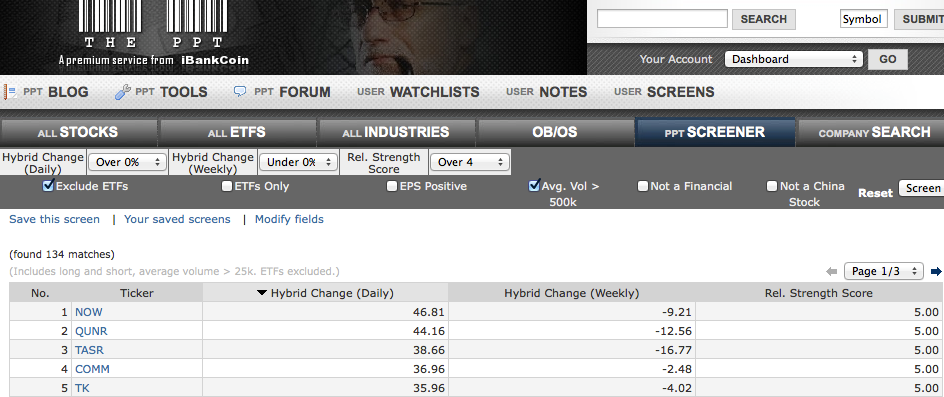

It is always a tough proposition to call a bottom or catch the elusive “falling knife.” But the Chilean ag with lithium exposure, SQM, is sure sporting signs of turning around.

On the monthly chart, first below, SQM has seen an initial surge off major $25 support. Note that the low-$20’s marked massive support during the 2008 crash. At a minimum, one can trade against this level to manage risk.

In addition, CPL, a name I have mentioned before as a potential long-term investment idea, is now at the point where I think taking a starter long-term position is correct. The Brazilian utility, on the second monthly chart below, offers an impressive dividend and is beginning to react to its 2008 crash lows (note this monthly candle forming). You are also getting paid to wait, as Brazil has the World Cup in 2014 and the summer olympics in 2016.

_____________________________________________________________

_____________________________________________________________

Comments »