What a day yesterday.. I’m very happy to see the return of volatility.. and volume! (168m SPY shares today!)

HCPG notes “The .23% down in market doesn’t nearly reflect the damage we see in stock universe” <The action has certainly been sloppier lately and charts are not looking so clean to technicians>

This morning we have FedEx missing badly, citing international economic issues. <Focus on USA!>

Also we have SPY with a nice tiny ripper, up just shy of a point.

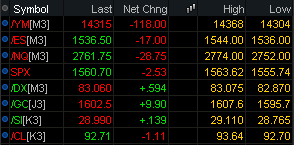

Here’s some levels to watch, courtesy of Scott Redler (RedDogT3Live):

“spy continues to hold this upper range. Support stand at $154.20 then $153.60 with resistance at $155.55 then $156.40ish”

Market Anthropology with a couple new posts out:

Driving The Euro – With its Rearview Mirror

Mining For A Blue Light Special

Blurbs like the following are why I like GravityIntl so much:

“Gold: Note psychological reflation bid perks up when FOMC lurks, EUR weakness on systemic risk/bank run psychology creates a transitory bid.” <Sure, people like to holler about “Fed printing” but ultimately, the demand for gold is shrinking.>

“Sharing one monetary policy across multiple fiscal policies continues to resurface anecdotal evidence of the flaws of this Euro experiment.” <YES! The single currency has been the root cause for all of the EZ’s troubles the last few years, as interests of individual countries are forced to be aligned when naturally opposed.>

gtotoy notes: “We see GS lose 147.30, then this correction goes on a tad longer. SPX 1525 1st “real” support under us” <GS is king of the banks and banks have been kings in this market…>

ukarlewitz tweets some beneficial information from BAML research:

“BAML: Fund mgr cash at 3.8% (3.5-5% range). 57% are overweight equities, the 2nd highest since 2001 (like Feb 2011), up from 51% Jan + Feb”

“BAML: fund mgrs dollar bulls at highest ever. 72%, a 30 percentage pt increase since Feb. Wow”

“BAML: fund mgrs most bullish on banks since Dec 2006. 14% overweight. Telecoms most underweight (28%) in 7 yrs. Risk-on”

“BAML: Net 53% fund mgrs are now underweight bonds, an increase from 47% in February. This is the lowest weighting since May 2011”

Here’s the link. Fat Pitch

And last from ukarlewitz is a RT of AlmanacTrader regarding a specific setup with a severe bearish outcome. Setup

ivanhoff with a noteworthy thought experiment tweet: “it would require a new & unscarred generation of investors to launch a full-scale bull market” <Would it?>

Cullen Roche at Pragmatic Capitalism with thoughts on Cyprus. Some Monetary lessons from Cyprus

I continue to believe the risk in equities to be distinctly to the downside here and remain in a hedged environment with about 35% cash.