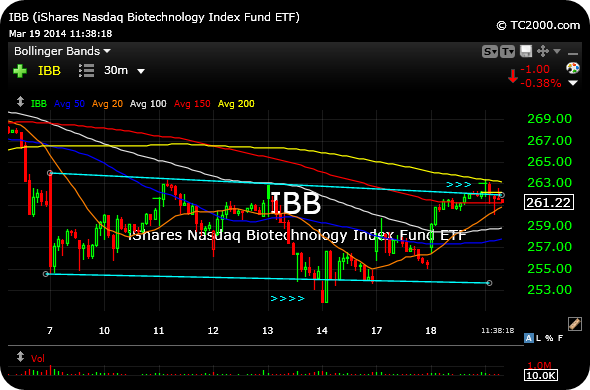

Magnifying today’s weakness in bonds is the selling in the REITs and utilities. As you know, those are rate-sensitive sectors.

While it is certainly true that the sector ETF’s for the REITs and utilities, first and second below, respectively, are far from being completely damaged, the selling today is making a minor dent in them. The IYR is losing its recent breakout level, for example.

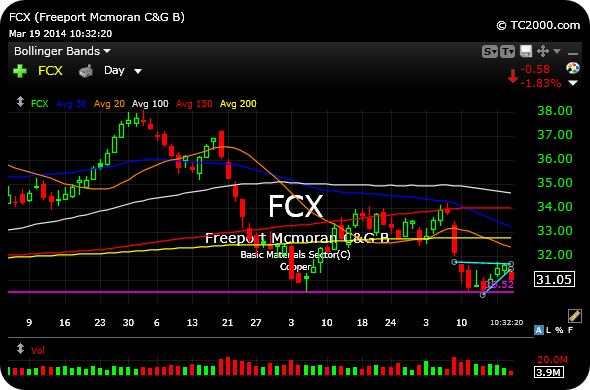

And the third chart is the daily of major ute ED, which shows a potential significant breakdown.

Indeed, many individual REITs and utes are not in as good of shape as their ETF’s had suggested.

Further weakness in bonds tomorrow and Friday likely sees me adding to my current bond short. I did, however, feel compelled to cover my Citi short inside 12631 for a loss given today’s strength.

__________________________________________

__________________________________________

__________________________________________

Comments »