[youtube:http://www.youtube.com/watch?v=Fo48YpNOesQ&feature=related 450 300] _______________________________

Ugh. I cannot bloody believe it. I just had a perfectly wrought lengthy post with graphics and witticisms galore… I pressed “Publish” and “voila!” I got the screen of zero tranquility. Apparently my entire post was wiped save for the foolish youtube video I’d downloaded earlier and “saved” to make sure it was showing up.

These are the petty frustrations of the financial blogger my friends and they are enough to drive one mad with righteous anger. So forget about the witticisms and the re-boot of my day of travel. Just know that I believe silver is becoming dangerously overvalued here at 52% over its 200-day EMA, while gold stays strong but humble at only 11.4% over it’s same metric.

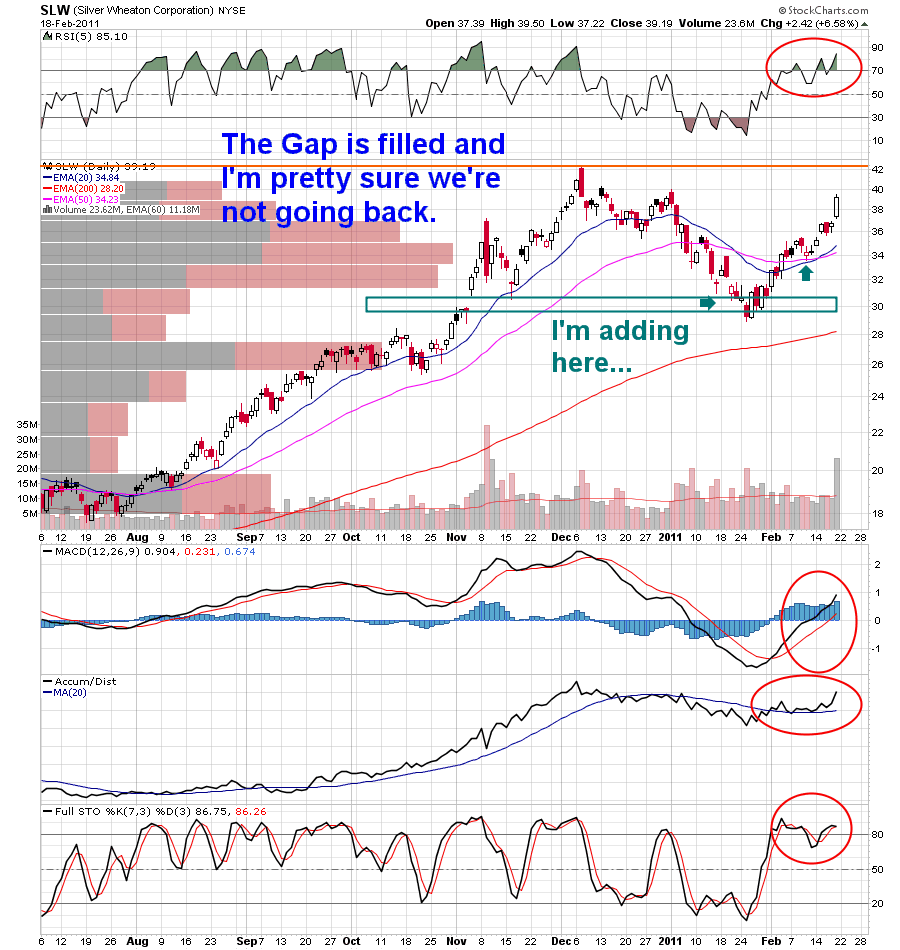

I didn’t sell anything more today because I was either driving or talking or talking and driving the entire trading session. Had I seen these things, I would’ve dumped more silver miners. I’ll probably do that tomorrow. In the meantime, two friends have shown progress. The first we spoke about mere days ago.

Look what XG has done since:

The second is our beloved Grandmama… asleep these many months, but waking now to a new day. Just as I predicted AGQ would rise to $300 this year, so too did I prophesy that RGLD would reach $100. I think today was a significant step toward that goal. Grab it on the retrace:

Note, this is a weekly chart and that’s one big grandmother of a consolidation…

I also like RBY here… stay well, my friends.

____________________________

Comments »