I just wanted to follow up on the day trade set ups I created yesterday. Most, if not all, went according to plan. Enjoy the analysis, I’m off to Star Bucks:

[SET UP #1]

“Elan (ELN) – the stock is losing volatility, which makes the risk lower. Follow the direction of the stock, since it should be consistent.”

Comment: This was the easiest day trade to make. Whenever a change of direction is confirmed a buy anywhere on the trend was a winner. Let’s say you entered at $15.40 and exited at $16.00 on the long, that’s a 3.89% gain.

Comment: This was the easiest day trade to make. Whenever a change of direction is confirmed a buy anywhere on the trend was a winner. Let’s say you entered at $15.40 and exited at $16.00 on the long, that’s a 3.89% gain.

———————–

[SET UP #2]

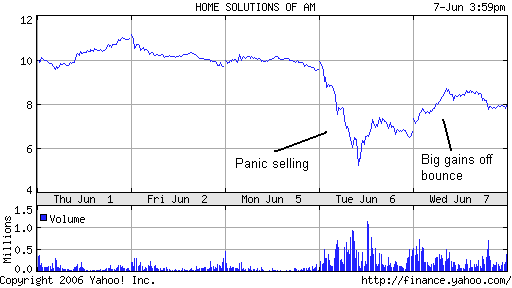

“Home Solutions (HOM) – I traded this all day Tuesday on rumors of the company performing bad business practices. Tomorrow be prepared for a huge spike due to Tuesday’s panic selling. You can trade this either way, but I suggest not holding this one overnight.”

Comment: This is a 5-day chart. Notice how the market “overreacted” on June 6. I made money off the overreaction, but never took advantage of the next day bounce. A late entry point would still give you at least 10% gain.

—————–

[SET UP #3]

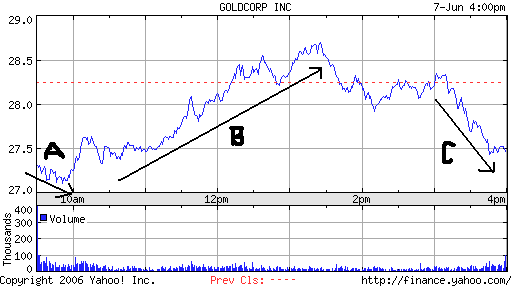

“Gold Corp (GG) – pay attention to the trend of the commodity prices and trade accordingly. I suspect GG and all other gold stocks to open up in the red, but any reversal in the commodity price, and you can go long. If gold opens below $630 expect gold stocks to have a continued sell off and short GG for 2%. “

Amazing isn’t it. Gold stocks, especially GG, follow the commodity price. Point (A) was the reaction to Gold falling overseas. Point (B) is a rally in America, but at (C) the rally ended and many investors in the stocks exited not wanting to hold it overnight. GG was a good long candidate during the miniature gold rally.

——————-

[SET UP #4]

“Peru Copper (CUP)- this company deserves much attention after what I saw happened in the final few minutes on Tuesday. This stock just took off. Something is going on. Play this either way- long, short.”

Comment: Once again, the “fastest Cop in town“, Peru Copper, had big moves during the day. Watch this stock tomorrow since trading was halted at 3pm. News of an important mine is coming up. Stock will once again move very fast.

——————–

[SET UP #5]

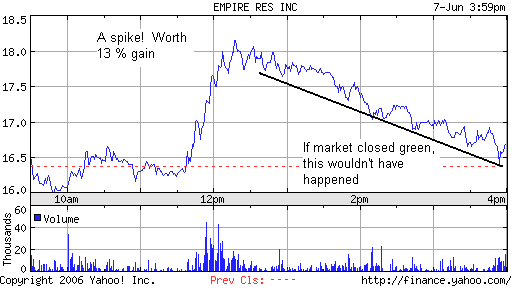

“Empire Resources (ERS)- is begging for a bounce. Watch this stock every morning until that bounce occurs. Where is the bottom for this stock?!”

COMMENT: The bounce certainly did come, but you had to be a good day trader to exit the trade when it returned below $17.00. Investors are still waiting for a confirmed reversal, so there should be more of these spikes in the next few days. Also, any sudden reversal in the indexes will dictate the direction of this stock… for example, what happened today!

Comments »