Two updates on some losing positions I had of late…

In case you missed it, last Friday I sold out of my bond short position. I had locked in a win on a piece of it but the final half turned into a relatively small loser as bonds have remain quite resilient.

On the first daily chart below, you can see TLT hovering near the all-important $109.34-36 area, just above. I expect this to be a huge battleground for the rest of the week to see if another leg higher is imminent, or instead if bond bears finally crack the code. Overall, I am still looking to re-enter the short bond trade. But I simply need to see more of a reason to get involved.

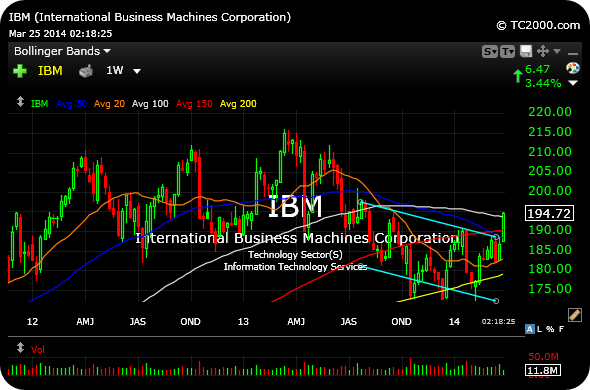

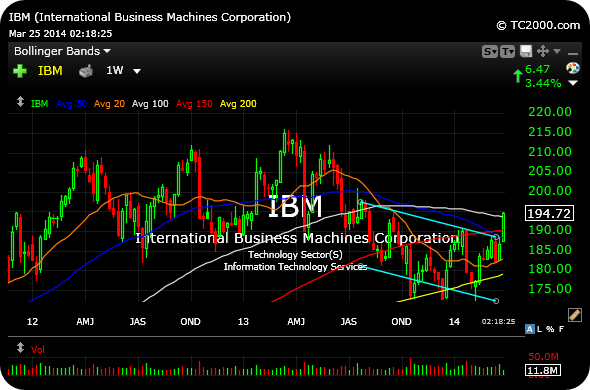

And earlier today inside 12631 I covered my IBM short starter position for just over a 4% loss. The rotation into old tech firms since last week has been strong and remained so into today. The stock has made a solid comeback and is quickly gaining attention, though I still have my doubts as to whether it can lead the bull higher or indeed if its strength can even stick on its own merits. Still, losses need to be cut and kept contained.

The weekly chart for Big Blue, second below, shows a falling channel upside breakout. But I expect overhead supply to kick in soon from all those trapped buyers dating back to 2012.

______________________________________________________

______________________________________________________

Comments »