Comments »Feb. 23 (Bloomberg) — Asian stocks slumped, led by financial and commodity companies, as losses at Japan’s Norinchukin Bank and BlueScope Steel Ltd. heightened concerns that the global recession is deepening.

Sumitomo Mitsui Financial Group Inc., Japan’s third-biggest bank, slid 4.7 percent as concern the U.S. government will take over financial companies sent stocks there lower on Feb. 20. BlueScope, Australia’s largest steelmaker, tumbled 9.6 percent in Sydney after saying it may have a loss this half and cutting its dividend payment. Toyota Motor Corp., the world’s largest carmaker, fell 2.3 percent after the Nikkei English News said the company will cut global vehicle production.

“There is a worry that the recession will be deeper and more prolonged than previously expected,” said Prasad Patkar, who helps manage $1 billion at Sydney-based Platypus Asset Management. “My sense is that the current consensus is for a recovery in first half of next year. The new lows are telling you that the market believes a recovery will be muted.”

The MSCI Asia Pacific Index fell 1 percent to 75.30 at 9:42 a.m. in Tokyo, The gauge tumbled 7 percent last week, the sharpest decline since the period ended Oct. 24, and has lost 15 percent in 2009 as the economic slowdown hurts corporate profits.

Japan’s Nikkei 225 Stock Average lost 1.4 percent to 7,315.66. Australia’s S&P/ASX 200 Index fell 1.2 percent. New Zealand’s NZX 50 Index lost 0.6 percent, set to close at the lowest since May 2004.

Toshiba Corp., Japan’s biggest chipmaker, slumped 10 percent after the Yomiuri newspaper reported the company is considering raising funds to strengthen its finances. Newcrest Mining Ltd., Australia’s largest gold producer, rallied 2.3 percent as bullion exceeded $1,000 an ounce for the first time since March.

Biggest Bankruptcy

Futures on the U.S. Standard & Poor’s 500 Index lost 0.6 percent today. The gauge dropped 1.1 percent on Feb. 20. Citigroup Inc. and Bank of America Corp. tumbled as Senator Christopher Dodd, chairman of the Banking Committee, said it may be necessary to nationalize some banks for “a short time.”

Sumitomo Mitsui dropped 4.7 percent to 2,825 yen. Mitsubishi UFJ Financial Group Inc., Japan’s biggest bank, lost 3.5 percent to 414 yen.

Norinchukin Bank, which isn’t listed, said on Feb. 20 that it will raise 1.9 trillion yen ($20 billion) through share sales. Norinchukin, owned by more than 4,000 shareholders including farm, fishing and forestry cooperatives, lost at least $10 billion on overseas asset-backed securities following the collapse of the American housing market.

Tokyo-based SFCG Co., which provides small enterprises with loans, today said it filed for protection from creditors with 338 billion yen in liabilities, making it Japan’s biggest bankruptcy this year.

Mounting Losses

The MSCI Asia Pacific’s finance gauge is the worst performer of the broader index’s 10 industry measures this year as losses from the financial crisis swelled. The International Monetary Fund said last month bank losses worldwide from toxic U.S.-originated assets may reach $2.2 trillion.

“Investors are increasingly wondering which businesses can survive in the coming months,” Tomochika Kitaoka, a strategist at Tokyo-based Mizuho Securities Co., said in an interview with Bloomberg Television.

BlueScope tumbled 9.6 percent to A$2.82 as the global slowdown forced steelmakers to cut output, prompting the company to say today that it may have a second-half loss. BlueScope, which reported a three-fold increase in first-half profit, cut its interim dividend by 77 percent.

Toyota, Toshiba

Rio Tinto Group, the world’s No. 3 mining company, lost 4 percent to A$48.26. BHP Billiton Ltd., Rio’s largest rival, declined 1.3 percent to A$29.49. Copper in New York lost 3.7 percent on Feb. 20 in New York as the global economic slump increased stockpiles of the metal. Futures rose 1.5 percent in after-hours trading.

Toyota dropped 2.3 percent to 3,020 yen. The company will cut worldwide vehicle production by 20 percent this calendar year on slumping demand, the Nikkei reported, without saying where it got the information.

Toshiba tumbled 10 percent to 207 yen following the Yomiuri’s Feb. 20 report that the company is considering raising more than 300 billion yen.

Newcrest gained 2.7 percent to A$33.93 following a two-day, 9 percent slump. Gold rose 2.6 percent to $1,002.20 an ounce on Feb. 20 as investors flocked to the metal as a safe haven. Prices increased 0.5 percent today.

Bernanke Will Personify Mighty Mouse

“here I come to save the day “

Comments »WASHINGTON (Reuters) – Federal Reserve Chairman Ben Bernanke this week will offer assurance that help is on the way for the troubled U.S. economy and may offer clues on additional steps that could be taken to halt an ever-steepening dive.

With U.S. stocks closing at 6-1/2-year lows on Friday on fears big banks will be nationalized, Bernanke will likely be pressed on government plans to clean up the financial sector when he delivers the Fed’s semiannual monetary policy report to Congress in two days of testimony on Tuesday and Wednesday.

In addition, the Fed chief will face the challenge of making the case that the U.S. central bank, which has chopped interest rates to near zero and flooded markets with hundreds of billions of dollars, still has the ammunition to pull the economy out of its worst downturn since the early 1980s.

“He’s going to talk about the Fed still having tools in its tool kit and that it will do whatever it can to get the economy going,” said Joseph LaVorgna, an economist for Deutsche Bank Securities in New York.

After bringing its main policy lever, the overnight interbank lending rate, as low as it practically can go in December, the Fed has largely ceded the spotlight to the new administration of President Barack Obama.

Obama has already signed into law an almost $800 billion government stimulus package and his team has rolled out bank and housing rescue plans.

RESCUE STILL UNFOLDING

Even so, the Fed remains busy behind the scenes and is counting on two massive programs to help spur consumer lending and stir some revival in the depressed housing market.

In one of these, the central bank has begun buying up to $600 billion worth of debt and mortgage securities backed by government-related mortgage finance providers, a program that has helped drive down mortgage costs.

In the other, the Fed is poised to throw a life-line to consumers with an initiative aimed at making it easier to get loans for homes, cars and on credit cards that could be up and running within a couple weeks.

Originally envisioned to provide $200 billion dollars to support lending, the Fed and Treasury said on February 10 that they were ramping up the program to as much as $1 trillion, with the Treasury agreeing to put up $100 billion to protect the central bank from potential losses.

But the economic picture has grown dimmer almost without letup despite the flood of money to financial institutions and promises of cash for households and consumers.

Fed officials acknowledged at their policy-setting meeting at the end of January that the economy was likely to shrink this year and that unemployment would rise to near 9 percent.

Offering a particularly downbeat assessment, officials said they saw no signs of stabilization in the housing market and warned any recovery would be unusually gradual and prolonged.

Bernanke may face some ire from lawmakers whose constituents are being pummeled by plunging stock and home values and who think the government has bungled its efforts to stabilize the economy.

“Disappointment with the prospect of immediate policy responses has helped remove the floor from markets,” Dominic Wilson of Goldman Sachs wrote in a note to clients.

WHAT’S NEXT

For financial markets, Bernanke’s views on how best to clean up the banks will be eyed particularly closely.

The week before last, Treasury Secretary Timothy Geithner sketched out plans for a public-private partnership to mop up bad mortgage-related debts clogging the banking system. But he provided scant details on how his plan would work and markets tanked as investors’ hopes for bold, quick action were dashed.

Markets will also be listening for any clues on whether the Fed might still be considering buying long-term U.S. government bonds as a way to drive down borrowing costs.

The Fed raised that possibility in December and said after its January 27-28 policy meeting that it was prepared to take that step if it believed it would be “particularly effective” in improving conditions in private credit markets.

Bernanke, however, has not mentioned the possibility of bond purchases in his last two public outings, and many observers think the Fed may be tip-toeing away from the idea.

The minutes from the Fed’s last meeting suggested the central bank was more likely to expand its mortgage-support efforts, since they have already proven effective, and officials have said they want a chance to gauge the impact of their unfolding actions before taking further steps.

Can the Bears Be Put In Check With Obama/Geithner Bank Plan Speech Looming ?

Will the bear be put on hold ?

Comments »The Obama administration is promising to flesh out its plan to repair the US banking system this week as investors and Wall Street executives express concerns about the creeping nationalisation of their industry.

With the US stock market sliding towards levels not seen in more than a decade, the Treasury hopes to lift some of the uncertainty with details on how to clear up the toxic assets clogging bank balance sheets and to “stress test” the solvency of the nation’s biggest financial institutions.

Confirmation that Tim Geithner, the Treasury Secretary, would make a statement in the coming week helped staunch stock market selling late on Friday, but it remains unclear exactly when an announcement will come or whether the administration had only been bounced into the new deadline because of the market’s gyrations.

Citigroup shares have plunged below $2 for the first time since 1991. Bank of America’s stock also plunged on Friday, until chief executive Ken Lewis furiously attacked those who thought it could be taken over by the government. “Speculation about nationalisation is based on a lack of understanding of our bank’s financial position as well as a lack of appreciation for the adverse ramifications for our customers and the economy,” he said. “Bank of America does not need any further assistance today and I am confident we will not need any further assistance in the future.”

BofA has received two tranches of taxpayer money already, and has a $118bn (£82bn) government guarantee against a further $118bn of losses.

Citigroup has avoided collapse through two government infusions of its own, but it has been lobbying for a plan that will sweep toxic mortgage assets from bank balance sheets into a separate government-controlled “bad bank”, whose losses – if there are any – would be repaid when the industry has returned to profitability.

Executives at both banks, and across Wall Street, are angry that the Obama administration has been allowing speculation about nationalisation to run riot. In a frenzied week of trading, speculators have claimed that the “stress test” to be carried out on all $100bn-asset banks is a means to engineer the takeover of weak players. The price action in the financial markets suggested increasing expectations that not just ordinary shareholder but preferred shareholders, too, could be wiped out. Meanwhile, traders swapped video of a slip of the tongue by Federal Reserve chairman Ben Bernanke, speaking last week. He said that “whatever actions may need to be taken at one point or another, I think there’s a very strong commitment on the part of the administration to try to return banks – or keep banks private or return them to private hands as quickly as possible”.

The index of US financial stocks has tumbled since Mr Geithner’s botched announcement of the next phase of the Wall Street bailout two weeks ago – an announcement that was light on detail and did not answer vital questions about how to deal with toxic assets and to recapitalise the banking system without nationalising large parts of it.

RBS Goes Sybil

Comments »The Royal Bank of Scotland (RBS) is to be split into a “good bank” and “bad bank” in a dramatic rescue restructuring in which assets worth several hundred billion pounds will be put up for sale.

Stephen Hester, RBS chief executive, will outline the plans this week as he unveils Britain’s biggest-ever corporate loss of up to £28 billion. He will cut costs by more than £1 billion a year, a move expected to lead to the loss of about 20,000 jobs, more than half of which will be in Britain.

Large parts of the group’s investment-banking business will be earmarked for sale or closed down. Its Asian operations and retail operations across central and eastern Europe will also be sold off.

All these operations will be bundled together in a “bad bank” inside the group, which will report its figures separately.

RBS will also place at least £200 billion of toxic assets into the government’s asset-protection scheme, a controversial insurance scheme designed to protect banks against further losses.

Billionaire investor Wilbur Ross leads a pack of vulture funds that are talking to the bank and the government about buying some of the bad loans, although it is unlikely a deal will be agreed in time for Thursday’s results. Virgin Money, Sir Richard Branson’s mortgage business, is another possible buyer.

The “good bank” will comprise retail and commercial banking in Britain, America and a handful of other countries where RBS has a significant presence.

A similar break-up deal is planned for Northern Rock, under a government initiative to kick-start lending into the economy. The government is expected to inject between £5 billion and £10 billion of new funding into Northern Rock as part of the deal.

The asset sell-off will be one of the biggest ever seen, and will lead to a substantial reduction of the bank’s £1 trillion balance sheet.

The £1 billion cost-cutting plan relates to the businesses being retained.

The group still employs more than 180,000 people around the world, including 100,000 in Britain. RBS has already cut more than 12,000 jobs in the past year.

This week’s results are expected to confirm a loss of between £7 billion and £8 billion, and a further write-down of up to £20 billion on its acquisition of the Dutch bank ABN Amro.

The £8 billion of credit losses suffered by the bank can be traced back to just 500 people, according to banking sources. About 80% of those responsible for the losses have already left the company, sources say.

Jay Levine, former head of RBS’s American investment-banking operations, who led the bank’s charge into sub-prime loans, left in late 2007 – after receiving close to £40m in pay and bonuses over three years.

Market sources believe the bank has made profits of several billion pounds through trading in the foreign-exchange markets, both in its operations in London and in its RBS Greenwich division in America.

The bank is also offering loans to staff who had been expecting cash awards. They will be allowed to use the stored-up bonuses as collateral on their loans.

Billions more to prop up lenders

A further £500 billion of taxpayers’ money is to be pumped into the banks through a slew of initiatives to be announced this week.

The Bank of England will launch its so-called “quantitative-easing” plan, in which at least £100 billion will be spent on buying bonds and gilts from Britain’s banks. The final figure could climb much higher, according to economists.

The government will also launch its controversial asset-protection scheme, which is expected to protect at least £400 billion of “toxic” loans with a taxpayers’ guarantee.

Royal Bank of Scotland is expected to place at least £200 billion of assets into the insurance scheme, although negotiations on the final figure are continuing this weekend.

Lloyds Banking Group, which will unveil losses of more than £10 billion this week, is also in negotiations to use the scheme. Analysts believe the bank could place about £200 billion of assets into it.

The moves coincide with the launch in America of President Barack Obama’s new bank “stress-test” plan, also expected this week.

From Geyser to Miser

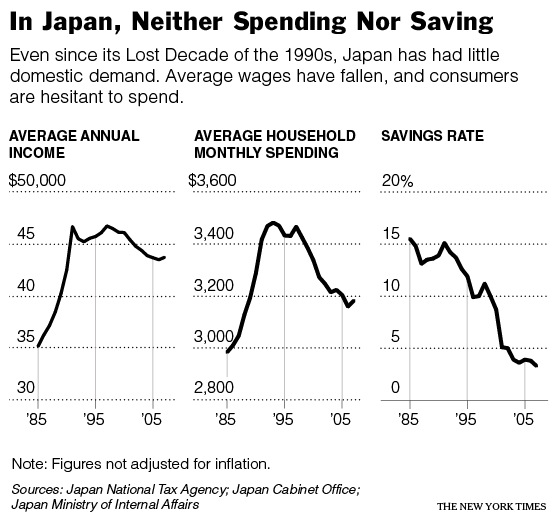

TOKYO — As recession-wary Americans adapt to a new frugality, Japan offers a peek at how thrift can take lasting hold of a consumer society, to disastrous effect.

Comments »The economic malaise that plagued Japan from the 1990s until the early 2000s brought stunted wages and depressed stock prices, turning free-spending consumers into misers and making them dead weight on Japan’s economy.

Today, years after the recovery, even well-off Japanese households use old bath water to do laundry, a popular way to save on utility bills. Sales of whiskey, the favorite drink among moneyed Tokyoites in the booming ’80s, have fallen to a fifth of their peak. And the nation is losing interest in cars; sales have fallen by half since 1990.

The Takigasaki family in the Tokyo suburb of Nakano goes further to save a yen or two. Although the family has a comfortable nest egg, Hiroko Takigasaki carefully rations her vegetables. When she goes through too many in a given week, she reverts to her cost-saving standby: cabbage stew.

“You can make almost anything with some cabbage, and perhaps some potato,” says Mrs. Takigasaki, 49, who works part time at a home for people with disabilities.

Her husband has a well-paying job with the electronics giant Fujitsu, but “I don’t know when the ax will drop,” she says. “Really, we need to save much, much more.”

Japan eventually pulled itself out of the Lost Decade of the 1990s, thanks in part to a boom in exports to the United States and China. But even as the economy expanded, shell-shocked consumers refused to spend. Between 2001 and 2007, per-capita consumer spending rose only 0.2 percent.

Now, as exports dry up amid a worldwide collapse in demand, Japan’s economy is in free-fall because it cannot rely on domestic consumption to pick up the slack.

In the last three months of 2008, Japan’s economy shrank at an annualized rate of 12.7 percent, the sharpest decline since the oil shocks of the 1970s.

“Japan is so dependent on exports that when overseas markets slow down, Japan’s economy teeters on collapse,” said Hideo Kumano, an economist at the Dai-ichi Life Research Institute. “On the surface, Japan looked like it had recovered from its Lost Decade of the 1990s. But Japan in fact entered a second Lost Decade — that of lost consumption.”

The Japanese have had some good reasons to scale back spending.

Perhaps most important, the average worker’s paycheck has shrunk in recent years, even after companies rebounded and bolstered their profits.

That discrepancy is the result of aggressive cost-cutting on the part of Japanese exporters like Toyota and Sony. They, like American companies now, have sought to fend off cutthroat competition from companies in emerging economies like South Korea and Taiwan, where labor costs are low.

To better compete, companies slashed jobs and wages, replacing much of their work force with temporary workers who had no job security and fewer benefits. Nontraditional workers now make up more than a third of Japan’s labor force.

Younger people are feeling the brunt of that shift. Some 48 percent of workers age 24 or younger are temps. These workers, who came of age during a tough job market, tend to shun conspicuous consumption.

They tend to be uninterested in cars; a survey last year by the business daily Nikkei found that only 25 percent of Japanese men in their 20s wanted a car, down from 48 percent in 2000, contributing to the slump in sales.

Young Japanese women even seem to be losing their once- insatiable thirst for foreign fashion. Louis Vuitton, for example, reported a 10 percent drop in its sales in Japan in 2008.

“I’m not interested in big spending,” says Risa Masaki, 20, a college student in Tokyo and a neighbor of the Takigasakis. “I just want a humble life.”

Japan’s aging population is not helping consumption. Businesses had hoped that baby boomers — the generation that reaped the benefits of Japan’s postwar breakneck economic growth — would splurge their lifetime savings upon retirement, which began en masse in 2007. But that has not happened at the scale that companies had hoped.

Economists blame this slow spending on widespread distrust of Japan’s pension system, which is buckling under the weight of one of the world’s most rapidly aging societies. That could serve as a warning for the United States, where workers’ 401(k)’s have been ravaged by declining stocks, pensions are disappearing, and the long-term solvency of the Social Security system is in question.

“My husband is retiring in five years, and I’m very concerned,” says Ms. Masaki’s mother, Naoko, 52. She says it is no relief that her husband, a public servant, can expect a hefty retirement package; pension payments could fall, and she has two unmarried children to worry about.

“I want him to find another job, and work as long as he’s able,” Mrs. Masaki says. “We must be ready to fend for ourselves.”

Economic stimulus programs like the one President Obama signed into law last week have been hampered in Japan by deflation, the downward spiral of prices and wages that occurs when consumers hold down spending — in part because they expect goods to be cheaper in the future.

Economists say deflation could interfere with the two trillion yen ($21 billion) in cash handouts that the Japanese government is planning, because consumers might save the extra money on the hunch that it will be more valuable in the future than it is now.

The same fear grips many economists and policymakers in the United States. “Deflation is a real risk facing the economy,” President Obama’s chief economic adviser, Lawrence H. Summers, told reporters this month.

Hiromi Kobayashi, 38, a Tokyo homemaker, has taken to sewing children’s ballet clothes at home to supplement income from her husband’s job at a movie distribution company. The family has not gone on vacation in two years and still watches a cathode-ray tube TV. Mrs. Kobayashi has her eye on a flat-panel TV but is holding off.

“I’m going to find a bargain, then wait until it gets even cheaper,” she says.

Can Obama Downsize Government & the Defecit?

Comments »WASHINGTON — After a string of costly bailout and stimulus measures, President Obama will set a goal this week to cut the annual deficit at least in half by the end of his term, administration officials said. The reduction would come in large part through Iraq troop withdrawals and higher taxes on the wealthy.

Mr. Obama’s budget outline, which he will release on Thursday, will also confirm his intention to deliver this year on ambitious campaign promises on health care and energy policy.

The president inherited a deficit for 2009 of about $1.2 trillion, which will rise to more than $1.5 trillion, given initial spending from his recently enacted stimulus package. His budget blueprint for the 2010 fiscal year, which begins Oct. 1, will include a 10-year projection showing the annual deficit declining to $533 billion in the 2013 fiscal year, the last year of his term, officials said.

While that suggests a two-thirds reduction, exceeding Mr. Obama’s goal of at least half, advisers note that the current deficit as a starting point is inflated by one-time expenses to stimulate the economy.

Measured against the size of the economy, the projected $533 billion shortfall for 2013 would mean a reduction from a deficit equal to more than 10 percent of the gross domestic product — larger than any deficit since World War II — to 3 percent, which is the level that economists generally consider sustainable. Mr. Obama will project deficits at about that level through 2019, aides said.

In his weekly radio and Internet address on Saturday, Mr. Obama said his first budget was “sober in its assessments, honest in its accounting, and lays out in detail my strategy for investing in what we need, cutting what we don’t, and restoring fiscal discipline.”

“We can’t generate sustained growth without getting our deficits under control,” he added.

The president will propose to tax the investment income of hedge fund and private equity partners at ordinary income tax rates, which are now as high as 35 percent and could return to 39.6 percent under his plans, instead of at the capital gains rate, which is 15 percent at most.

Senior Democrats in Congress joined with Republicans in 2007 to oppose that increase. But with Wall Street discredited and lucrative executive compensation a political target, the provision could prove more popular among lawmakers.

Mr. Obama will also call for letting the Bush tax cuts on income, dividends and capital gains lapse after 2010 for individuals who make more than $250,000 a year. But while the top rate for income would rise to 39.6 percent, the top rate for capital gains and dividends would be 20 percent.

As a candidate, Mr. Obama called for immediately repealing those tax cuts. He decided instead to keep them in place through 2010, as scheduled, reflecting the widespread belief that raising taxes further depresses economic activity.

As for war costs, Mr. Obama’s campaign projected that withdrawing combat troops from Iraq would save about $90 billion a year. But it is not clear how much any savings would be offset by increased spending in Afghanistan, where Mr. Obama has ordered an additional 17,000 troops, bringing the total there to 56,000.

The budget will provide the first clues to how Mr. Obama will reassert fiscal discipline after signing into law a $787 billion economic recovery plan. As difficult as cutting the deficits will be, much of the reduction by the end of his term will simply reflect an end to spending from the two-year stimulus package and — assuming the economy recovers — higher tax revenues and lower expenditures for safety-net programs like unemployment compensation.

Mr. Obama will propose cutting a variety of programs, including the Medicare Advantage subsidies for insurance companies that cover seniors who can otherwise acquire health coverage directly from the government. Another target is spending on private contractors, especially for defense, which spiked during the Bush administration. And he will scale back some promises, including his proposal to double money for foreign aid.

The budget on Thursday will come amid a week of reminders of the nation’s fiscal plight. On Monday Mr. Obama will hold a “fiscal responsibility summit” at the White House with members of Congress from both parties, economists, union leaders and business representatives. On Tuesday he will make a televised address to a joint session of Congress — the equivalent of a State of the Union speech for a new president — that advisers said would focus on the economy. Meanwhile, Congress will debate $410 billion in overdue appropriations for this fiscal year.

Yet Mr. Obama will inflate his challenge by forsaking several gimmicks that President Bush used to make deficits look smaller. He will include war costs in the budget; Mr. Bush did not, and instead sought supplemental money from Congress each year. Mr. Obama also will not count savings from laws that establish lower Medicare payments for doctors and expand the alternative minimum tax to hit more taxpayers — both of which Mr. Bush and Congress routinely took credit for, while knowing they would later waive the laws to raise doctors’ payments and limit the reach of the tax.

Full details of Mr. Obama’s budget for the 2010 fiscal year will be released in April. The outline on Thursday will make clear that he intends to push ahead on promises to contain health care costs and expand insurance coverage, and to move toward an energy cap-and-trade system for controlling emissions of gases blamed for climate change.

“The president believes there are essentially three areas that have to move forward even as we pare back elsewhere — health care, energy and education,” said David Axelrod, his senior adviser. “These are the bulwark of a strong economy moving forward.”

While some people have predicted that Mr. Obama would have to shelve his priorities given rising deficits, his determination to proceed, especially on health care, reflects his economic advisers’ conviction that the government cannot control its finances without reforming health care. The ballooning cost of health care, and thus Medicare and Medicaid, is the biggest factor behind projections of unsustainable deficits in coming decades.

“He wants to present an honest budget, he wants to focus on health care, and he will cut the deficit by at least half by the end of his first term,” Peter R. Orszag, director of the White House Office of Management and Budget, said in an interview.

Mr. Obama will suggest in his budget that expanding health coverage to the more than 46 million uninsured can be done without adding to the deficit, both by making cost-saving changes in the delivery of care and by raising revenues. Advisers declined to identify the tax source.

Changes to the health care system will require investments in disease prevention programs, health information technology and research on cost-effective treatments, among other steps. Some money was included in the stimulus package. Even so, many health analysts believe big savings cannot be realized soon.

On energy policy, Mr. Obama’s budget will show new revenues by 2012 from his proposal to require companies to buy permits from the government for greenhouse gas emissions above a certain cap. The Congressional Budget Office estimates that the permits would raise up to $300 billion a year by 2020.

Since companies would pass their costs on to customers, Mr. Obama would have the government use most of the revenues for relief to families to offset higher utility bills and related expenses. The remaining revenues would cover his proposals for $15 billion a year in spending and tax incentives to develop alternative energy.