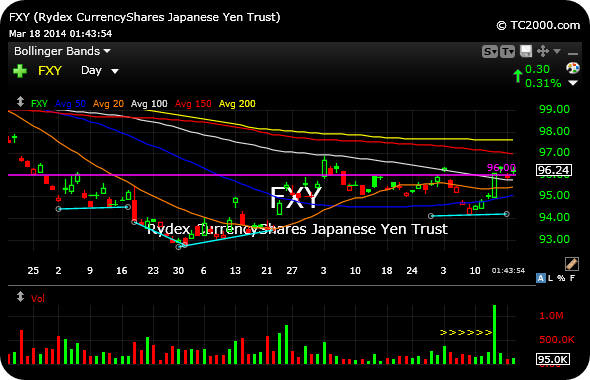

Lots of cross-currents in the rally today, as the Japanese Yen is noticeably diverging.

Typically, the Yen should be getting wrecked in a “risk on” environment.

But we can see the Yen daily chart ETF, below, hold over the key $96 level and actually quite firm, especially against the Dollar.

Keep an eye on this one going forward, if you are not already.

Also note continued strength in some of these stealth restaurant stocks we have been profiling, such as BLMN FRGI TXRH to follow DAVE DFRG KONA higher. And even IRG may be bottoming. BKW JACK SONC have been the monster fast food winners.

As I write this, gold miners are attempting to hold an early-afternoon upside reversal.

_______________________________________________________

Comments »