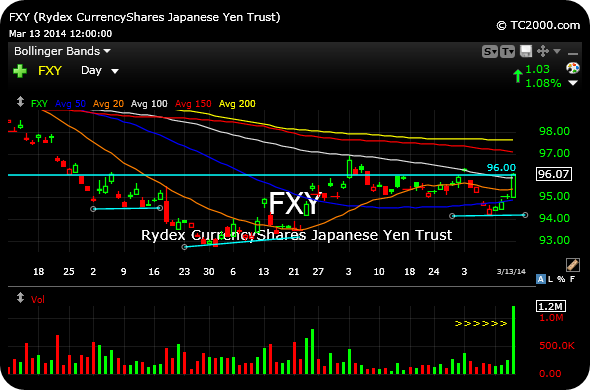

The 30-minute QQQ chart, complete with all the marquee issues which were weak this morning, is at a critical juncture this afternoon.

You can see major support (on this timeframe) being probed as we speak.

Weakness in the likes of Apple and Google is no doubt placing pressure on the ETF, while Amazon remains resilient of late.

Let’s see if the storm clouds bring the rain, or instead if the weather breaks and the bulls’ sun comes back shining through.

What are you trading into the final hour?

_____________________________________________________

Comments »