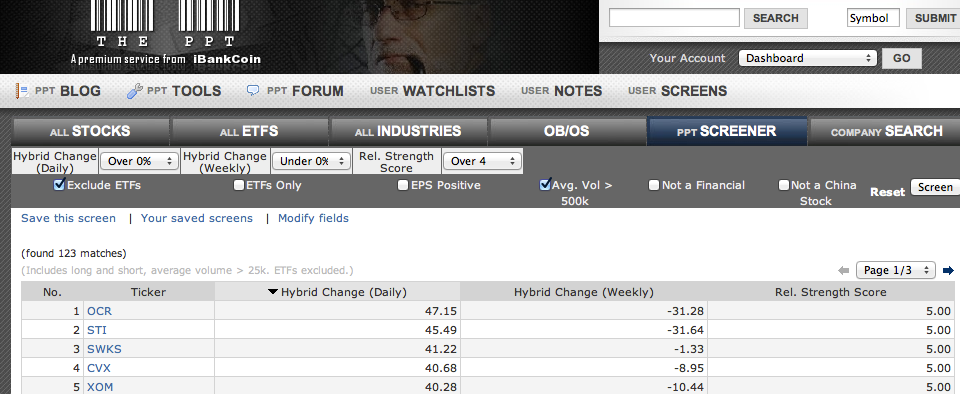

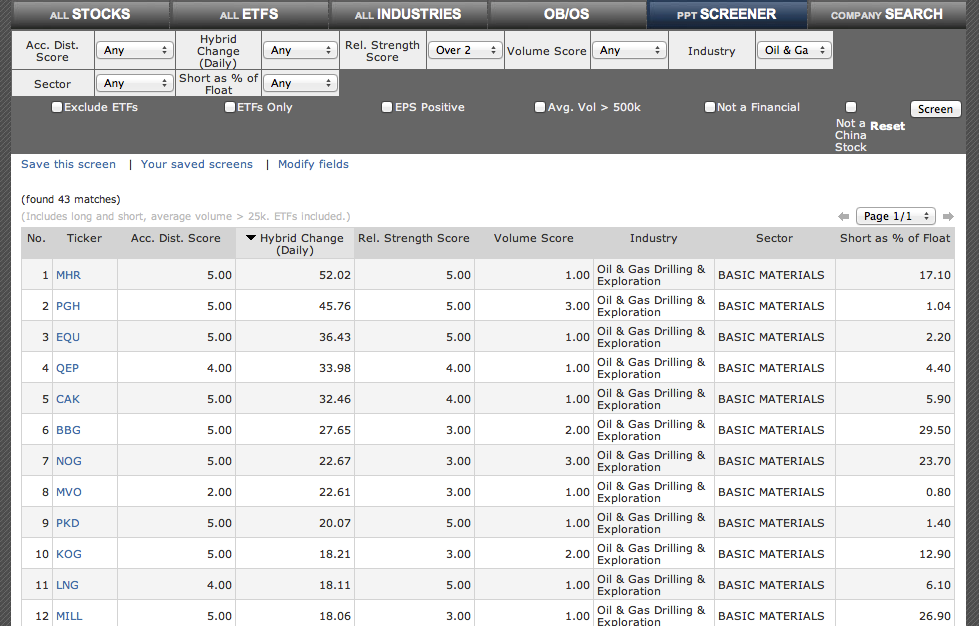

To update my post from this morning and my long NUGT (3x levered long ETF for gold miners) inside the 12631 Trading Service, I am looking at the $23.75-$24.20 area as the initial target. However, I am not viewing that area as an automatic sell spot. I am simply looking to see how strong buyers are in the face of logical minor resistance, seen on the daily chart below for the GDX (straight-up gold miner ETF).

I am looking to add to my position more than I am looking to sell at this point.

_______________________________________________

Comments »