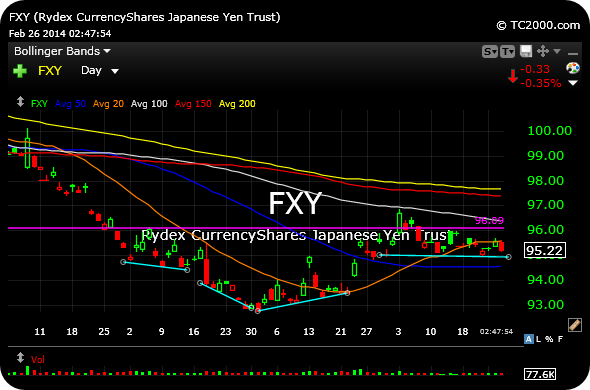

Despite an earnings gap higher, J.C. Penney is likely going to open this morning below its 2000/2001 crash lows, seen on the monthly chart below–Denoted by the horizontal light blue line.

If you are looking for anything more than a quick long trade, I suspect you need to see that $8.75-$9 area eventually negotiated adequately. Until then, stay nimble, as the stock remains damaged goods. And if you think the stock is still going to zero, that is your target short entry to trade against.

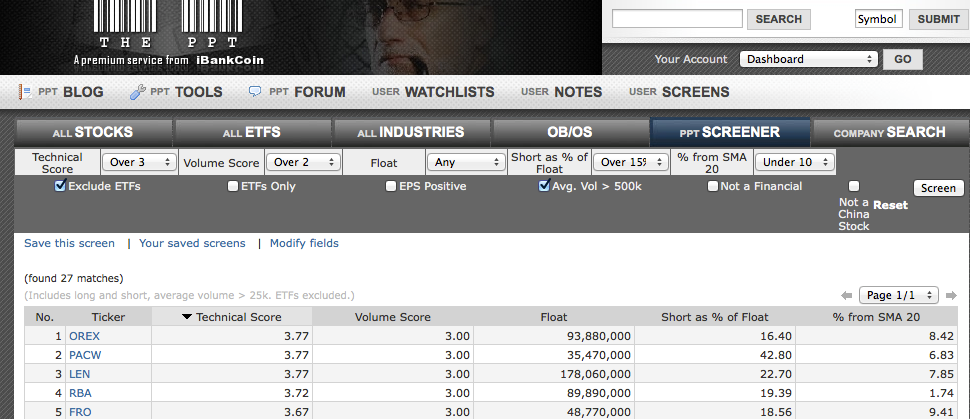

Which stocks are at the top of your watchlists this morning?

_______________________________________________________

Comments »