[youtube:http://www.youtube.com/watch?v=RabhcwuTjAo 450 300]

___________________________________

We’re getting into the gambling season, boys and girls. Not just the annual March Madness, which is pure nirvana for we college hoop fans, but we’re also starting to talk Derby Prep racing, and even some golf course skins.

What better time, then to start pushing “all in” while everyone else is scurrying under rocks and diving for cover? Listen, I have friends in Japan, people I went to school with, so I don’t mean to disregard this great tragedy, or diminish it’s human impact. But if you think the market is turning because of Japan, or becase of Wacky Quadaffi, or for any other exogenous reason, you need to start thinking about a good index fund, and maybe concentrating on your brackets.

Listen close, as this may be one of the last few times you’re blessed with the benefit of my counsel. You have very little time left to get your portfolio right, and I’m a very busy, busy man. You’ve been running around, like a man in a wifebeater tee shirt with an insane clown posse tatto on your right shoulder, and you’ve been buying “the hot thing,” “the sexy thing,” and let’s face it, “the easy thing.” This game is not meant to be easy. It’s meant to be a bare nekkid, blind folded race through a maze full of knee-high bear traps snapping away at your bag.

It’s time to stop screwing around. This market is very close to getting that last bit of string pushed out, and you are better off closing out all your positions and going to cash like Scottie than continuing to chase every fleeting fancy sparkler in these latter waning days.

Needless to say, I’m not going to cash, though I did raise some today. How? By selling out the remainder of my non-PM, non-core plays. I made the exception by keeping a little bit of hedged MON and UPS, but everything else that does not glitter or end up in the tank of my car is now gone. And even my earl plays are very minimal. I’ve got a little bit of ERX and a little bit of PBR and a smidgeon remaining of OXY. Everything else — gone.

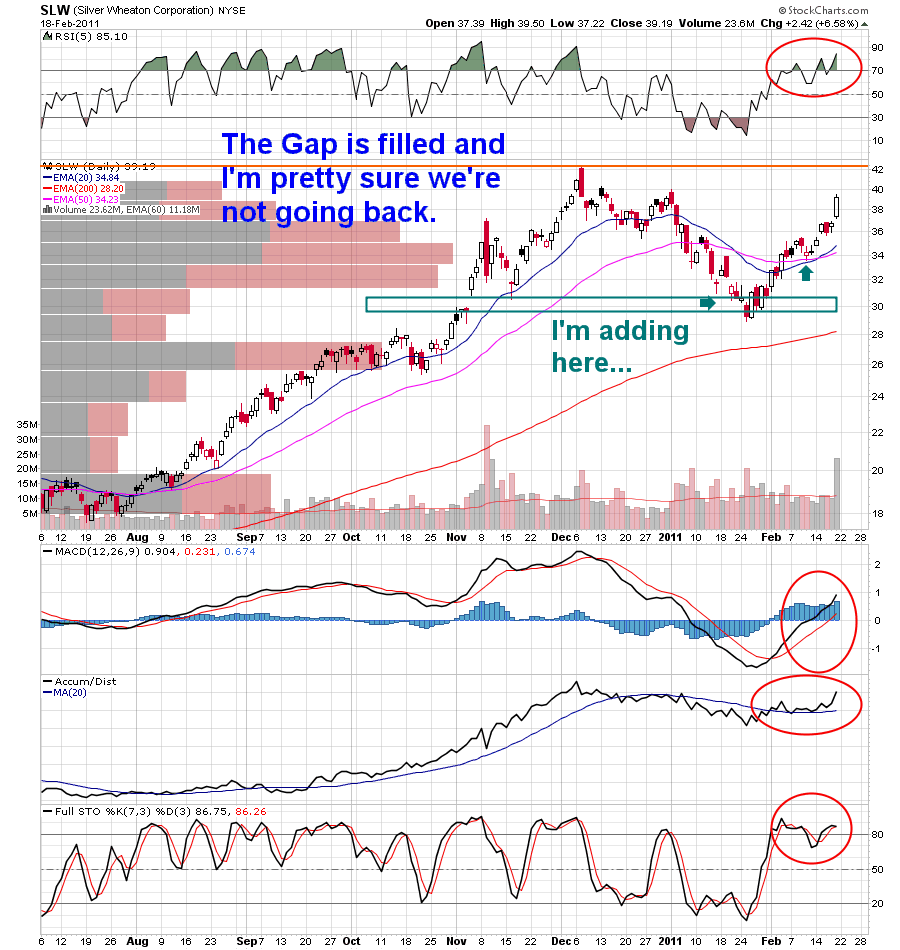

I will likely take some of that cash and use it for some additional leverage, probably for in-the-money calls on GDX, GDXJ and SLW. These are more liquid PM option plays, and I don’t plan to be in them very long, but I will know when to climb into them. It will be when the hammer below breaks through the glass flooring that has become so brittle… so brittle:

Print this page out, tape it to the top of your moniter, and refer to it frequently whenever you get the urge to purchase something frivolously.

My best to you all, really.

____________________________________

Comments »