There are a few important events on the economic calendar that are lining up this week:

- Tuesday 6/13 8:30 AM- Producer Price Index (PPI). This announcement, which measure prices of goods at wholesale level, will no doubt affect the sentiment of the important CPI announcement this Wednesday.

- Wednesday 6/14 8:30 AM- Consumer Price Index (CPI). The CPI is the most widely sited inflation indicator. There’s no coincidence that Bernanke kept inflation speak on the headlines today.

Get ready! The market will react. What I’m looking for is data that shows the market overreacted to the inflation news, which hopefully leads to a lot of “gapping up.” Don’t forget, options expire in two weeks, so if there is to be stock price manipulation (a theory I can’t ignore), it should happen right about now.

MARKET OUTLOOK 6-13-06… not so good

Gold Falls Below $600!

As I type this, gold has dropped overseas and is trading near low $590s. This will hurt metal stocks in the morning (GG, EZM, CUP, TIE, RTI etc.), but be prepared for an attempt to resurface above $600… and be prepared for an extended decline. More bad news for Gold– dollar is gaining on the Euro and Yen, making a hedge in gold against the dollar looking less desirable.

Japan Stock Market Plunges 4%

Rising interest rates in the U.S. will only hurt their importers… for example, Japan. Investing overseas has crossed my mind during this temporary bear market, but that idea seems to be fading fast. First India, now Japan… I don’t want to imagine what would happen here if China takes a hit next. Can you believe that Bernanke has the power to cause a global sell off?!

U.S. Soccer Team Loses to Czech, 3 – Nil

The market is doomed! Not the best indicator, but the U.S. is officially on a losing streak… Dow, Nasdaq, and soccer.

… so, I’m not optimistic at all with tomorrow’s market. It’s pretty ironic that the cause of the markets’ current fall out will be a potential catalyst to turn things around! Yup, investors will be looking for good inflation news with this month’s PPI and CPI data which comes out in the next two days.

Day Trading Strategy

I’m getting set to short more stocks on continued panic selling. There’s just too much negative news right now. Nevertheless, it won’t be easy for day traders. Once again, I’m keeping it simple, sort of:

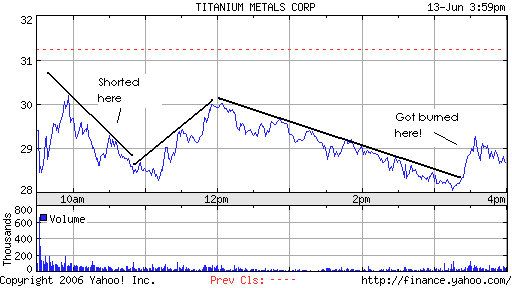

- TIE, ERS, GG, EZM, ZOLT, CMVT, FNET shorting on any continued weakness.

- Cramer bullish on WCI, so I’ll be ready to short it

- Cramer bearish on TIVO & DIGE, so I’ll be ready to short these too

- Trade metal stocks according to metal commodities

Wow, I couldn’t find a single descent stock to go long. But the PPI data is the wildcard. If it’s good, the market will pick up and I’ll switch my positions.

Comments »