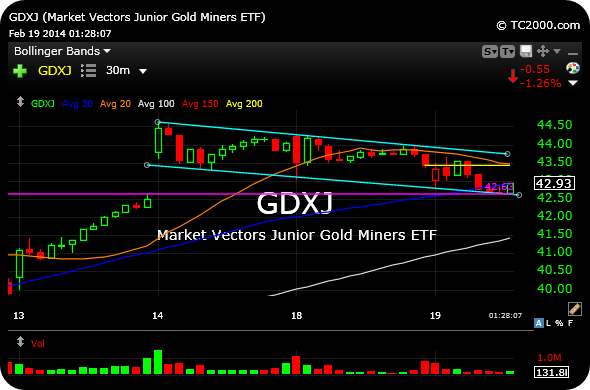

I am still long SKF (ultra-SHORT financials) inside 12631, which had not stopped me out over the past several days despite the financials drifting higher. As you can see on the updated sector ETF for the finnies, a head and shoulders top is still in play with failure at the right shoulder today. So far, so good, at least.

Who is playing Tesla earnings? What is your strategy?

_______________________________________________________

Comments »