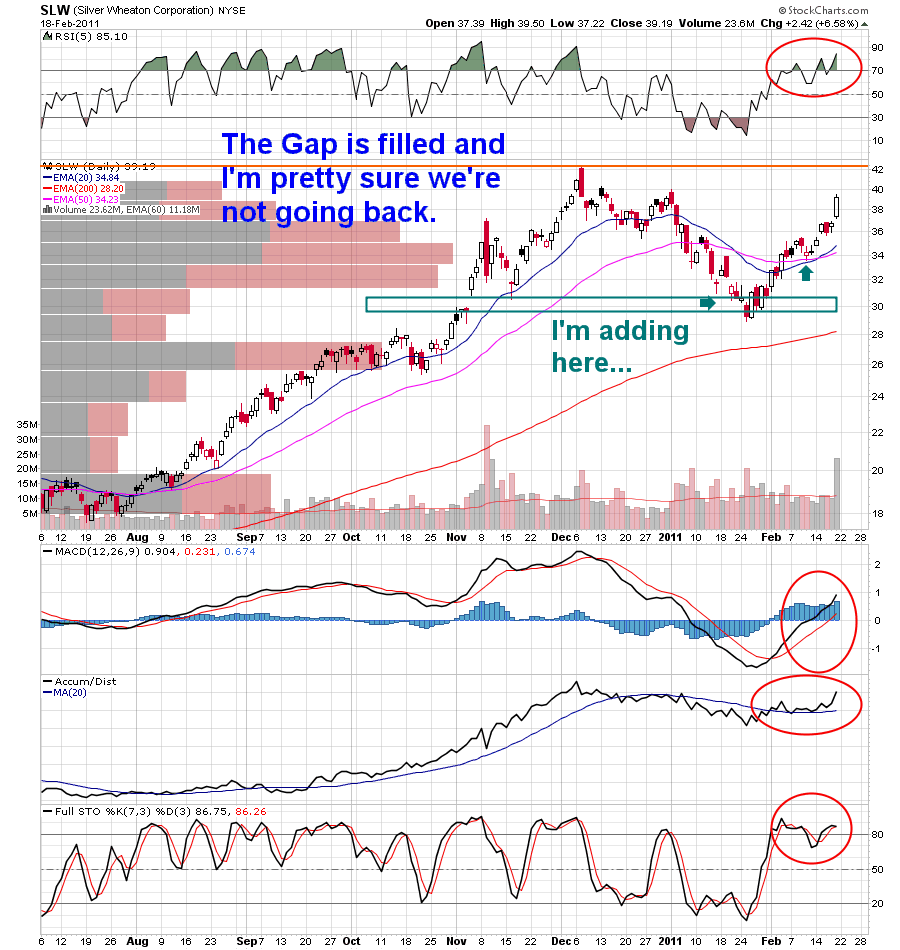

As I expected (was hoping?), the dollar gnomes have collapsed the dollar anew. This has led to some very nice activity in the silver and gold pits, with the kind of flagging (bullish) that makes my heart grow fond.

I will likely add here and there to my hordes today, and will let you know if I do. Right now I am enjoying strong moves in SLW, EGO, IAG and my various ETF plays, including the doubles AGQ and NUGT.

As always, if you want to toe-dip, start with the basics — GDX, GDXJ and SIL. Highest octane is in the crazy silvers, like my favourites AG and EXK. Today and for the next few days, SSRI should also be moving to make up for the plungerooni (overdone) yesterday.

Lastly, don’t forget about the “rare earth” plays like QRM and AVL for added dollar inflation pop.

My best to you all on this day of honour.

____________

Comments »