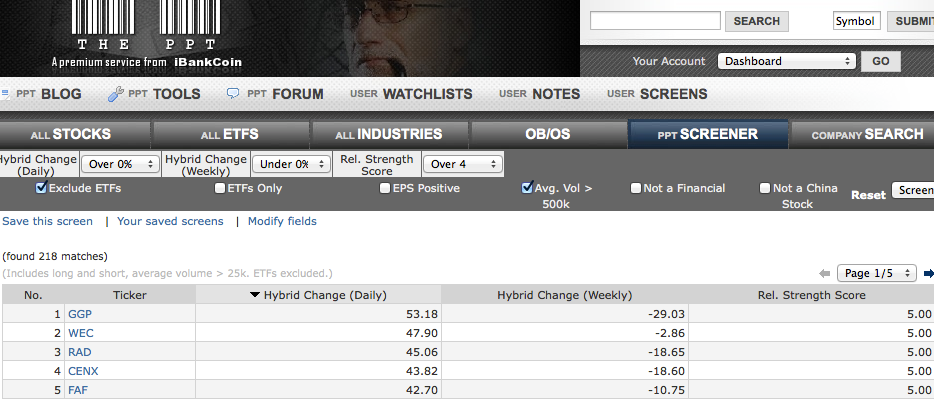

If you enjoy my blog posts and videos, then I would encourage you to please click on this 12631 hyperlink for more details about joining our great team of traders at a very reasonable price. 12631 is a trading service which @RaginCajun and I direct here at iBankCoin.

Enjoy tonight’s video, and enjoy your evening.

Comments »