Courtesy of the Philipp Bagus and Markus H. Schiml from the Ludwig von Mises Institute

This requires attention so I’ll let you at it:

Since August 15, 1971 the US dollar has been an irredeemable paper currency. Every irredeemable paper currency in history has failed. Yet, the experiment of the US dollar and the rest of the fiat paper world continues.

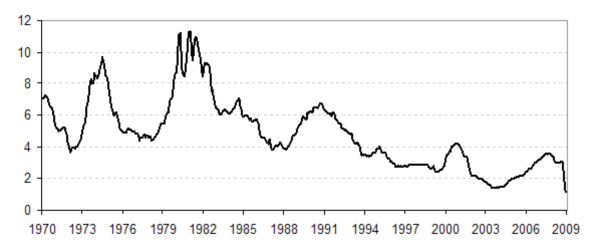

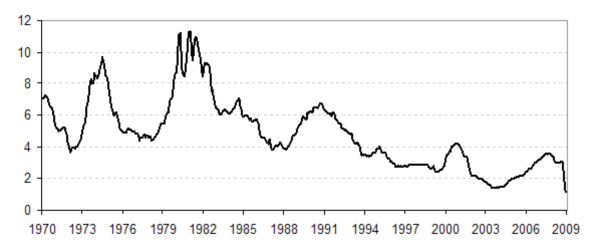

During the current crisis, however, financial systems all over the world are increasingly struggling, and the end of the experiment seems closer. In fact, the Federal Reserve System has used up much of its “ammunition” for monetary interventions in an attempt to keep the experiment going, lowering its target interest rate almost to zero. Other central banks are also quickly approaching the “zero limit” for interest rates.

Above chart is the average of the worlds interest rates.

During these inflationary decades, economic structures have developed that can only survive with falling interest rates. As the world approaches a zero interest rate, it appears that finally there might be a full adaptation of the structure of production to the demands of consumers, and the experiment might come to an end.

Yet, has the Fed really “run out of ammunition”? First of all: what is the Fed shooting at? It is trying to artificially stimulate the economy with its monetary policy, thereby it is also unwittingly shooting at the value of the currency. Through its monetary policy, the Fed is trying to bail out an insolvent and illiquid banking system to maintain an unsustainable structure of production. As long as the currency is not totally destroyed, the Fed will never run out of ammunition. In order to assess the ammunition left, one should have a look at the balance sheet of the Federal Reserve — especially at the assets the Fed can still obtain. The Fed’s balance sheet also gives insights on the condition or quality of the dollar.

Since the crisis broke out, the Fed has continuously weakened the quality of the dollar by weakening its balance sheet. In fact, the assets the Federal Reserve holds have deteriorated tremendously. These assets back the liability side of the balance sheet, which mainly represents the monetary base of the dollar. The assets of the Fed, thereby, hold up the value of the dollar. At the end of the day, it is these assets that the Fed can use to defend the dollar’s value externally and internally. Thus, for example, it could sell its foreign exchange reserves to buy back dollars, reducing the amount of dollars outstanding. From the point of view of the buyer of the foreign exchange reserves, this transaction is a de facto redemption.

In the first stage of the crisis that lasted until September 2008, the Federal Reserve did not increase its balance sheet. Instead, the Fed changed its balance sheet’s structure. These changes are very important for the value of the currency. Imagine that the Fed announces tomorrow that is has sold all its gold and has bought Zimbabwean government bonds with the revenues. The Fed would explain this move by arguing that the stability of the Zimbabwean economy would be crucial for the US economy and the welfare of mankind. This action by itself would not change the quantity of money at all, which shows that concentrating exclusively on the quantity of money is not sufficient to evaluate the condition of a currency. Qualitative issues can be even more important than mere quantities. In fact, an asset swap from gold to Zimbabwean government bonds would mean a strong deterioration of the quality of the dollar.

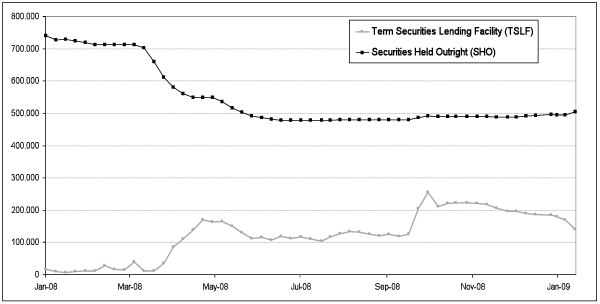

While this example might sound extreme, something similar happened during the first stage of the sub-prime crisis. The Fed weakened the composition of its balance sheet not in favor of the Zimbabwean economy but in favor of the US banking system. The Federal Reserve sold good assets in order to acquire bad assets. The good assets were not gold but mainly the still highly-liquid US treasury bonds in the category of “securities held outright.” The bad assets were not Zimbabwean government bonds but loans given to troubled banks backed by problematic and illiquid assets. This weakened the dollar.

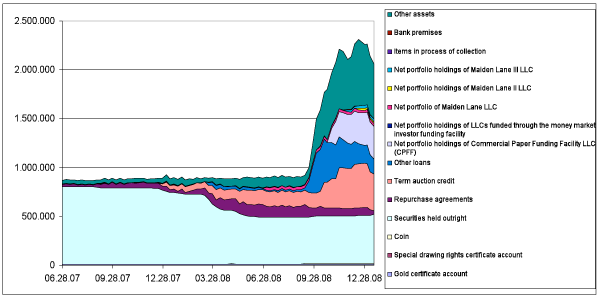

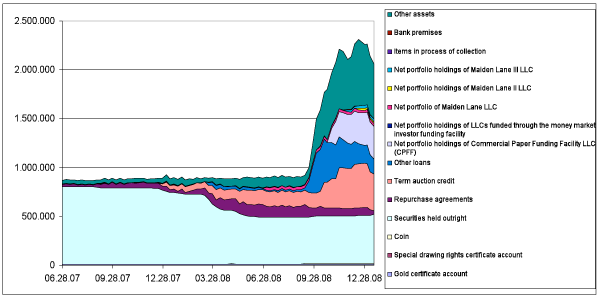

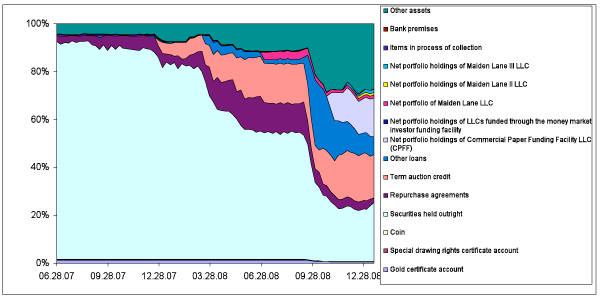

Fed Balance Sheet Assets in the millions- Source Federal Reserve

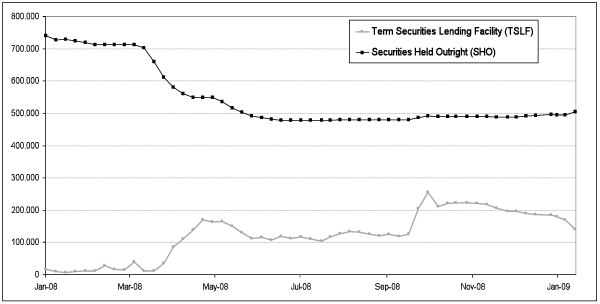

As can be seen in the chart, starting in August 2007, the lower-quality assets increased. They grew especially in the form of repurchase agreements and, later, new types of credits such as term-auction credits — through the Term Auction Facility (TAF) — starting in December 2007. As the Federal Reserve did not want to increase its balance sheet, it sterilized the increasing amount of bad assets by selling good assets to the troubled banking system. Swapping good assets for bad assets can in fact be considered a bail out of the banking system on a gigantic scale. Moreover, the Federal Reserve started lending securities (good assets) to banks in the so-called Term Securities Lending Facility (TSLF). This measure provided the banks with high-quality assets they could pledge as collateral for loans. As a consequence, the amount of securities decreased via selling and lending, as can be seen in the following chart.

TSLF and SHO in U.S. millions

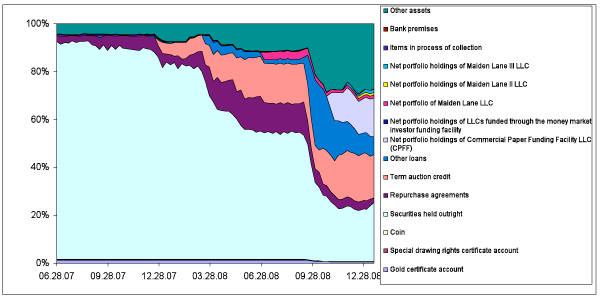

Thus, the average quality of the Federal Reserve balance sheet deteriorated in the first stage of the crisis and continues to do so as shown in the following compositional graph.

Fed Balance Sheet Assets in percentage

In the second stage of the crisis, which started with the Lehman bankruptcy, it became clear that the policy of merely changing the balance-sheet structure was coming to an end. The Fed was running out of Treasury bonds. Moreover, this policy did not allow for the strong liquidity boosts that the Fed deemed appropriate in this situation. Hence, the Fed started to increase its balance sheet. It no longer “sterilized” the additional loans it granted with the sale of good assets. In fact, it would not have had enough good assets left to sell. In our imaginary example, the Fed would run out of gold. It would stop selling gold and keep on buying Zimbabwean government bonds. Of course, the Fed did not buy Zimbabwean government bonds but other assets of low quality, mainly loans to an insolvent banking system. As a consequence, the sum of the balance sheet has nearly tripled since June 2007.

The increase of the balance sheet in favor of the financial system required some unconventional policies. Thus, the Fed has invented new credit programs with a tendency for longer terms, such as the aforementioned TAF. It has granted special loans to AIG and bought Bear Stearns assets that J.P. Morgan did not want. It has allowed primary dealers to borrow directly from the Federal Reserve in the Primary Dealer Credit Facility (PDCF). In addition, the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF) was created. This facility allows depository institutions to borrow from the Fed with collateral of asset-backed commercial paper.

Later the Fed decided to supplement the AMLF with the Commercial Paper Funding Facility (CPFF). Now unsecured commercial paper is also eligible as collateral. (Unsecured commercial paper is not backed by specific assets but only by the name of a company.)

Furthermore, the Fed has set up the Money Market Investor Funding Facility (MMIFF), which allows money market mutual funds to borrow from the Fed via special purpose vehicles. Three characteristics of these policies can be found:

1. they contain credits of longer maturities;

2. they contain credits of a broader range of eligible institutions backed by a broader range of assets than was the case before; and

3. they, thereby, reduce the average quality of the Fed assets and consequently the quality of the dollar.

Despite of all these efforts, credit markets still have not returned to normal. What will the Fed do next? Interest rates are already practically at zero. However, the dollar still has value that can be exploited to keep the experiment going. Bernanke’s new tool is the so-called quantitative easing. Quantitative easing is when a central bank with interest rates already near zero continues to buy assets, thus injecting reserves into the banking system. In fact, quantitative easing is a subsection of qualitative easing. Qualitative easing can be defined as the sum of the policies that weaken the quality of a currency.

But what new assets is the Fed acquiring? The Fed has already started buying the debts of Fannie Mae, Freddie Mae, and the Federal Home Loan Banks. It has also bought mortgage-backed securities issued by Fannie Mae, Ginnie Mae, and Freddie Mac. Bernanke is also considering buying other securities backed by consumer loans, credit card loans, or student loans. Long-term government debt is also on the list of assets that the Fed might buy.

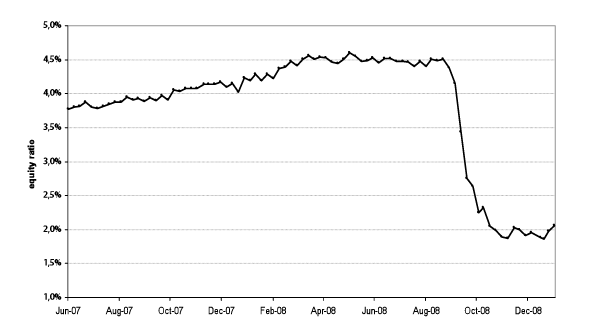

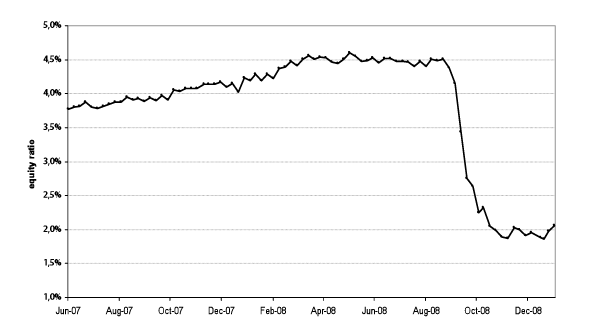

In the analysis of the Fed balance sheet and the condition of the dollar, another detail is extremely important. The equity ratio in the Fed balance has fallen from about 4.5 to 2%.

Figure 5:

Fed Balance Sheet in percent

This figure implies an increase of the Fed’s leverage from 22 to 50. As we have seen there are large new positions of dubious quality on the Federal Reserve balance sheet. More specifically, should only 2% of the Fed’s assets go into default — or if there is a loss in value of 2% — the Fed becomes insolvent.

Only two things can save the Fed at this point. One is a bailout by the federal government. This recapitalization could be financed by taxes or by monetizing government debt in another blow to the value of the currency.

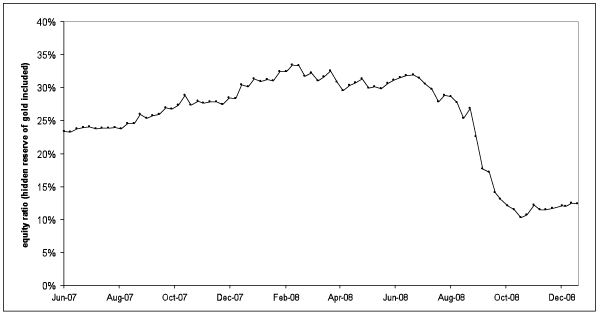

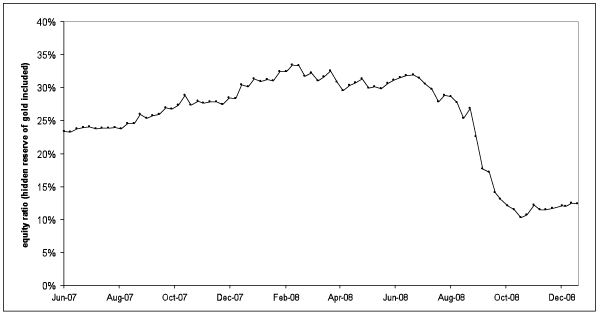

The other possibility is concealed in the hidden reserves of the Fed’s gold position, which is only valued at $42.44 per troy ounce on the balance sheet. A revaluation of the gold reserves would boost the equity ratio of the Fed to 12.35%.[1]

Figure 6:

Fed Balance Sheet Equity Ratio including hidden reserves in percent

It is ironic that in troubled times a revaluation of the “barbarous relic” could save the Fed from insolvency. Yet, this would only be an accounting measure and would not change the fundamental problems of the paper dollar. While shooting its last bullets and weakening the dollar, the Fed is outmaneuvering itself. The end of the experiment is getting closer.

Comments »